TypingDNA’s biometrics fraud prevention technology for BBVA’s mobile banking app – case study

Digitalization plays a key strategic role in helping BBVA achieve the goal it has set of becoming the best digital bank in Mexico. BBVA is the largest financial institution in Mexico that dominates about 20% of the market. It is a subsidiary of Banco Bilbao Vizcaya Argentaria (BBVA), one of Europe’s leading financial groups that is considered one of the largest in the eurozone. BBVA operates throughout Mexico, serving customers through an extensive branch network and other distribution channels such as ATMs, banking correspondents, POS terminals, internet, and cell phones, among other things. The largest Mexican bank had in 2019 over 10.1 million digital clients and 9.6 million mobile customers.

Challenges – Security and Fraud prevention

As global internet access increases, so does the amount of cyberattacks. In 2019, for example, $17,700 was lost each minute due to phishing scams. Protecting customer’s assets and brands is a core cybersecurity challenge that requires an in-depth approach different from the classic two-factor authentication based on usernames and passwords with a second factor such as a one-time password. To protect the authentication process as well as identities, new technology is needed for enhanced security.

User experience and ease of adoption

Since its inception, online banking has revolved around two-factor authentication that results in a burdensome user experience and high costs for maintaining hardware inventory such as tokens, or later, SMS OTP with a significant impact on the ease of transaction signing. Typing biometrics represent a seamless, innate solution for authentication, making it easy to use and adopt.

Solution

The collaboration on the POC started within BBVA’s Open Innovation program, the first platform of its kind that has been developed by BBVA specifically to streamline connections with the external fintech ecosystem.

TypingDNA’s Authentication API is used to obtain a contextual biometric pattern of each customer, minimizing risk when mobile banking sessions are initiated with biometric identifiers.

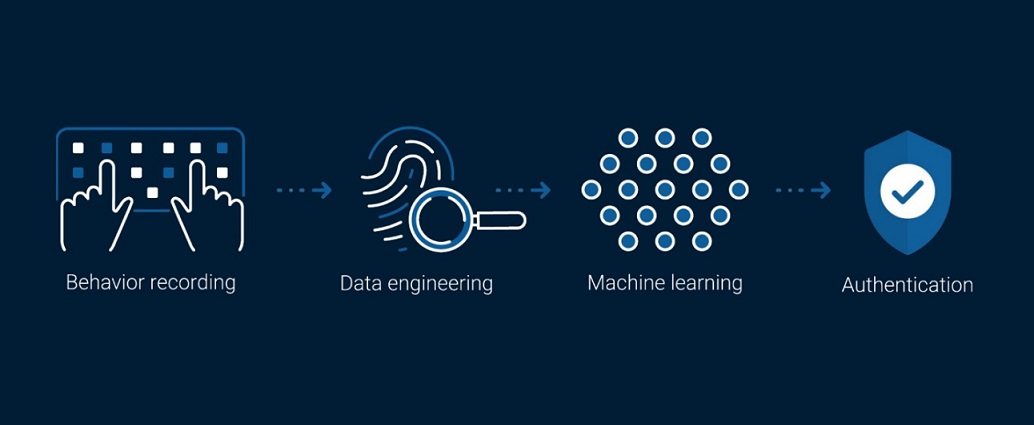

Specifically, the integration of TypingDNA’s behavioral biometrics technology was introduced to mobile apps to support the authentication of users and prevent fraud. The typing biometrics solution allows for seamless validation of the user’s identity by first capturing their unique typing pattern and then comparing future device interactions with the previous ones. Mobile device interaction is part of the fraud prevention engine analyzing the risk and constitutes a second authentication factor.

Results

The user-centric solution allowed passive risk scoring and enabled BBVA to flag suspicious activity in a way that didn’t hinder the user journey while offering high accuracy rates. Since it doesn’t require specialized sensors or specific hardware to be deployed and used by end customers, TypingDNA’s solution proved to be an easy-to-use authentication factor.

All financial institutions need to prioritize account security to prevent fraudsters from reaching sensitive information and transferring funds illegally. At the same time, they need to deliver user-friendly solutions that keep customers at the center of any development. By using TypingDNA’s typing biometrics proprietary technology, BBVA is able to do both: improve the user experience while strengthening security.

More about the TypingDNA’s tehnology were presented by Alex Iosif, Account Executive TypingDNA, at Gala NOCASH. Details in the video below:

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: