Two professors from the University of Würzburg argue that „ECB approach to the digital euro suffers from a wrong focus”. „The appropriate response to the declining use of cash in retail payments is not a CBDC, but the orchestration of competitive national retail payment systems.”

„In our view, the ECB’s approach to the digital euro suffers from a wrong focus. As the discussion of the CBDC as a monetary anchor shows, it is mainly based on the digital euro as a payment object and leaves unclear how the payment system in which it would circulate would be organised” – according to a research paper published by SUERF – The European Money and Finance Forum.

The topic of digital future of the public money (digital euro, CBDCs & stablecoins) will be widely discussed at Banking 4.0 – international blockchain conference.

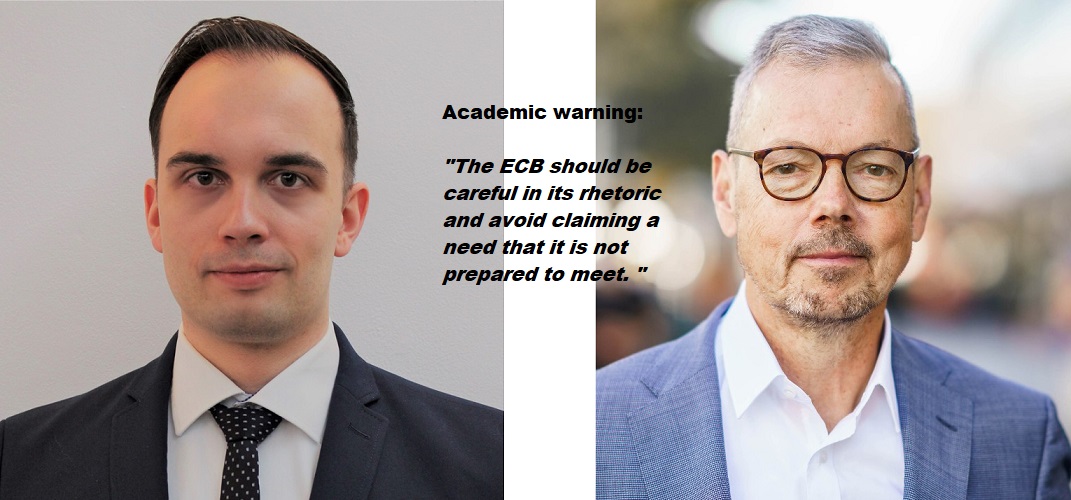

Recently, Peter Bofinger and Thomas Haas from the University of Würzburg published a research paper analyzing the monetary anchor function of a CBDC in the euro area. They study and evaluate the argument by the ECB, which justifies the potential introduction of the digital euro with the role of a central bank digital currency as a monetary anchor.

The European Central Bank justifies the introduction of the digital euro with the role of a central bank digital currency as a monetary anchor. Three anchor roles for a CDBC can be distinguished: First, as an anchor for commercial bank deposits, guaranteeing their convertibility into central bank money. Second, as an anchor to maintain the national currency as a unit of account. Third, as an anchor for maintaining the central bank’s control over the financial system.

The authors discuss the different anchor roles and analyse whether the introduction of a CBDC is necessary for these anchor functions. They argue that a CBDC can be justified as an anchor for bank deposits, but this would require unlimited access to a store of value, whereas the ECB envisages very limited CBDC holdings as a means of payment.

Anchoring the national currency as a unit of account requires the stability of the currency. For the central bank’s control over the financial system, it is crucial that banks need central bank money as a means of payment and settlement. Thus, it is the holding of central bank money by banks, and not by non-banks, that is required as the ultimate monetary anchor for the financial system.

Finally, the experience of several major central banks shows that the appropriate response to the declining use of cash in retail payments is not a CBDC (focus on the payment object), but the orchestration of competitive national retail payment systems (focus on the payment system.

They thus conclude that „the ECB’s approach […] has the wrong focus„.

More key takeaways

The research paper shows that a digital euro is not needed as a monetary anchor for the euro area. It is true that, from a legal point of view, commercial bank deposits should be fully convertible into central bank deposits. Since such convertibility is technically difficult to achieve with cash, convertibility into digital central bank deposits offers an easy alternative.

For good reasons, however, the ECB envisages only a very low ceiling for digital euro accounts. „The ECB should therefore be careful in its rhetoric and avoid claiming a need that it is not prepared to meet.” the authors says. Moreover, even if non-banks do not hold cash or CBDCs, it can be shown that individual banks still have the discipline to pursue sound policies.

What matters for the unit of account role of the euro, is not the use of a CBDC in daily payments, but a monetary policy that maintains price stability.

As far as the monetary anchor is concerned, a closer analysis reveals that this role is sufficiently fulfilled by the need of commercial banks to hold central bank reserves. In other words, the monetary anchor is not the holding of central bank assets by non-banks, but the holding of central bank assets by commercial banks.

Finally, the authors consider that the discussion on the monetary anchor role of the digital euro shows that the ECB’s approach to the challenges posed by the dynamic global payments landscape is flawed. The example of several major central banks demonstrates that it is possible to develop a competitive national retail payment system without the need for a CBDC.

About the authors

Peter Bofinger is Professor for international and monetary economics at the University of Würzburg. From 2004 to 2019 he was a member of the German Council of Economic Experts, which is an independent advisory body to the German federal government. Previously he had been Vice-President of the University of Würzburg and an economist at the Deutsche Bundesbank. Peter Bofinger is a Research Fellow of the Center for Economic Policy Research London and a Member of the INET (Institute for New Economic Thinking) Commission on Global Economic Transformation. A focus of his research is on monetary theory and policy with a focus on the digitalization of money and the implications of alternative models for the financial sphere (real models versus monetary models) for the analysis of interest rates and international capital flows.

Thomas Haas is a PhD candidate at the University of Würzburg and a research and teaching associate of Professor Peter Bofinger for Monetary Policy and International Economics. His research interests are monetary theory and policy, banking and the financial system, and the digitalization of money.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: