PayDirect, the new payment product launched today by TrueLayer, combines one-click registration with instant payments and withdrawals. All within your app.

„For the first time, we’re bringing together the power of open banking with the UK and Europe’s fastest payment rails to provide our customers with a complete, white-labelled solution for onboarding users in seconds (verifying account ownership directly with the bank), instant low-risk payments into any account, instant payouts (for seamless withdrawals and refunds) and smoother reconciliation (no more mistyped references as payment details are automatically populated),” according to the press release.

“PayDirect builds on our open banking expertise to streamline onboarding, pay-in and payout, to help operators deliver an experience that is fit for the digital age,” said Ossama Soliman, Chief Product Officer, TrueLayer.

PayDirect serves businesses across a number of industries, including financial services, wealth management and trading, marketplaces, ecommerce and iGaming.

„With PayDirect, businesses benefit from high conversion and payment success (which can equate to millions in recovered revenue at the end of the year), better customer experience and retention (because of instant payment and refund capabilities), lower operational costs (accelerating AML processes and no chargeback handling), low fraud and chargebacks, (saving 0.5% — 1% of revenues),” the company said.

What problems does PayDirect solve?

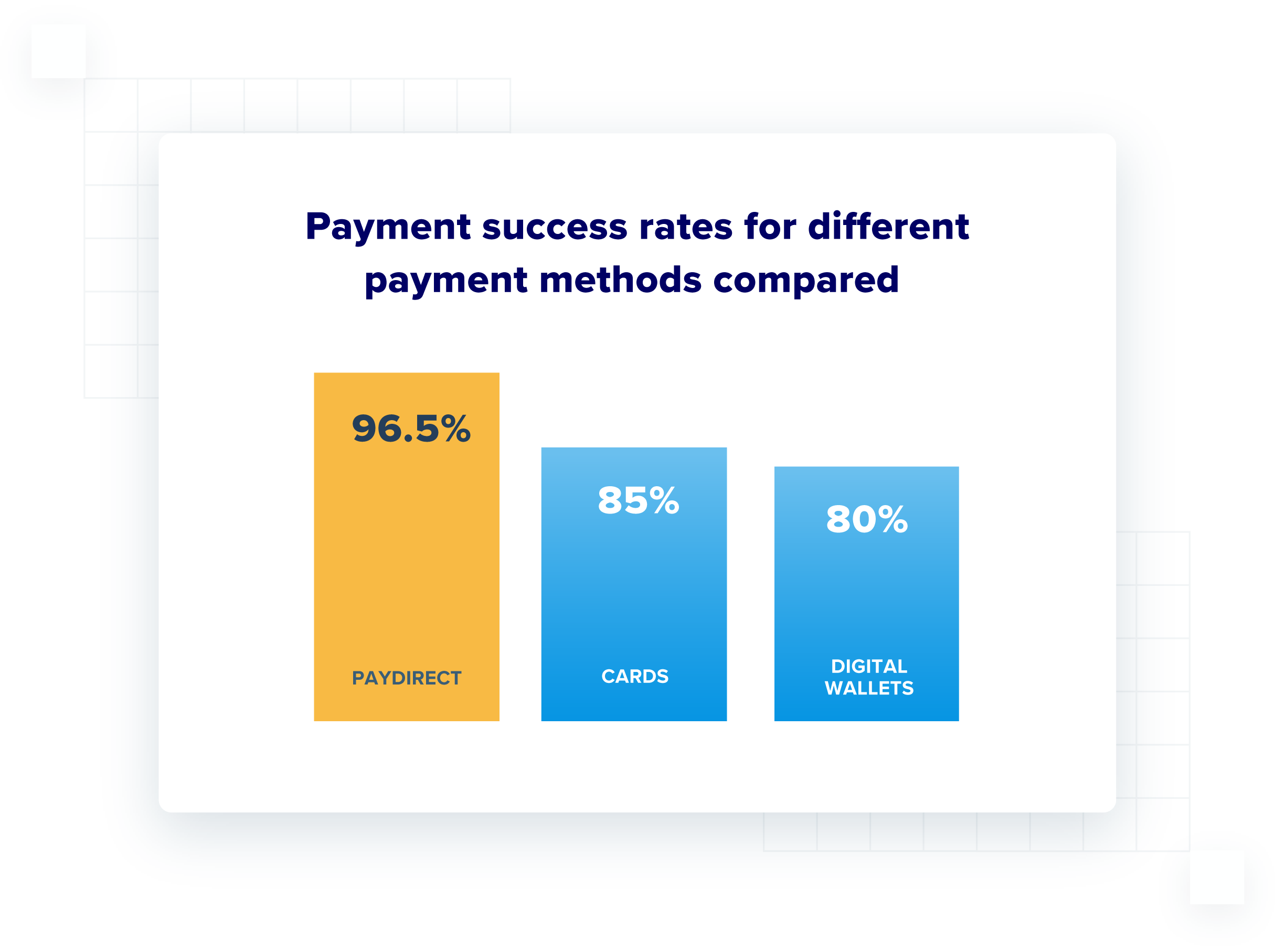

1. Card and wallet payments fail 15–20% of the time

Card payments have high failure rates for a number of reasons. Users need to manually input their details meaning mistakes can be made, fraud checks are often overzealous, payments are subject to spending limits and cards can expire or get cancelled when lost or stolen.

Because PayDirect payments are authenticated directly with the bank, funds are pushed from the consumer account to the merchant account, securely and without any spending limits, leading to higher success rates (c.96.5% success; c.3.5% failure).

When you look at overall conversion across the payment process, PayDirect typically converts 20% higher than cards, equating to millions or hundreds of millions in revenue a year for businesses.

2. Card-based payments are prone to chargebacks and fraud

Fraud losses for businesses on card payments continue to spiral, hitting EUR 1.55 billion in 2020. With PayDirect, payments are authenticated directly with the bank and biometrically, making fraud near impossible and saving businesses 0.5% –1% of revenues.

Strong Customer Authentication (SCA) this year will make cards safer and reduce losses, but, with many providers implementing clunky workarounds, it’s set to deliver a poorer customer experience. This, as Microsoft has found, negatively impacts conversion, leading some commentators to predict that European businesses stand to lose €57 billion in economic activity

3. The user experience of paying online is broken

With card-based payments and traditional bank transfers, customers have to manually key in payment details or trust a website to store them.

In regulated industries where verification requirements are cumbersome, customers must prove account ownership, income and more, before purchase. Yet almost two thirds of customers won’t tolerate a signup that lasts more than 5 minutes.

4. Customers are frustrated with slow payouts

In many industries, slow payment continues to be a key source of frustration for customers, complaints, bad reviews — and ultimately churn, with 46% of customers willing to switch providers that offer instant withdrawals (YouGov 2020).

PayDirect solves these problems. Combining the power of open banking with the fastest payment rails, it gives businesses a high-converting, low-fraud online payment solution.

How does it work for businesses?

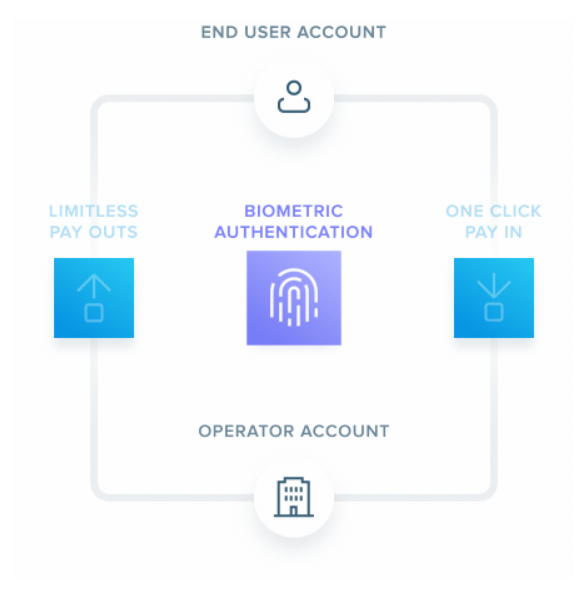

PayDirect provides customers with a single programmatic interface for onboarding users, receiving instant, secure deposits into their account, and providing instant withdrawals.

Deposits are automatically reconciled against users, allowing businesses to easily verify account ownership for meeting AML requirements.

Verified account details are then associated with each user, allowing businesses to provide instant withdrawals back into the same account.

Businesses are also able to withdraw from their account into their bank account.

What does it mean for consumers?

At TrueLayer, among our customer base, we typically see that 1 in 4 customers choose open banking payments, soon after it’s introduced.

There are a number of reasons why it makes sense for customers. By paying this way, they benefit from low risk of fraud (since they’re authenticating with their face or their fingerprint on their mobile device), faster refunds and withdrawals, less false positives during fraud checks, faster, more seamless checkout (since they don’t need to remember or input payment card details).

To make a payment:

4. The user can withdraw funds in one click. No need to send them to there. bank or a login screen, they can instantly withdraw directly from your site.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: