an article written by Garret Reich, Editorial Associate at The Financial Brand

The credit card is approaching its 75th birthday in a few years. But considering a new report indicating consumers are phasing out the product, it’s fair to ask if the credit card industry will see another 75 years.

There are about 365 million open credit card accounts in America, one million for every day of the year, according to the American Bankers Association. That’s more credit cards than there are people (328.2 million).

While that number may seem astronomical, credit cards appear to be faltering in consumer popularity, according to a survey of more than 1,000 U.S. consumers by global fintech for account-to-account payment company GoCardless.

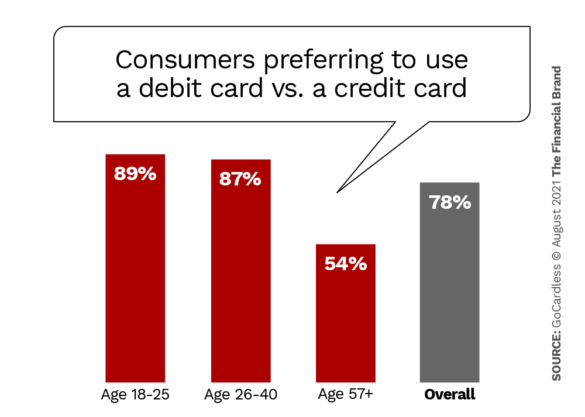

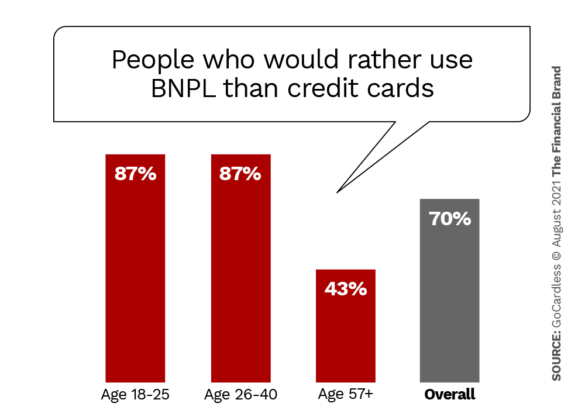

In their place the debit card, along with alternative forms of payment such as Buy Now, Pay Later plans, are appealing strongly to consumers (especially among younger generations), the data show. P2P payments via Venmo, Zelle and Square Cash are another fast-growing payment option.

GoCardless cites the pandemic as a main driver of credit card depreciation, saying it “dampened the enthusiasm” for the popular card product. Respondents to GoCardless’ survey — conducted in June and July of 2021 — say they use their credit cards less because of financial concerns. That suggests the pronounced negative impact on credit card use in the early stages of the Covid pandemic may have produced long-term effects.

Almost half (46%) admit they’re wary of slipping into debt, one quarter (25%) say they worry about not paying off the monthly balance in full and another quarter say they’re even worried about making the minimum payment.

“The pandemic put people in tough positions financially, and that likely accelerated the move away from credit cards,” said Hiroki Takeuchi, Co-Founder and CEO of GoCardless in a statement, adding “this is part of a larger trend, particularly among young Americans.”

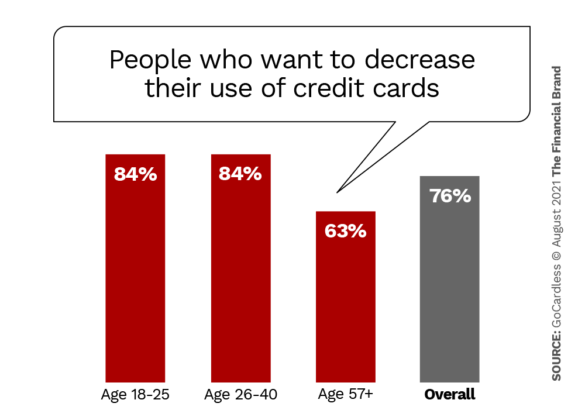

But, just how many people are trying to wean their credit card out of their wallets? GoCardless estimates more than three out of every four Americans want to decrease their credit card usage.

Financial institutions are already offering replacements for the average credit card. In addition to P2P options, several are launching reward checking accounts, which allow customers to make purchases from their primary banking account, while earning higher-than-average returns.

A Generational Attitude Shift

Siamac Rezaiezadeh, Director of Product Marketing at GoCardless, tells The Financial Brand that while credit card use may decrease in the coming years, the industry certainly won’t die out overnight.

Nonetheless, card issuers shouldn’t ignore the glaring signs suggesting it could happen, especially as the next generations of banking customers continue to redirect how payments are made.

“The number of 18- to 24-year-olds who say they will use a credit card to pay for services like Uber or buy products on Amazon is less than half that of Gen X’ers,” Rezaiezadeh explains. “Credit cards will become much less relevant within a generation, if not sooner.”

It’s no surprise that Gen Z is at the forefront of the movement away from credit cards. Rezaiezadeh maintains they and Millennials alike grew up during a global financial crisis, observed multiple data breaches as the banking world shifted to a digital approach. Then, the pandemic struck.

“It’s been a transformational 10+ years,” he adds. “And it’s starting to show. It’s clear that the pandemic has dampened American enthusiasm for credit cards.”

Takeuchi agrees, going so far as to predict that credit cards will be obsolete in a generation or two.

As a result of the pandemic, 76% of 18- to 24-year-olds say they’re less likely to pull out their credit card, followed closely by 74% of 25- to 40-year-olds, GoCardless reports.

Interestingly enough, these two generations are not only comfortable with relying on their debit card over their credit card, but they also have a piqued interest in non-interest installment apps, such as those provided by Affirm and Klarna.

“The figures are higher among the next generations of shoppers — indicating a permanent shift in consumer preferences as Gen Z and Millennials increase their purchasing power in the coming years,” the GoCardless report states. “In addition to harboring a distinct dislike for credit cards, both cohorts revealed a striking preference for new forms of payment, including Buy Now Pay Later (BNPL).”

Read the article in full here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: