TransferWise for Banks has partnered with Monzo in the UK, bunq in the Netherlands, N26 and Mambu in Germany, Activo Bank in Portugal and LHV in Estonia, with Novo and Stanford Federal Credit Union in the US and EQ in Canada. The company also announced partnerships with BPCE, France’s second largest bank, and Up! in Australia.

„We look forward to building many more partnerships in the future”, Transferwise said. The first one could by with Libra Internet Bank in Romania. Libra’s Romanian customers can already transfer money from their current account to the TransferWise account, opened at Libra, and then transfer it further, nationally or internationally, using the Transferwise application. The cost for the transfer of 1000 euros is 10.15 euros.

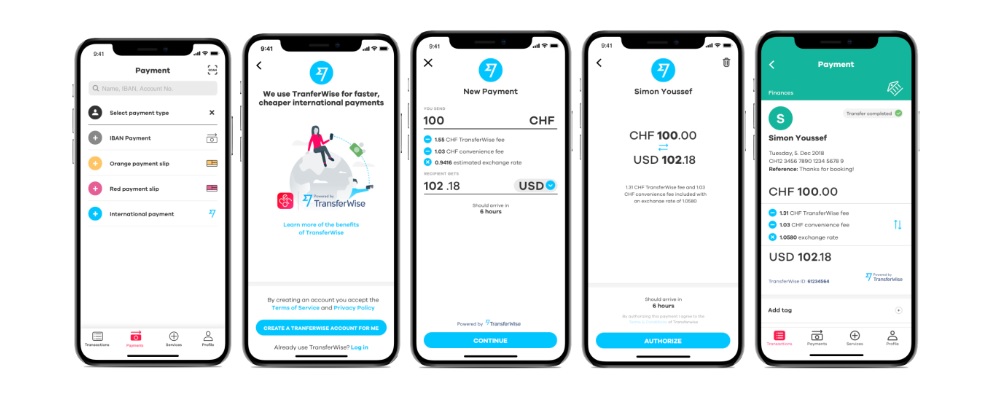

„For the first time, we’ve brought TransferWise for Banks, our bank-friendly API integration, to Switzerland, enabling financial institutions the ability to surface our best in class international transfer experience within their banking app directly to their customers for cheaper, faster, transparent international payments,” according to the press release.

„All this is possible thanks to our powerful and easy to use API, which is the gateway to our infrastructure,” the company said.

Meet Switzerland’s first 100% fully digital account

“This partnership will greatly reduce the pain of sending money internationally and makes the neon account truly borderless.” – Jörg Sandrock, CEO of neon.

neon is challenging the Swiss banking market with its first fully digital account offereing. neon’s more than 30,000 users are now able to use TransferWise’s low cost and transparent service to send money abroad, straight from the neon app.

neon customers enjoy the convenience of not having to download a separate app to send money overseas and can link their existing TransferWise account or, if they don’t have one, seamlessly open one with one click.

The ability to make the payment directly from their neon account means sending an international transfer through the neon app is even faster and more convenient than doing it through TransferWise.

„The Swiss neobank is now taking advantage of our proven system of payment rails and API that connects people and banks around the world. Our dedicated TransferWise for Banks team supported neon through all stages of the build to ensure a seamless experience both for neon and their customers”, the company added.

We’re now plugged into core banking system of Hypothekarbank Lenzburg AG

“It was pretty easy for us to integrate TransferWise’s global infrastructure into the Finstar ecosystem. As a result, we will bring cost savings to even more people in Switzerland.” – Marianne Wildli, CEO Hypothekarbank Lenzburg

TransferWise latest partnership comes to life through the integration of the company’s API into Finstar, the core banking system developed and marketed by the Hypothekarbank Lenzburg. The bank with a listing on the Swiss stock exchange is processing all transactions for neon users. neon has access to the data using the Finstar API and the TransferWise API.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: