Total cash spending will increase between 2012 and 2022

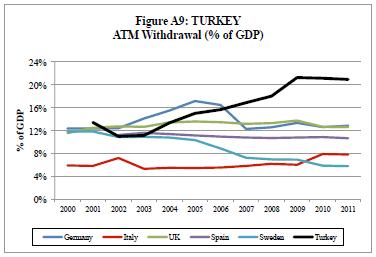

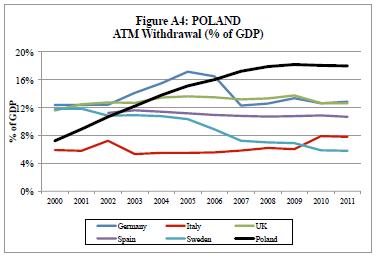

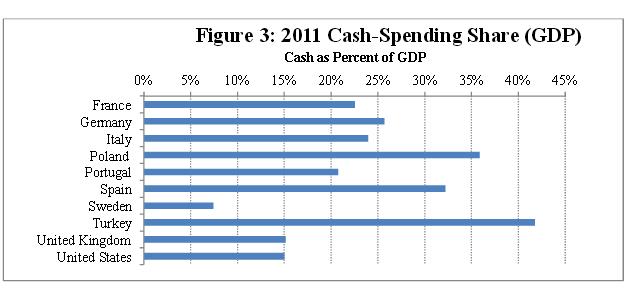

Ten specific markets were examined in detail to calculate the growth or decline in cash over the next decade. The ten markets include the US, UK, France, Spain, Sweden, Portugal, Turkey, Poland, Germany, and Italy. In all but one, Sweden, where the percentage of spending done in notes and coins by consumers is expected to decline, all study countries are projected to show an increase in total cash usage.

“We find that total cash spending will increase between 2012 and 2022, despite the decline in the cash-spending share, because total spending will increase over this period. There is great diversity in the details across countries in the historical and future evolution of cash use by consumers. However, our key finding is that, contrary to popular reports, cash is not dying”, according to a study by Market Platform Dynamics.

„In most countries total cash spending will continue to increase, although at a slower rate than historically, and the share of spending with cash will decline but at a modest rate”.

Even in places like Kenya and Japan and China and India where mobile phones are well-penetrated and innovations in national schemes like M-Pesa have gained traction, cash is used more than ever.

The study called “Paying with cash: a multi-country analysis of the past and future of the use of cash for payments by

consumers”, provide estimates of cash use for 2000-2011 and forecasts for 2012-2022 for ten diverse countries.

The study findings suggest that although payments innovation will eventually eat into consumers’ use of cash, significant impacts will take at least a decade to be felt.

Says MPD CEO Karen Webster: „Cash has survived for thousands of years because it is an exceptional innovation – easy to use, almost all merchants accept it and people like it. But, it’s inevitable that as innovations around mobile and payments mature, the use of cash will be impacted – it will just take a lot longer than a lot of people would like you to believe.”

The full technical paper, which includes a detailed discussion of the cash usage methodology and country cash usage projections, can be found here. Download the document now 912.8 kb (PDF File)

Source: Market Platform Dynamics

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: