It took longer than expected for the iPhone to become a wallet. But the patience of Apple is slowly paying off, according to the Wall Street Journal.

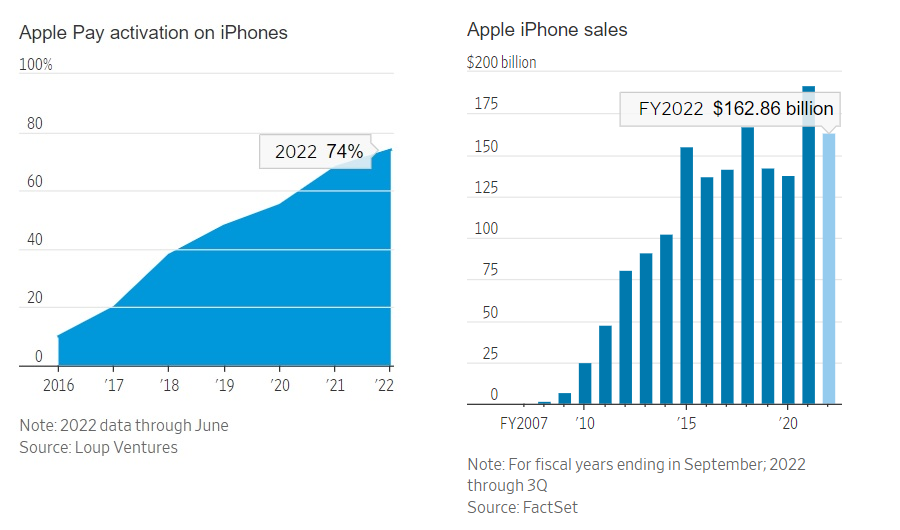

Apple presented a new service called Apple Pay in 2014. The percentage of iPhones with Apple Pay activated was 10% in 2016 and 20% in 2017, according to research from Loup Ventures, as most people seemed perfectly happy with their plastic cards and leather wallets. Adoption nearly doubled again in 2018. It hit 50% by 2020. Now it’s around 75% and inching closer to ubiquity. Of course, not every account that gets activated remains in active use.

The company’s data suggested that customers were pleased with Apple Pay once they tried it. “People love Apple Pay,” Loup Ventures analyst Gene Munster said in a recent interview. Apple just needed more customers to use it.

The company says that 90% of retailers across the U.S. now take Apple Pay. The number that accepted contactless payments when the service was introduced was 3%.

The fees Apple collects from banks whose cardholders use Apple Pay amount to less than 1% of the company’s overall revenue, but Apple generates so much profit from iPhone sales that even billions of dollars would be a rounding error.

The activation rate of Apple Pay has begun to resemble the classic trajectory of tech adoption, which suggests that what is now a tiny slice of Apple’s pie can get much bigger, along with the overall market for contactless payments. Such tap-to-pay spending accounts for nearly 20% of Visa’s face-to-face transactions in the U.S., but the rates in big cities have climbed above 25%, with the Bay Area at 30% and New York reaching 45%. Apple Pay is also the top payment app for teenagers, according to investment firm Piper Sandler. As teens and cities go, so goes the nation.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: