Blog post by Fabio Panetta, Member of the Executive Board of the ECB

Adequate availability of cash is crucial for the functioning of the economy. Even in normal times, three-quarters of consumer transactions in the euro area are made in cash, with large countries such as Germany, Spain and Italy using cash at rates that are around or even well above the euro area average. Cash thus remains the dominant means of payment for consumers, and is of fundamental importance for the inclusion of socially vulnerable citizens, such as elderly or lower-income groups.

The provision of banknotes

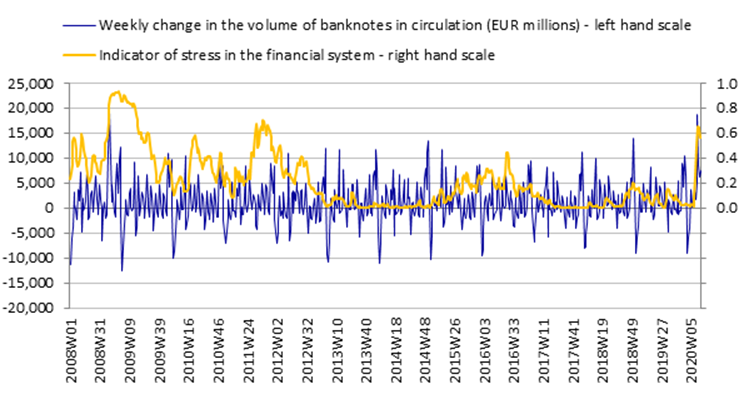

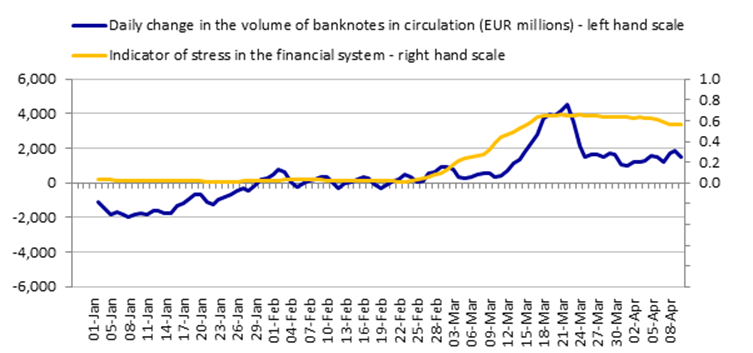

During the crisis the demand for cash has become less predictable. As the pandemic spread across Europe, we saw a spike in demand for cash: in mid-March the weekly increase in the value of banknotes in circulation almost reached the historical peak of €19 billion (see Chart 1). This increase partly reflected higher spending in supermarkets and shops – especially from 13 to 20 March, when the demand for cash was similar to that in the week before Christmas. But it also reflects people’s impulse to hoard cash during a crisis. The rising demand for cash in times of extreme uncertainty is not a new phenomenon; such increases were seen during the financial crisis in 2008 (see Chart 1), and there is generally co-movement between the volume of banknotes in circulation and indicators of financial tension (see Charts 2). In early April cash demand returned to normal levels, and several countries are now seeing cash withdrawals below expected levels for the time of year; this is partly due to the lockdown, which has limited the opportunities for spending.

Chart 1 – Weekly growth of banknotes in circulation and stress in the financial sector (January 2008 – March 2020)

The indicator used in the charts was developed by Holló, D., Kremer, M. and Lo Duca, M. (2012), “CISS – A composite indicator of systemic stress in the financial system”, Working Paper Series, No 1426, ECB, March.

Chart 2 – Daily growth of banknotes in circulation and stress in the financial sector

Note: Eurosystem net issuance (i.e. issued minus returned banknotes) is normally negative at the beginning of the year, because after the December peak lodgements of banknotes at national central banks are higher than cash demand.

Source: ECB data; five-day moving average.

To ensure that handling cash remains as safe as possible, ECB is working closely with top-tier European laboratories to assess the behaviour of coronaviruses on different surfaces. The results indicate that coronaviruses can survive more easily on a stainless steel surface (e.g. door handles) than on our cotton banknotes, with survival rates approximately 10 to 100 times higher in the first few hours after contamination. Other analyses indicate that it is much more difficult for a virus to be transferred from porous surfaces such as cotton banknotes than from smooth surfaces like plastic.

Overall, banknotes do not represent a particularly significant risk of infection compared with other kinds of surface that people come into contact with in daily life. However, our cooperation with scientific laboratories will continue in the coming weeks to preserve public trust in the safety of banknotes.

Electronic payments

Even before the outbreak of the pandemic, the ECB stressed that Europe must be able to supply fundamental services such as electronic payments autonomously, in order to strengthen its sovereignty in the global economy. With this in mind, the Eurosystem’s retail payment strategy aims to foster pan-European market solutions for instant payments[1] at the point-of-sale (to pay in brick-and-mortar shops) and online payments (for e-commerce). We are actively supporting initiatives that allow European users to reap the benefits of the Single Market and that can fulfil certain key objectives.[2] Work in this field is continuing despite current events, with regular contact between the ECB, the European Commission and private payment service providers.

The ECB is also exploring possible future avenues by assessing the case for issuing a “digital euro”. A high-level task force is currently examining the pros and cons of introducing a digital currency, which could be used by intermediaries or even by citizens through their electronic devices (such as smartphones or tablets) for their day-to-day spending needs.

However, our analysis of the opportunities and challenges of central bank digital currencies – which will consider the experience of the COVID-19 crisis – should not discourage or crowd out market-led initiatives aimed at introducing private electronic means of payment with similar features in terms of user needs.

Market infrastructures

Such innovations in the field of payments have been made possible by advances in the infrastructures underlying financial transactions. A noteworthy example is the Eurosystem’s TARGET Instant Payment Settlement (TIPS) service, a powerful infrastructure which allows funds to be transferred in real time around the clock every single day of the year.

The system, which went live in November 2018, finalises instant payments in central bank money, meaning that it does not entail financial risk for either the payer or the payee. It can also handle payments in other currencies; indeed, earlier this month, the Swedish central bank, Sveriges Riksbank, decided to adopt TIPS as of May 2022, relying on the Eurosystem to process the 1.5 million instant payments made daily in Swedish krona. TIPS is designed to settle a regular load of more than 43 million instant payment transactions a day, and could handle up to 2,000 transactions per second in peak times.

In a bank-financed economy like the euro area, banks must be able to negotiate huge amounts of liquidity in a safe, fast and efficient way in order to keep the real economy going. To this end, the Eurosystem operates a real-time gross settlement (RTGS) system called TARGET2.[3]

Through TARGET2, large payments in euro by central banks and commercial banks are processed and settled in central bank money, i.e. in accounts held with a central bank. More than 1,000 banks currently use TARGET2 to initiate transactions in euro, and 52,000 banks worldwide and their customers can be reached via TARGET2.

In recent weeks we have been monitoring the performance of TARGET2 particularly closely: the system registered an increase in the number of transactions (around 361,500 on a daily basis on average in March, as against 346,000 on average in March 2019) and has continued to perform efficiently …

The full article here

###

[1]Instant payments are electronic retail payment solutions that process payments in real time, 24 hours a day, 365 days a year, where the funds are made available for immediate use by the recipient

[2]The Eurosystem has identified five key objectives for its pan-European retail payment strategy: full pan-European reach and unified customer experience; convenience and cost efficiency; safety and security; European identity and governance; and, in the long run, global acceptance.

[3]RTGS systems finalise the settlement of interbank funds transfers on a continuous, transaction-by-transaction basis throughout the working day

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: