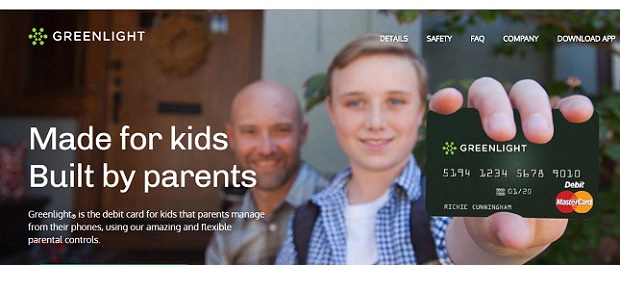

There’s now an Apple Pay smart debit card for kids – it can be used in over 120 countries

Greenlight Financial Technology, Inc., announced that the Greenlight smart debit card for kids now works internationally, and also integrates with Apple Pay. Greenlight is a special debit card and service that allows families to monitor and control how and where kids can spend money. Since June 29, Greenlight’s smart debit card for kids is working with Apple Pay as well.

Here’s how Greenlight describes its smart debit card for kids:

With Greenlight®, the money you give your child is divided into two categories: money they can Spend Anywhere, and money they can spend ONLY at a store (or a kind of store) you’ve approved in advance. We call these permission-based spending opportunities “a greenlight.”

When the debit card is used by someone without permission or over the spending limit, it will be declined and an alert will be sent to the family. Kids can always view spending power in their own app as well.

Starting with June 29, Greenlight debit cards can be used internationally in over 120 countries after initially being limited to transactions in the US. Greenlight is also turning on Apple Pay support for kids who can add the smart debit card to Apple’s Wallet service on the iPhone, iPad, Apple Watch, and Mac.

„Greenlight’s smart debit card for kids can be used internationally in over 120+ countries. Greenlight began with a focus on the U.S. market and its 10,000+ customers are on track to complete over 1,000,000 transactions this year. Now, with summer approaching, kids traveling abroad for vacation or to study, can use their Greenlight debit cards instead of carrying cash.

In addition to its expanded international capabilities, Greenlight’s smart debit card for kids now integrates with Apple Pay. As a result, kids don’t need to have the physical Greenlight card in order to make a purchase – they just need their iPhones. With Apple Pay integration, Greenlight users have peace of mind that their payments by iPhone, Apple Watch, iPad, and Mac are safe and private.”, according to the press release.

“High schoolers often have a chance to visit other countries through their foreign language classes and many families take vacations internationally, so we’re excited to enable our customers to use their Greenlight Cards worldwide,” said Tim Sheehan, CEO and co-founder of Greenlight Financial Technology, Inc. “Young people are leading the way in paying for things using their mobile phones, so we’re pleased to enable Apple Pay for Greenlight customers.”

Greenlight’s smart debit card service includes a free trial to start and costs $4.99/month for the primary account.

Starting with iOS 11, Apple is introducing a virtual debit card feature to its Wallet app with Apple Pay Cash, although smart limit features and a physical debit card won’t be included.

About Greenlight Financial Technology, Inc.

Greenlight Financial Technology, Inc. creates safe, healthy and family-friendly financial services. Greenlight’s first product, a smart debit card for kids, is the world’s first debit card for kids with patent-pending technology that lets parents pick the exact stores where their children can spend. The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by MasterCard International. Headquartered in Atlanta, GA, this FinTech company has raised over $7.5 million in seed funding, backed by leading investors including Relay Ventures, Social Capital, NEA, TTV Capital, Boom Ventures and Tech Square Labs.

Source: prnewswire.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: