The Biden administration has proposed a new Federal Trade Commission rule that would require more transparency from companies when it comes to hidden or misleading charges, as well as regulation from the Consumer Finance Protection Bureau and the Department of Labor.

The cost to overdraw a bank account could drop to as little as $3 under a proposal announced by the White House. Banks charge a customer an overdraft fee if their bank account balance falls below zero. Overdraft started as a courtesy offered to some customers when paper checks used to take days to clear, but proliferated thanks to the growing popularity of debit cards. So, for instance, a $10 debit card transaction could cost a bank customer $40 if their balance goes below zero.

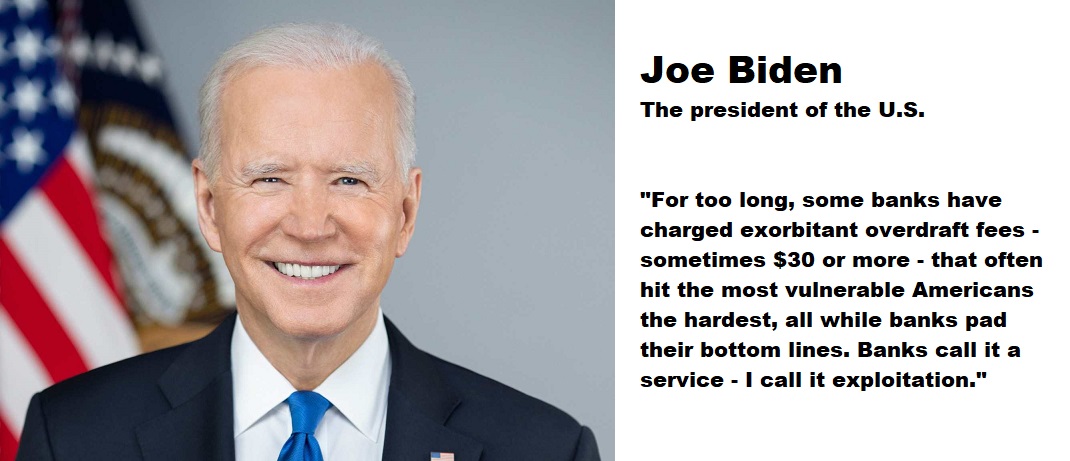

Statement from President Joe Biden on the CFPB’s Proposed Rule to Curb Overdraft Fees:

„When companies sneak hidden junk fees into families’ bills, it can take hundreds of dollars a month out of their pockets and make it harder to make ends meet. That might not matter to the wealthy, but it’s real money to hardworking families—and it’s just plain wrong. This is about the companies that rip off hardworking Americans simply because they can.

That’s why today, my Administration took new actions to tackle these hidden fees by proposing a rule that would end excessive overdraft fees. For too long, some banks have charged exorbitant overdraft fees—sometimes $30 or more—that often hit the most vulnerable Americans the hardest, all while banks pad their bottom lines. Banks call it a service—I call it exploitation. Today’s proposal would cut the average overdraft fee by more than half, saving the typical American family that pays these fees $150 a year. That would add up to save families $3.5 billion every year.”

Under the proposed rule, banks could only charge customers what it would cost them to break even on providing overdraft services. This would require banks to show the CFPB the costs of running their overdraft services, a task few banks would want to handle.

Alternatively, banks could use a benchmark fee that would apply across all affected financial institutions. Regulators proposed several fees — $3, $6, $7 and $14 — and will gather industry and public input on the most appropriate amount. The CFPB says it arrived at these figures by looking at how much it cost banks to recoup losses from accounts that went negative and were never paid back.

Context – junk fees costs Americans billions each year

The Consumer Financial Protection Bureau (CFPB) today proposed a rule to rein in excessive overdraft fees charged by the nation’s biggest financial institutions.

„For decades, very large financial institutions have been able to issue highly profitable overdraft loans, which have garnered them billions of dollars in revenue annually. Under the proposal, large banks would be free to extend overdraft loans if they complied with longstanding lending laws, including disclosing any applicable interest rate. Alternatively, banks could charge a fee to recoup their costs at an established benchmark – as low as $3, or at a cost they calculate, if they show their cost data.” according to the press release.

„Decades ago, overdraft loans got special treatment to make it easier for banks to cover paper checks that were often sent through the mail,” said CFPB Director Rohit Chopra. „Today, we are proposing rules to close a longstanding loophole that allowed many large banks to transform overdraft into a massive junk fee harvesting machine.”

The proposed rule would apply to insured financial institutions with more than $10 billion in assets, which covers approximately the 175 largest depository institutions in the country. These institutions typically charge $35 for an overdraft loan, even though the majority of consumers’ debit card overdrafts are for less than $26, and are repaid within three days.

Approximately 23 million households pay overdraft fees in any given year. The CFPB estimates that this rule may save consumers $3.5 billion or more in fees per year. The potential savings would translate to $150 for households that pay overdraft fees.

Proposed Rule

The proposed rule would require very large financial institutions to treat overdraft loans like credit cards and other loans as well as to provide clear disclosures and other protections. Many banks and credit unions already provide lines of credit tied to a checking account or debit card when the consumer overdraws. The proposal provides clear rules of the road to ensure consistency and clarity.

The CFPB also is proposing to limit the longstanding exemption to overdraft practices that are offered as a convenience, rather than as a profit driver. The proposed rule would allow financial institutions to charge a fee in line with their costs or in accordance with an established benchmark. The CFPB has proposed benchmarks of $3, $6, $7, or $14 and is seeking comment on the appropriate amount.

CFPB’s Junk Fee Efforts

The proposed overdraft rule is part of a continued effort by the CFPB to rein in junk fees and spur competition in the consumer financial product marketplace. In early 2022, the CFPB launched an initiative to save Americans billions in junk fees, which generated more than 80,000 responses from the public. The overwhelming majority of the responses were complaints about overdraft fees.

The CFPB has taken multiple actions to curb out-of-control overdraft fees and other junk fees prevalent in consumer financial products. The CFPB issued guidance to rein in surprise overdraft fees in October 2022. It also took enforcement actions against Wells Fargo, Regions Bank, and Atlantic Union to return to consumers $205 million, $141 million, and $5 million in unlawful fees, respectively, in addition to significant civil money penalties paid to the CFPB’s victims relief fund.

Additionally, the CFPB’s recent supervisory efforts resulted in financial institutions returning $120 million in junk overdraft and non-sufficient funds fees to consumers. And in a separate enforcement action, the CFPB ordered Bank of America to pay $90 million for, among other things, double-dipping on non-sufficient funds fees.

After the CFPB began its work to tackle junk fees, many banks began reforming their overdraft and non-sufficient funds fees policies. Those reforms have resulted in $3.5 billion in annual savings on overdraft fees and an additional $2 billion in savings on non-sufficient funds fees.

The CFPB has also taken actions on credit card late fees and customer service fees. In February 2023, the CFPB proposed a rule to rein in excessive credit card late fees. In October 2023, the CFPB issued an advisory opinion to halt large banks from charging illegal junk fees for basic customer service.

___________

“Junk fees” are just what they sound like: hidden or misleading charges that increase the total cost of concert tickets, hotel rooms, utility bills and other goods and services.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: