Huawei and Visa revealed as digital money transfer leaders in new competitor leaderboard.

A new study from Juniper Research, found the value of digital money transfer & remittances transactions will increase by 41% over the next four years; up from $4.5 trillion in 2024. This growth is largely due to the significant adoption of digital money transfer in developing regions, through solutions such as mobile money, and the impact of instant payments in developed markets, such as the EU.

Which Money Transfer Platform Vendors Lead the Market in 2024?

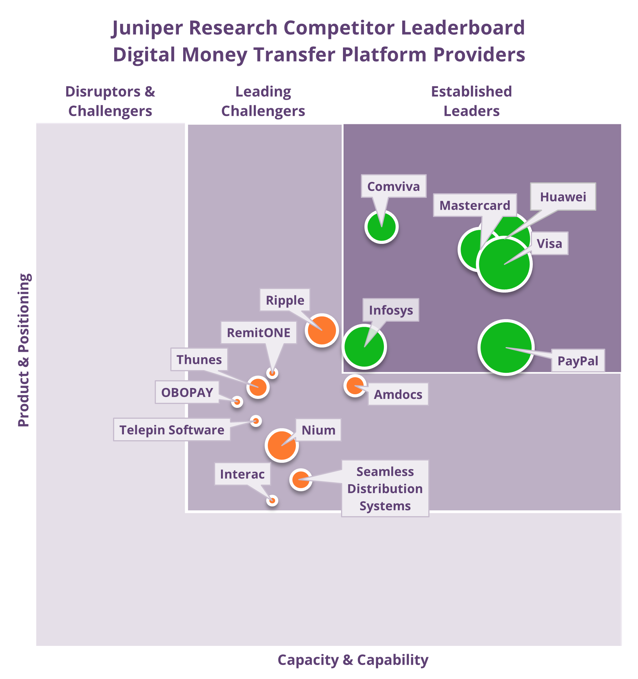

Underpinned by a robust scoring methodology, the new Competitor Leaderboard ranked the top 15 digital money transfer platforms, using criteria such as the completeness of their solutions, geographical spread, and future business prospects.

The top 5 vendors for 2024: 1) Huawei, 2) Visa, 3) Mastercard, 4) Comviva and 5) PayPal

Competitor Leaderboard Findings & Recommendations

The leading players scored particularly well on their breadth and creativity of offerings, but the report cautioned that to stay ahead, vendors must develop solutions that operate on a PaaS (Payment-as-a-Service) approach. To enable this, money transfer platforms need to develop stronger API offerings, which will allow third parties to integrate payments seamlessly into offerings such as superapps.

Report author Cara Malone explained: “Money transfer vendors need to prioritise innovation in this fast-moving space. Alongside developing a PaaS approach, providers should consider taking advantage of stablecoins, an asset or fiat-backed cryptocurrency, to improve factors such as stability, transparency and speed.”

_____________

Find out more about the new report: Global Digital Money Transfer & Remittances Market 2024-2028, or download a free sample.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: