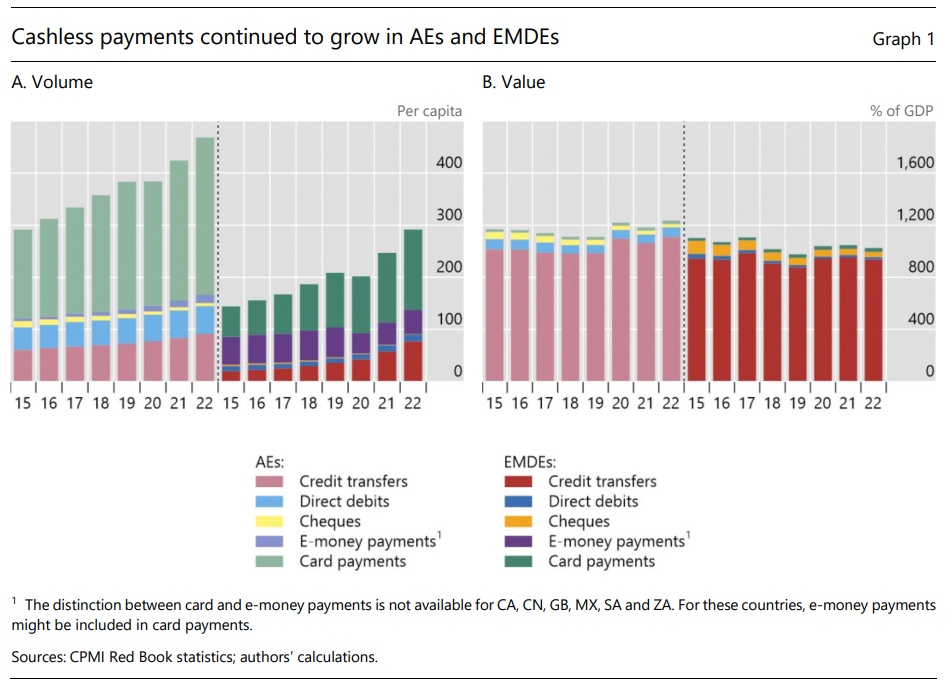

Due to the continued rise in digital payments, the volume of cashless payments increased markedly in 2022. The average yearly number of cashless payments per capita grew from 426 to 468 (+10%) for advanced economies (AEs) and from 246 to 291 (+18%) in emerging market and developing economies (EMDEs) (Graph 1.A). Except for in Argentina, payment cards were the most used payment instruments, followed by credit transfers.

Cheque payments continued to decrease almost everywhere. On average, users in AEs made five cheque payments per person in 2022 (down from six in 2021). In EMDEs, where the use of cheques was already limited, the average fell to less than one. Overall, consumers and businesses in AEs made on average twice as many cashless transactions than those in EMDEs.

On average, the value of cashless payments as a percentage of nominal gross domestic product (GDP) increased by 4% in AEs and decreased by 2% in EMDEs (Graph 1.B). In both groups of economies, credit transfers continued to account for most of the payment value. While the value of e-money payments made up only a small share of the total, it grew most strongly, both in AEs (+15%) and EMDEs (+22%).

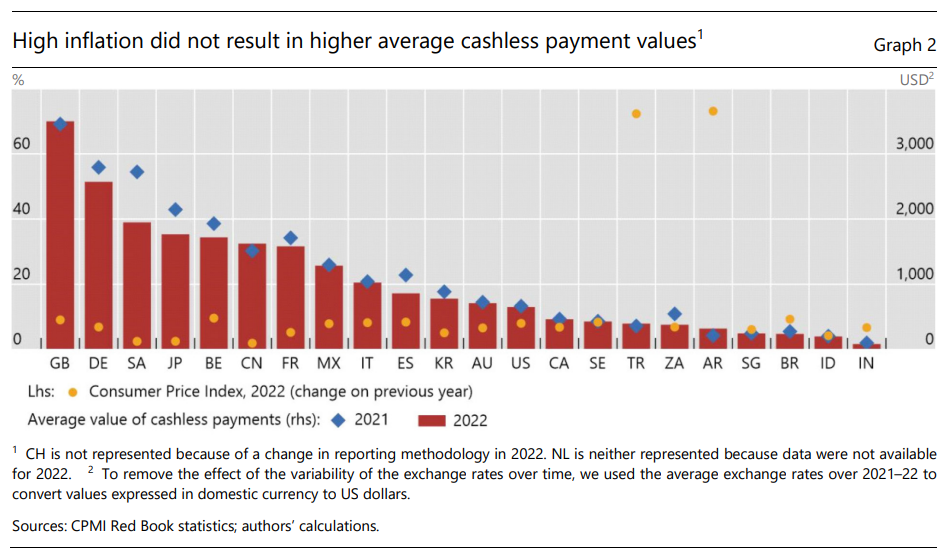

Cashless methods are increasingly used for small payments. The (nominal) average transaction value of cashless payments either continued to decline or stabilised in most countries in 2022 (Graph 2). This shows that the general increase in price levels did not result in higher average cashless transaction values.

It suggests that the number of cashless payments generally grew faster than their value and that users are becoming more accustomed to paying with cashless methods, even for smaller transactions.

Existing research shows that cash is used particularly for low-value purchases. Therefore, the observed decline and stabilisation of the average value of cashless payments, and card payments in particular, might signal a reduced demand for cash as a method of payment. Due to the anonymous nature of cash, the use of cash for payments is often proxied by the value of cash in circulation. A further deep dive into the cash in circulation data from the Red Book statistics finds a significant association with the average value of card payments (see Box 2). This suggests that users indeed increasingly choose to pay digital instead of with cash, and that this trend continued in 2022.

Fast payments are a prominent driver of payment digitalisation

Over the past few years, many jurisdictions have introduced fast payments as an alternative to cash or card payments, to foster financial inclusion, lower transaction costs and increase competition for retail

payments.

Fast payments, sometimes referred to as instant, real-time, immediate or rapid payments, are typically small-value payments in which the funds are made available to the payee in real time or near real time and as near as possible to 24 hours a day and seven days a week.

While to date, fast payments are mainly used for domestic payments, they also have the potential to improve cross-border payments. The CPMI has identified interlinking fast payment systems as one of the most promising solutions for making cross-border payments cheaper, faster, more accessible and more transparent. In fact, interlinking fast payment systems is one of the CPMI’s priority actions to help achieve the G20 targets for cross-border retail payments and remittances by 2027.

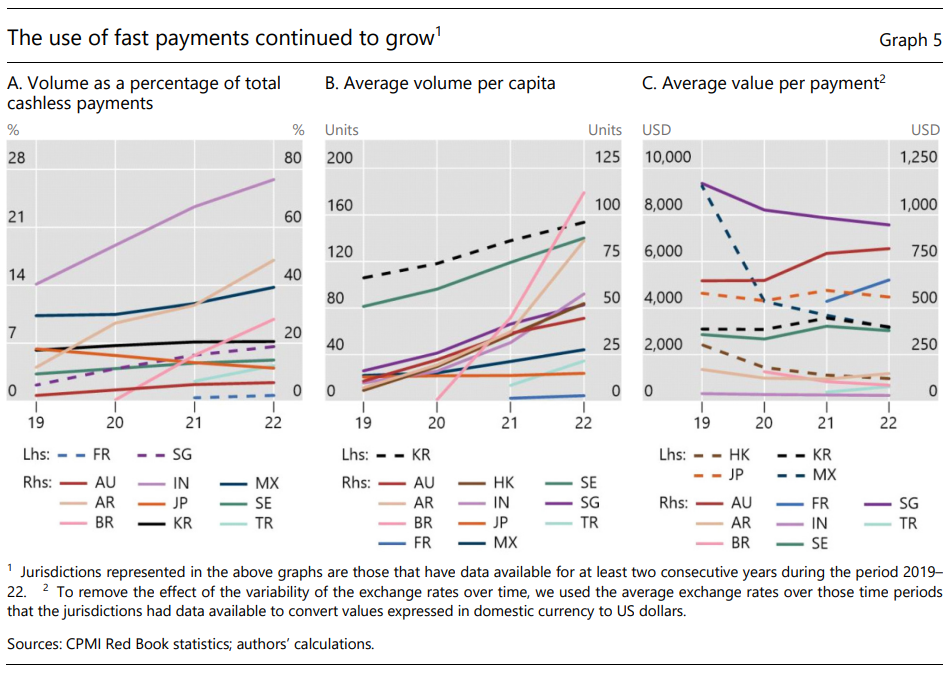

Most CPMI jurisdictions have at least one fast payment system, operated either by the central bank

or the private sector. The share of fast payments in total cashless payments continued to grow in 2022 in most jurisdictions for which we have data (Graph 5.A). In terms of number of transactions, this share was largest in India (76%), Argentina (49%), Mexico (39%) and Brazil (28%). In terms of payments per capita, it was highest in Korea (154), followed by Brazil (112) and Sweden (88) (Graph 5.B). Due to an unprecedented rapid growth in 2022, the number of fast payments per capita in Argentina (86) is now almost the same as in Sweden.

The development of average transaction values varies greatly between jurisdictions. In some countries the average size of a fast payment has grown over time, while in others, fast payments are increasingly used for small transactions (Graph 5.C). These differences may reflect differences in use cases, both between countries and over time. For example, in Türkiye, fast payments are used mainly for person-toperson and person-to-business payments, while in other jurisdictions, fast payments are also (increasingly) used for government payments and transactions between businesses, which are often higher in value.

Moreover, trends in average transaction values may reflect changes in transaction limits, imposed by either the fast payment system or the financial institutions offering these services to their clients.

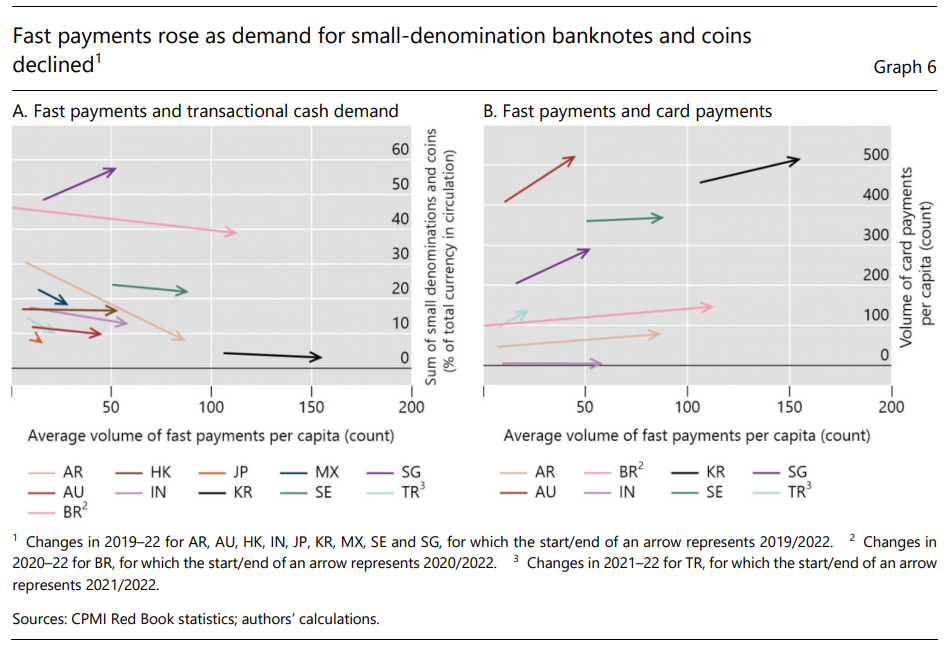

In nearly all jurisdictions, the volume of fast payments increased while demand for smalldenomination banknotes declined (Graph 6.A). At the same time, the volume of fast payments went hand in hand with an increase in the number of card payments (Graph 6.B). This suggests that fast payments are a prominent driver of the general digitalisation of countries’ payment ecosystems.

More details here: Tap, click and pay: how digital payments seize the day

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: