Shift4 has acquired a majority stake in Vectron, which will provide Shift4 with ~65,000 POS locations across Europe, local product expertise, and a European distribution network of ~300 POS resellers. The company has also completed its previously announced acquisition of Revel Systems, which will provide Shift4 approximately 18,000+ merchant locations and an estimated $17B payment opportunity.

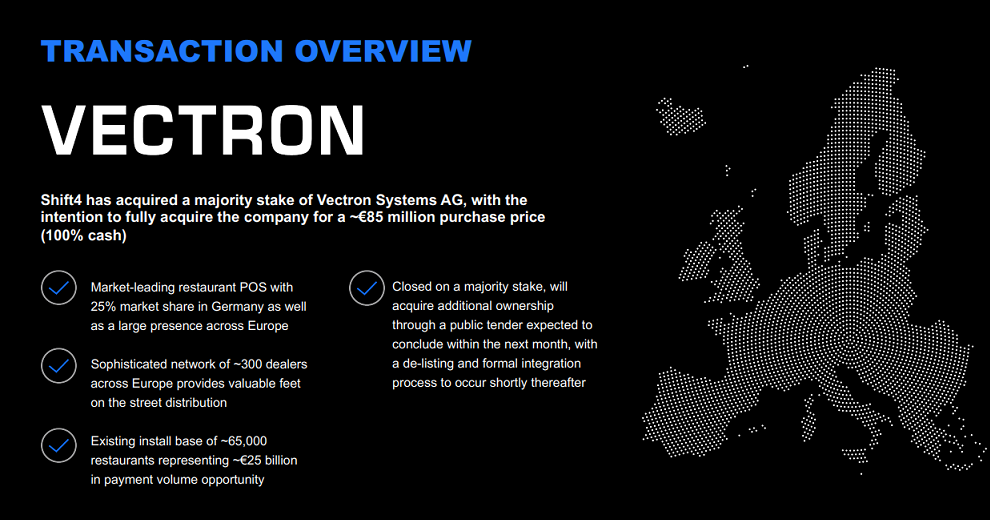

Shift4, the leader in integrated payments and commerce technology, has acquired a majority stake in Vectron Systems AG, one of the largest European suppliers of point-of-sale (POS) systems to the restaurant and hospitality verticals.

„Based in Germany, Vectron has ~65,000 POS locations across Europe, representing ~€25 billion in volume opportunity with minimal payment monetization today. Shift4 is expected to acquire additional ownership of Vectron through a public tender offer that is expected to conclude within the next month, with a de-listing and formal integration process to occur shortly thereafter.” – according to the press release.

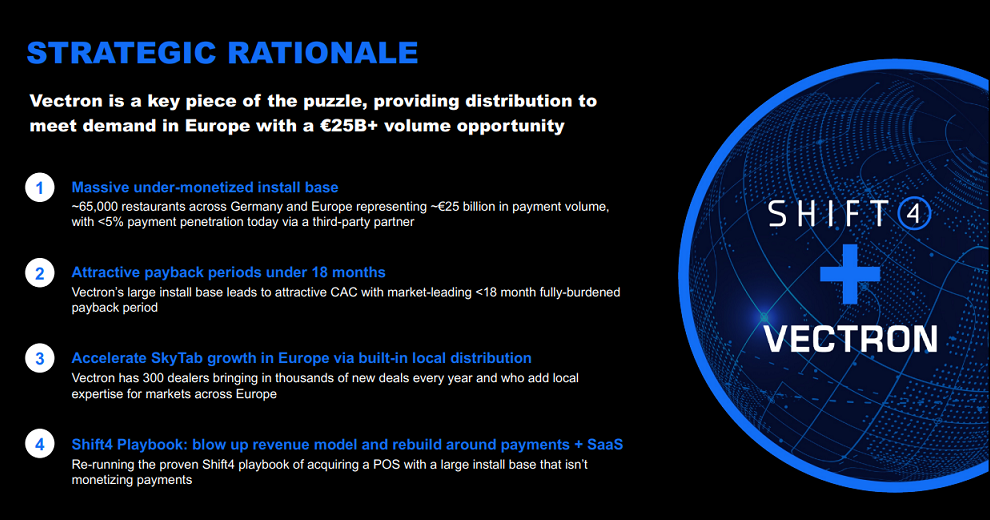

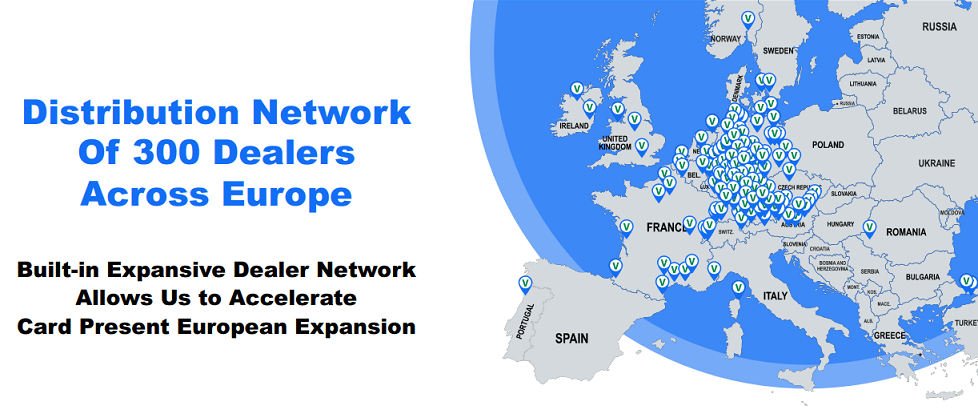

„The acquisition is expected to provide Shift4 with an expansive customer footprint across Europe as well as a distribution network of ~300 POS resellers. As a result of the acquisition, Shift4 believes it will be able to add its integrated payment services to current Vectron customers and products, while also empowering the sales force with a compelling all-in-one POS and payments solution unrivaled in Europe.” – the company said.

“Shift4 was at the forefront of the convergence between software and payments in the restaurant and hospitality verticals in the US. We see an incredible amount of demand for a similar all-in-one solution across Europe,” states Shift4 CEO Jared Isaacman. “With our integrated payments and SkyTab offering, we believe we have the best solution at the right price point. Vectron will provide valuable local expertise, infrastructure, and the distribution necessary to meet the demand. This acquisition is right out of the Shift4 playbook – enabling us to unlock synergies, expand our distribution, and monetize payments for a large existing install base.”

In addition to the acquisition of Vectron, Shift4 has also completed its previously announced acquisition of Revel Systems. Revel has over 18,000 merchant locations across the United States and internationally which Shift4 estimates represents a $17B+ payment opportunity. Revel also has a direct sales and dealer distribution network which Shift4 believes can be leveraged to accelerate SkyTab distribution both domestically and abroad. Please reference Shift4’s Q1 2024 Shareholder Letter for more information on the Revel acquisition.

Shift4 retained Perella Weinberg as financial advisor and Gleiss-Lutz as legal advisor on the acquisition of Vectron, and Chiesa, Shahinian, and Giantomasi as legal advisor on the acquisition of Revel.

____________

Shift4 is boldly redefining commerce by simplifying complex payment ecosystems across the world. As the leader in commerce-enabling technology, Shift4 powers billions of transactions annually for hundreds of thousands of businesses in virtually every industry.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: