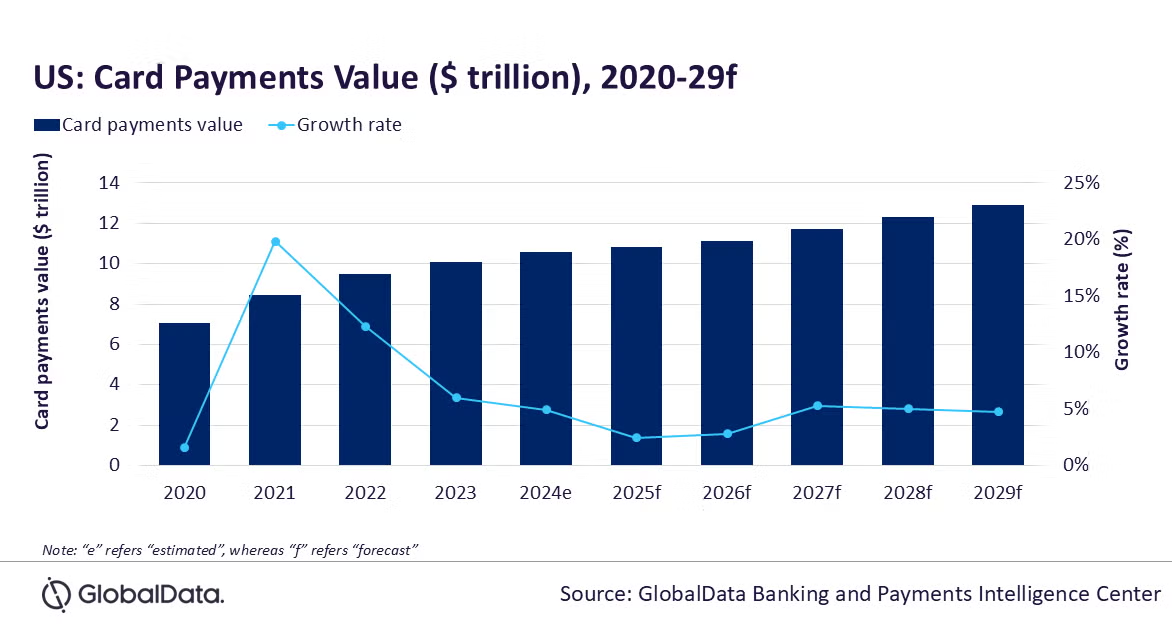

The US card payments market is projected to grow by a modest 2.4% in 2025, reaching $10.8 trillion, as economic uncertainty and rising tariffs weigh on consumer spending. While strong foundations like high card penetration and contactless adoption persist, inflationary pressures and trade disruptions are expected to challenge the market’s resilience and slow its previously robust growth trajectory, according to GlobalData, a leading data and analytics company.

GlobalData’s report, “United States (US) Cards and Payments: Opportunities and Risks to 2028,” reveals that the card payment value in the US registered a growth of 6% in 2023, driven by the rise in consumer spending. The value registered an estimated growth of 5% in 2024 to reach $10.6 trillion. However, the latest tariffs can pose a challenge for the overall economic growth, while rising inflation is expected to curb consumer spending, resulting in a slowdown in the overall card payments value.

The US card payments market is highly mature, and arguably even over-served by its financial institutions with high card penetration and usage. Ready access to formal financial services has resulted in a population that is very comfortable using debit, credit, and charge cards for payments.

Ongoing investments in payment infrastructure, increasing contactless payment adoption, and e-commerce growth have accelerated expansion in the US card payment market. Contactless cards have driven low-value daily transactions, further bolstered by the COVID-19 pandemic. However, economic uncertainty fueled by Trump’s tariffs now threatens to slow this momentum, creating headwinds for sustained growth in the sector.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, comments: “Economic forecasts for many markets, including the US, were seen as positive until the beginning of the year due to expected economic recovery and reduced inflation. However, the current situation is now considered uncertain once again. The trade wars have already disrupted financial markets and caused businesses to face uncertainty, potentially leading to weakened economic growth.”

While tariffs pose challenges for all players in the economy, the main impact on the card payments will be via inflation, and depressing retail activity. As a result, both payment volumes and average transaction values will see slowdown, ultimately hurting the revenues of card issuers, payment processors, networks, and acquirers, including any business segments involved in the value chain.

Furthermore, tariffs on imports and supply chain disruptions from China and other markets may also increase costs of payment terminals and hardware components, which may impact small businesses accepting card payments.

Sharma concludes: “Looking ahead, the transition to electronic payments is expected to continue over the next five years due to the growing number of electronic payments. However, ongoing economic uncertainty will continue to present challenges for the industry. The card payments value is expected to register a compound annual growth rate (CAGR) of 4.1% between 2024 and 2029 to reach $12.9 trillion.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: