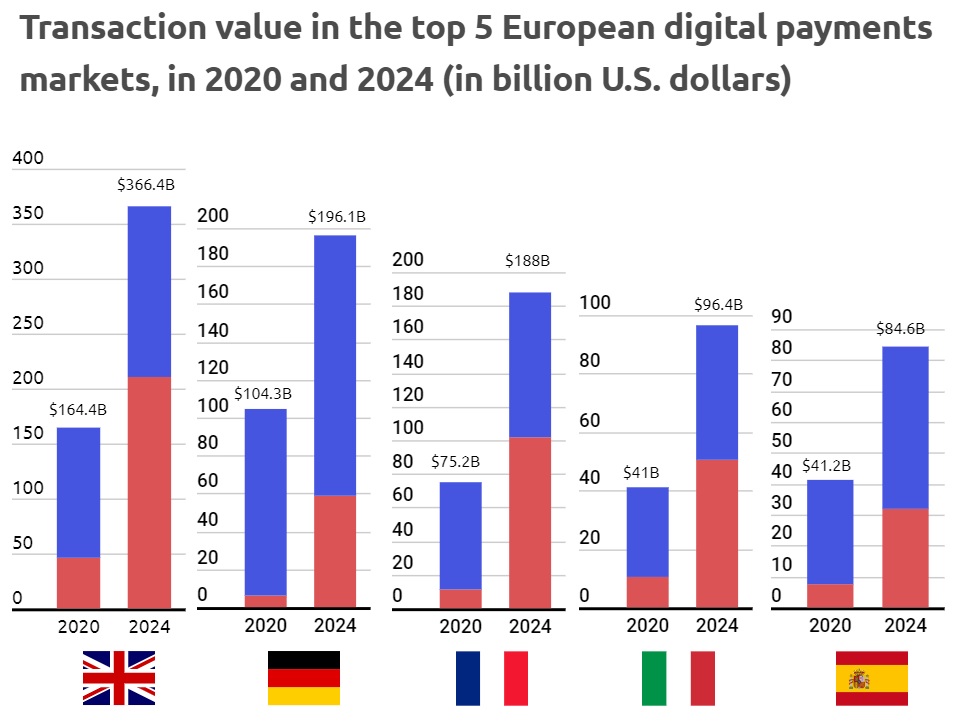

Recent years have witnessed an impressive growth of the European digital payments industry with transaction value rising by more than $200bn since 2017, and reaching $708.3bn in 2020. According to data presented by BuyShares, the United Kingdom, as Europe’s largest digital payments market, is expected to generate 25% of that value.

Mobile POS Payments in the United Kingdom to Surge by 360% by 2024

With 81.8% of its citizens using online payments in 2019, the United Kingdom ranked as the country with the highest share of online payment users globally, revealed Statista 2020 FinTech Report.

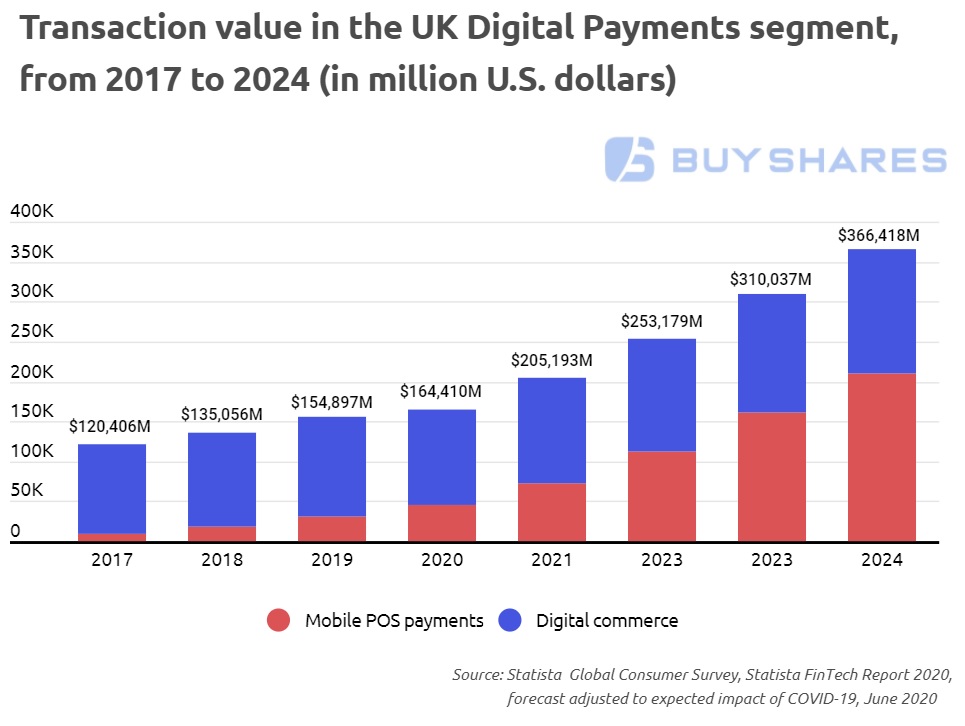

In 2017, the UK digital payments industry hit $120.4bn transaction value, and eCommerce generated 90% od that value. By the end of 2019, this figure rose by 30% reaching $154.8bn.

Online payments in the United Kingdom continued rising amid COVID-19 lockdown, with millions of people choosing webshops instead of brick and mortar stores. Statistics show the UK digital payments market is set to reach $164.4bn value in 2020, almost $10bn increase year-on-year.

Mobile POS payments played a huge role in that increase. In 2019, the mobile segment of the British digital payments industry generated $30.9bn in revenue. Digital commerce, as the most significant revenue stream, hit $123.9bn value last year.

However, in the last twelve months, the mobile POS payments rose by $14.8bn, reaching $45.7bn in 2020. Digital commerce payments, on the other hand, dropped by $5.3bn, falling to $118.6bn transaction value this year.

The Statista 2020 Fintech Survey revealed that mobile POS payments in the United Kingdom are expected to surge by 360%, reaching $210.8bn value by 2024. Digital commerce transactions are set to jump over $155bn value, a $37bn increase in four years. The entire digital payments industry in the United Kingdom is forecast to double and hit a $366bn transaction value by 2024.

The UK to Remain Europe’s Largest Digital Payments Industry

Statistics show the United Kingdom is set to remain Europe’s largest digital payments industry, with the transaction value almost double than the other two leading markets. As the second-largest digital payments industry in Europe, Germany is expected to hit $104.3bn transaction value this year, 38% less than the leading United Kingdom. France, Spain, and Italy follow with $75.2bn, $41.2bn, and $41bn, respectively.

However, statistics show these four European digital markets are set to witness impressive growth in the next four years, with their combined transaction value growing by 116% and reaching $565.1bn by 2024.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: