The UK Cards Association: almost a third of card spending is now on Internet – „online shopping has become a way of life”

For the very first time amount of online spending on cards is published along with number of online transactions. New figures show that during January, consumers spent twice as much on cards on average via the internet as they did in-store.

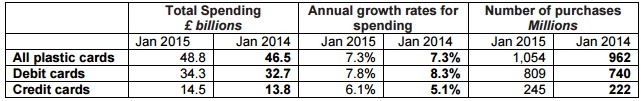

New figures show that more than 30 per cent of the value of all spending on cards in January was via the internet, with £15.4bn of the £48.8bn total spent in this way. The number of online card transactions made up 12.3 per cent of total card purchases which equates to 118m of all 1,054m card payments.

This is the first time The UK Cards Association has published the amount spent on the internet using cards by value or by number of transactions. This data will now be released on a monthly basis.

The new data also revealed people spend twice as much on average via the internet as they do in-store, with the average transaction value for each standing at £96.10 and £46.53 respectively in January. Interestingly the most common online card purchase was on entertainment which stood at 27 per cent of total internet card volume, whilst food and drink accounted for 7 per cent of all online purchases in January.

Richard Koch, Head of Policy at The UK Cards Association, said: “These figures demonstrate the extent to which online shopping has become a way of life, with almost a third of all card spending now happening on the internet. Interestingly, while people still make transactions more regularly in shops, when they do shop on the internet, they tend to spend far more – demonstrating that consumers’ bigger transactions happen online.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: