The U.S. Securities and Exchange Commission (SEC) Chairman confirms bitcoin is a commodity

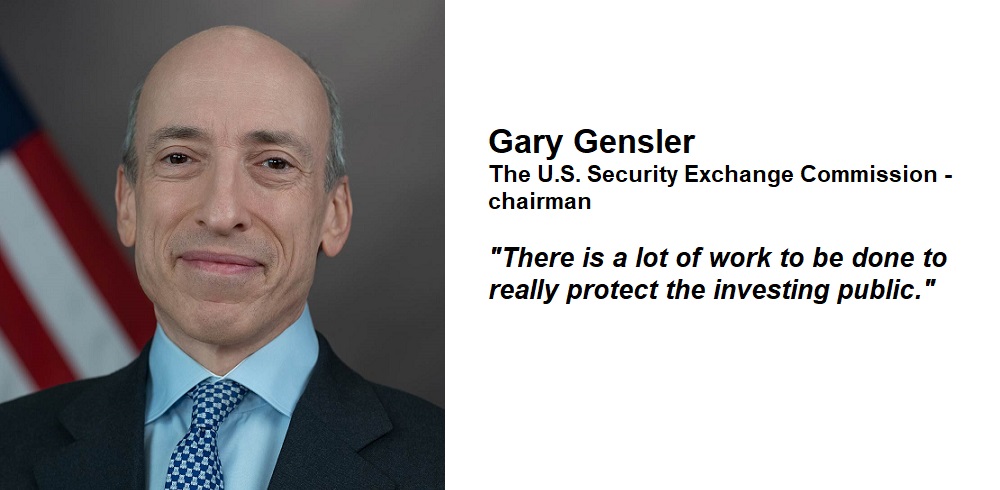

The inevitable regulation of the cryptocurrency market is “a significant step closer” due to comments made on Monday by the U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler, says Nigel Green, CEO of one of the world’s largest independent financial advisory organizations

Speaking to CNBC’s Jim Cramer, Gensler said that Bitcoin is now to be labeled as a commodity.

Nigel Green says: “The comments from Gary Gensler clears up years of debate. One of the world’s most influential regulators has now confirmed that it views Bitcoin as a commodity, in much the same way gold is, and not a security.

“The financial watchdog said that many tokens on the market have the key attributes of securities, which puts them under the jurisdiction of the SEC, but not Bitcoin.

“As a commodity in the U.S., Bitcoin would fall under the oversight of The Commodities Futures Trading Commission.”

The deVere CEO says that there are three key takeaways from the comments made by the SEC chief.

“First, the SEC’s approach is to galvanize Bitcoin’s long-held status as ‘digital gold.’

“Bitcoin is often referred to as ‘digital gold’ because like the precious metal it is a medium of exchange, a unit of account, non-sovereign, decentralized, scarce, and a store of value.”

He adds: “I believe that the world’s largest crypto will dethrone gold as the ultimate safe-haven asset within a generation as millennials and younger investors, who are so-called ‘digital natives’, believe it competes better.

“Millennials are to become an increasingly important market participant in the coming years, with the largest-ever generational transfer of wealth – predicted to be more than $60 trillion – from baby boomers to millennials taking place.

“Another key factor is the historic levels of money-printing as central banks around the world attempt to prop-up their economies following the fallout from the pandemic.

“If you are flooding the market with extra money, then in fact you are devaluing traditional currencies – and this, and the threat of inflation, are legitimate concerns to a growing number of investors, who are seeking alternatives.”

Nigel Green continues: “Second, Gensler said that regulators in the U.S., which include the SEC and the CFTC, have a lot of work to do in order to introduce comprehensive laws that would protect the investing public.

“This is a clear sign that the financial watchdogs are homing in on regulation of the sector. As I have long said, I believe this is inevitable – and it is something I support as cryptocurrencies become increasingly part of the mainstream, global financial system.”

“Third, the wider crypto sector will take the comments made by the chair of the SEC as bullish. We can expect prices to gradually rise.”

The deVere CEO is also doubling down on an earlier price prediction: “I remain confident that Bitcoin may get a tough summer, but that it could stage a bull run in the fourth quarter.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: