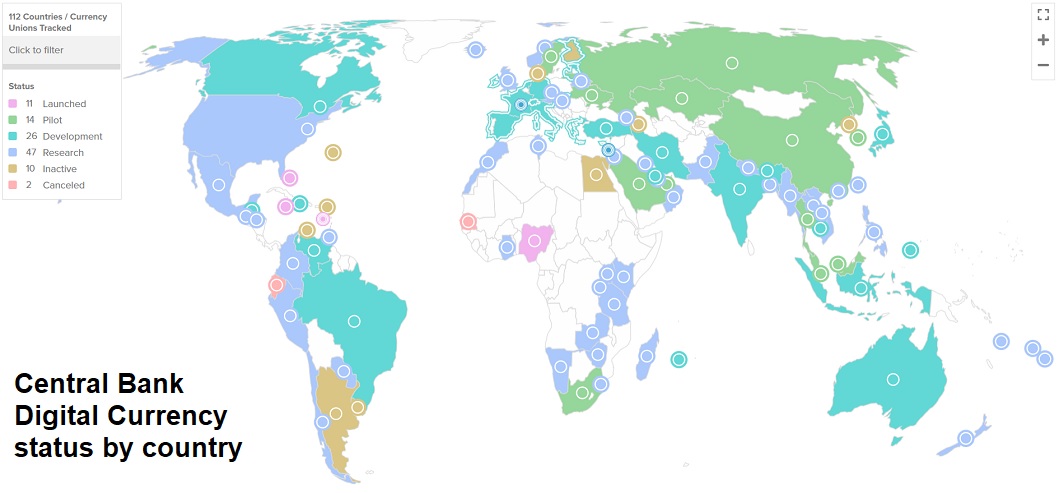

Over 100 countries are currently exploring centralized digital currencies but some are further ahead than others. In May 2020, only 35 countries were considering a CBDC. A new high of 50 countries are in an advanced phase of exploration (development, pilot, or launch), according to the Atlantic Council’s Currency Tracker.

10 countries have fully launched a digital currency, with China’s pilot set to expand in 2023. Jamaica is the latest country to launch a CBDC, the JAM-DEX. Nigeria, Africa’s largest economy, launched its CBDC in October 2021.

Many countries are exploring alternative international payment systems. The trend is likely to accelerate following financial sanctions on Russia. There are 9 crossborder wholesale (bank-to-bank) CBDC tests and 3 cross-border retail projects.

Of the G7 economies, the US and UK are the furthest behind on CBDC development. The European Central Bank has signaled it will aim to deliver a digital euro by the middle of the decade.

19 of the G20 countries are exploring a CBDC, with 16 already in development or pilot stage. This includes South Korea, Japan, India, and Russia. Each has made significant progress over past six months.

The financial system may face a significant interoperability problem in the near future. The proliferation of different CBDC models is creating new urgency for international standard setting.

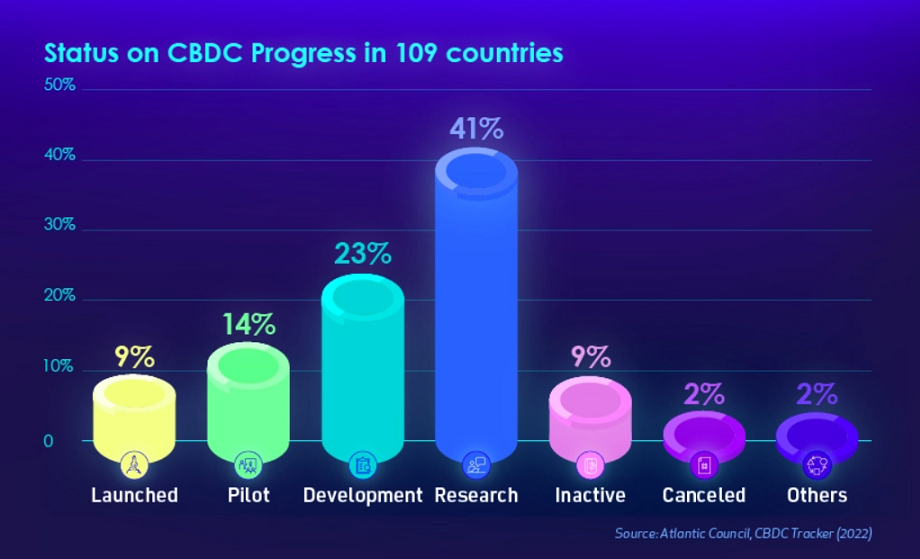

When aggregated, we can see that the majority of countries (over 40%) are in the research stage.

Just 9% of countries have launched a digital currency to date. This includes Nigeria, which became the first African country to do so in October 2021. Half of the country’s 200 million population is believed to have no access to bank accounts.

Adoption of the eNaira (the digital version of the naira) has so far been relatively sluggish. The eNaira app has accumulated 700,000 downloads as of April 2022. That’s equal to 0.35% of the population, though not all of the downloads are users in Nigeria.

Conversely, 33.4 million Nigerians were reported to be trading or owning crypto assets, despite the Central Bank of Nigeria’s attempts to restrict usage.

More details here

____________

What exactly is a Central Bank Digital Currency (CBDC)? A CBDC is virtual money backed and issued by a central bank. As cryptocurrencies and stablecoins have become more popular, the world’s central banks have realized that they need to provide an alternative.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: