Fingerprint Cards AB’s (Fingerprints™) second-generation T-Shape® sensor module and software platform for biometric payment cards have achieved compliance with Mastercard’s new Fingerprint Sensor Evaluation Process.

„Having passed the former specifications last year, Fingerprints has proactively secured this updated approval to simplify the process for card manufacturers to launch second generation biometric payment cards,” according to the press release.

„This development will minimize the time to market, lower related costs and is an important milestone for the deployment of biometric payment cards at scale, supporting greater convenience and security for consumers making in-store purchases,” the company explains.

The test was performed in line with Mastercard’s stricter anti-spoofing capabilities for biometric payment cards, which were issued last year. The Fingerprint Test Assessment Summary (FTAS) for sensor vendors confirms the performance of features that enhance the security, privacy, and user experience for cardholders.

“Yet again we are pushing technology boundaries by increasing the security features of our solution. This is an important achievement for our card partners, who can save time and money when launching and scaling second generation biometric cards. And ultimately for consumers, who will be able to enjoy a convenient and secure in-store payment experience” – says Michel Roig, President Fingerprint Cards Switzerland AG – Payment & Access.

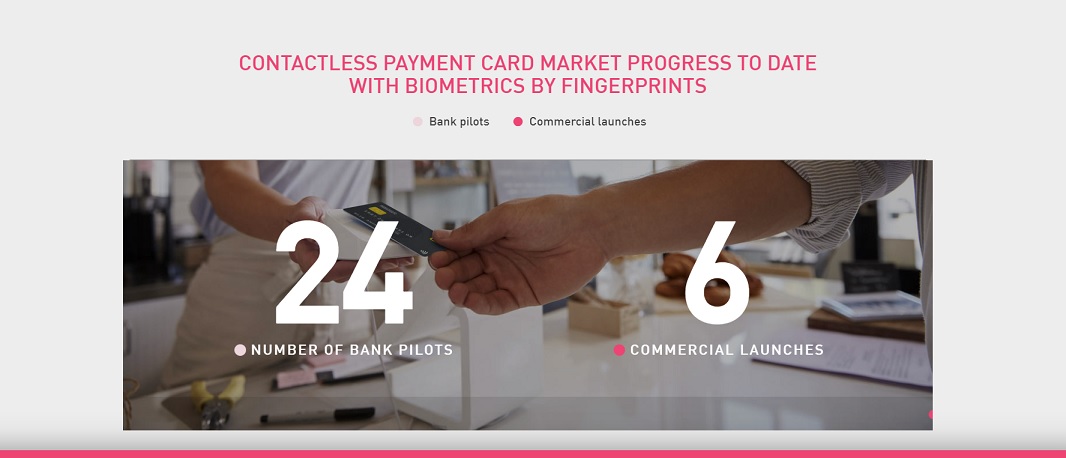

The second-generation T-Shape technology combines extensive R&D investment with key learnings from successful market pilots and commercial rollouts. It delivers increased performance and power efficiency, enabling the most cost-effective biometric payment cards to be produced and integrated using standard manufacturing processes.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: