RoFintech Association is proud to announce the launch of Romanian Open Banking Initiative – ROBI. With the aim of addressing the misalignment between the implementation of the Payment Service Directive (PSD2 and upcoming PSD3) and its objectives in terms of innovation and competition, „ROBI seeks to accelerate the adoption of open banking in the Romanian market and eliminate burdens faced by industry participants” – according to the press release.

The open banking directive, while designed to promote innovation and competition within the financial sector, has encountered challenges and slow adoption rates due to a lack of harmonization and transparency. Recognizing the need for a unified voice and vision, RoFintech has created am open banking working group specifically tailored to the Romanian market. The working group comprises esteemed contributors, including licensed Third-Party Provider (TPP) companies such as Paysera, Finqware, SmartFintech, Kevin and TrueLayer.

The primary objectives of ROBI are as follows:

. Creating a common framework for cooperation among open banking players operating in Romania.

. Analyze and monitor the current state of the Romanian open banking market to identify opportunities and obstacles.

. Establishing a robust collaboration platform among industry participants.

. Utilizing the PSD3 anticipated legislative updates to foster a unified approach and perspective.

. Enhancing the current open banking development and adoption processes by implementing best practices.

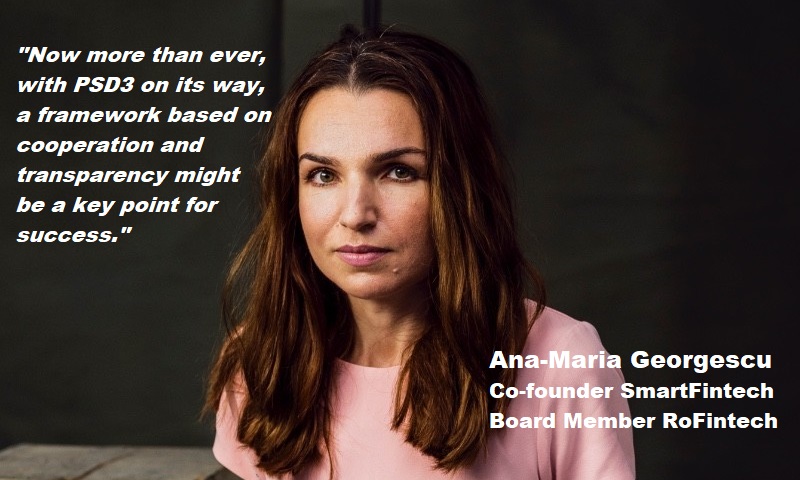

Under the coordination of Ana Maria Georgescu, the working group has already started its activities. Through ROBI, RoFintech aims to facilitate enhanced cooperation, efficiency, and progress within the local ecosystem, ensuring that the benefits of open banking are fully realized by all stakeholders.

Ana Maria Georgescu – Board Member RoFintech, Co-founder SmartFintech: „Perhaps a bold ambition, but our goal is to bring together open banking providers (TPPs), banks, and regulators to build together the best way forward. Open banking is a global transformation, and it is crucial to support the development of the Romanian market in this regard. Now more than ever, with PSD3 on its way, a framework based on cooperation and transparency might be a key point for success. We have confidence that Romania can become an important player in the development of this new financial ecosystem.”

Cosmin Cosma, President RoFintech, Co-founder Finqware: “We believe that the local implementation in Romania of PSD2 has the potential to be a best practice within EU zone and this is the success we aim to reach as the objective of this working group. ROBI was created by the Romanian Fintech Association with the clear aim to achieve this through transparent and effective collaboration between all the players (third party providers, banks, regulators). We are looking forward to see the Romanian consumers and businesses to have open banking as main interaction with their financial provider as soon as possible.”

Mihael Mihaylov – IRIS Solutions: “The team of IRIS Solutions is pleased to be part of ROBI. In order to achieve our shared objective of establishing an Open Banking ecosystem and putting its power and value in the hands of individuals and business organizations, we are pleased to join forces with our friends from other TPPs operating in Romania. Open Banking and Open Finance are among the pillars of EU’s digital strategy and it is our mission to support all business organizations in their digital transformation with the tools of Open Banking.”

Daniel Turbatu, Country Manager Paysera: „The Romanian public is still largely unaware of the benefits of OpenBanking. We need major support from the National Bank of Romania to join our efforts to educate the public about its importance and potential”.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: