article written by Chris Skinner, the author of the bestselling book Digital Bank

I first started blogging about smart mobile wallets in earnest in 2014. Back then, the mobile network operators were starting to get active and to try and bring the M-PESA and other experiences to the modern world. But no one wanted them. Six years later, mobile wallets are still pretty dire in most of Europe and America and, by comparison with card and cash, relatively unused.

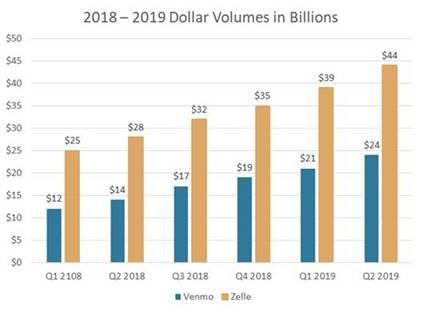

In America for example, the first mobile wallet I talked about was Venmo, a social mobile payments app created by two guys in 2010 and acquired by Braintree and then PayPal mid last decade. Due to its popularity, the American banks created Zelle in 2017 , which is now processing twice the volumes of Venmo.

Source: The Payments Journal

That means these two systems combined are processing around $250 billion of payments in 2019. Sounds good? Well, not really. According to the Federal Reserve the total of credit and debit card, ACH and cheque payments in 2018 totalled over $97 trillion, up by more than $10 trillion from 2015. In other words, payments with the two most popular American mobile wallet systems amounted to around 0.25 percent of the total payments processed in America.

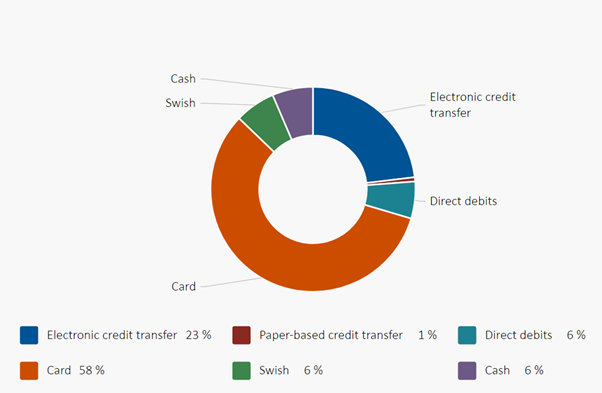

The same is true in Europe. There is no European mobile wallet. There are some good local solutions, specifically in the Nordic region, but no general wallet we all use (unless you mean Apple Pay or Android Pay). Even then, where mobile wallets have been successful are in countries like Sweden with the mobile wallet Swish, but even Swish only accounts for six percent of payments. Cards, with 58% of the market, are still dominating.

Source: Riksbank

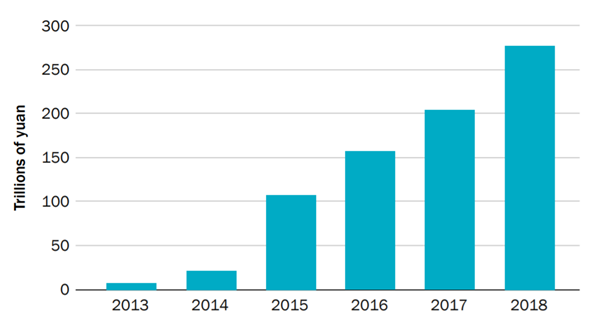

Meanwhile, you’ve probably heard about China’s mobile wallet and payments revolution, leading to a near USD$50 trillion of payments in 2019 processed.

Source: Brookings Institute

What’s the difference between China, Europe and America, and why has China adopted mobile wallet payments so fiercely whilst Europe and America have not?

There are a range of points that could be made here – too many for a daily blog as it’s more like an essay (read Digital Human) with its 30,000 word case study on Ant Group) – but the key areas must be around infrastructure, ease-of-use, incentives and ubiquity.

These are things that Europe and America got wrong, including Apple and Android. Around one in twenty card payments are made using Apple Pay today, generating a revenue that is miniscule but could be big. With time … and effort … and focus …

In fact, there is a fascinating article discussing why Alipay works and Apple Pay doesn’t, that came out last week:

As of late 2019, only 9% of American consumers had adopted Apple Pay while 81% of Chinese consumers used AliPay. What explains the huge gap between adoption of these mobile payment services in the two countries? The authors argue that it’s largely a question of approach. Based on our their experience in the financial services industry and work with platform companies, the authors identified two key strategic drivers for successful platform adoption: 1) Create value for all parties, not just the consumer, and 2) Monetize the ecosystem, not just the product.

I agree with this, in that Apple Pay created something with some incentive for the user and little for the received. In particular, I remember the laughter when I showed my Asian friends Apple Pay. The laughter was due to the app showing my credit card. In other words, Apple Pay had taken my card and purely replicated in into an app and that is the issue. The issue is that it’s no good trying to replicate the world of paying onto a mobile wallet. You need to create a new ecosystem of value, where payment is the side-product and not the end-goal. This is what the Chinese got right, and the USA and Europeans got wrong.

We even talked about this ten years ago. Ten years ago, the Nordic founded group called Mobey Forum – still going today – issued a report that I blogged about:

They assert that, instead, the mobile wallet needs to leverage value through loyalty schemes, coupons and offers to be more relevant to the consumer than their old wallet.

It went further, and said that mobile wallets need to more than just a wallet; more than just a payment; more than just finance and commerce … it needs to be all of those things but also about identity and security.

That was ten years ago. Ten years. In ten years, America has a trickle of payments made by mobile and Europe’s leading economy has managed to move one in twenty payments to the phone. In the meantime, China has moved so fast that three in five citizens use digital financial services and payments every single day.

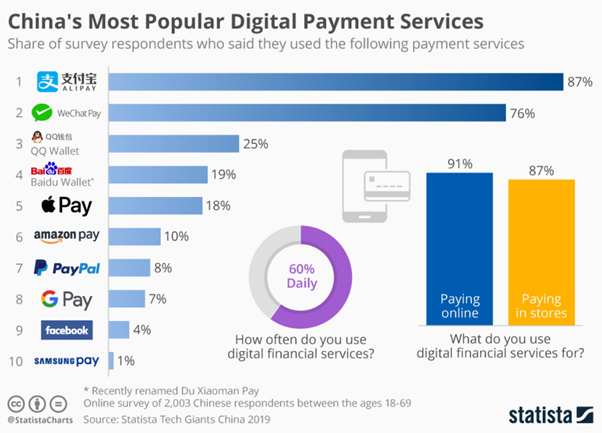

Source: Statista

This brings me back to those four key areas which underpin China’s success in rolling out such services: infrastructure, ease-of-use, incentives and ubiquity.

The infrastructure is simple. In Europe and America, we were rolling out new terminals and cards with Chips that enabled Chip and PIN. It’s been a complex and costly process, with merchants arguing over who pays. We then made it ten times worse by rolling out another chip – NFID – so that contactless could take off, as long as you had a card (or now a phone).

In China, Alipay and WeChat Pay rolled out QR codes. Cheap, simple and easy, with no overhead or acquisition costs, anyone could now take a payment by just having a piece of paper with a QR code.

That leads to the ease-of-use. Merchants could take payments fast and easily by reading QR codes from phone or consumers could make payments fast and easily by reading QR codes from their phone. It wasn’t as simple as that, however. The simplicity and ease-of-use came from the fact that the QR codes were embedded in super apps that covered everything from sending social messages to buying things online to proving who you are.

Unlike America and Europe who became addicted to apps like Amazon, Facebook and PayPal, China rolled out an integrated superapps version of these in the form of Alibaba and Tencent. As super-apps, they are more like an integrated Amazon, Facebook and PayPal, all in one. That was a key.

Then there are the incentives, in that if you have an ecosystem of commerce, social and financial all in one app, it is far easier to motivate people to use those services, particularly if there are rewards and savings to be made, than if you just had a piece of the puzzle. A critical success factor in China’s system was (a) social – the red envelope days that embraced a cultural shift from analogue to digital; and (b) commercial – giving merchants and consumers real-time discounts and offers via mobile.

If you’re not aware of the red envelope day, it’s a tradition in China to give friends and family some cash to Celebrate the Chinese New Year in a red envelope. In the mid-2010s, the marketing whizzes in China realised this was a great way to get people to understand and be incentivised to use mobile payments and created a specific program for just doing this.

The second is commercial, and the fact that if you are using Alipay then you get specifically targeted adverts with savings coupons as you walk past the stores. It makes shopping fun and gives great incentives to both merchant and consumer to engage. In other words, it’s just really easy to use and engage.

Then there’s ubiquity. The ability to pay by QR code in China is now so pervasive, available, able to be used both online and offline – a QR payment can be taken for processing later online – and simple, that it is unavoidable. Unlike in Europe and America where card is the dominant and simplest form factor to use for a payment, in China there are credit and debit cards, but the card payments infrastructure was nowhere near as mature or dominant as it is in Europe and America. This led to the opportunity to replace that network with the simpler form factor of mobile app with QR code. And a mobile app with QR code is so ubiquitous that you can use it for donating to your nearest temple or buying roasted peanuts from the corner street seller. Everything from paying bills to paying charities to supporting local street stalls is freely and easily supported by a mobile with a QR code. No merchant terminals are needed, no bank accounts and no cards. It’s free, easy and everywhere.

In summary, the mobile wallet has been rising for a decade but, for all the efforts in Europe and America, the system struggles. Card payments are still predominant, and the issue is that the form factors and infrastructure is not as appropriate or developed for mobile wallets as the environment that has led to the big players in China. Those factors are summarised as: infrastructure, ease-of-use, incentives and ubiquity.

About the author

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal’s Financial News.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: