The number one challenge faced by merchants under the new pandemic conditions is slow sales

2Checkout, the leading all-in-one monetization platform for global businesses, announced the findings from a global survey of over 800 merchants selling digital, physical goods and services online internationally on the expected impact of the COVID-19 pandemic on their business. Even though merchants in a few verticals have thrived during the COVID-19 lockdown, many more have experienced contractions and see the pandemic as a critical and significant threat to their business. The key findings are outlined below.

COVID-19 Impact

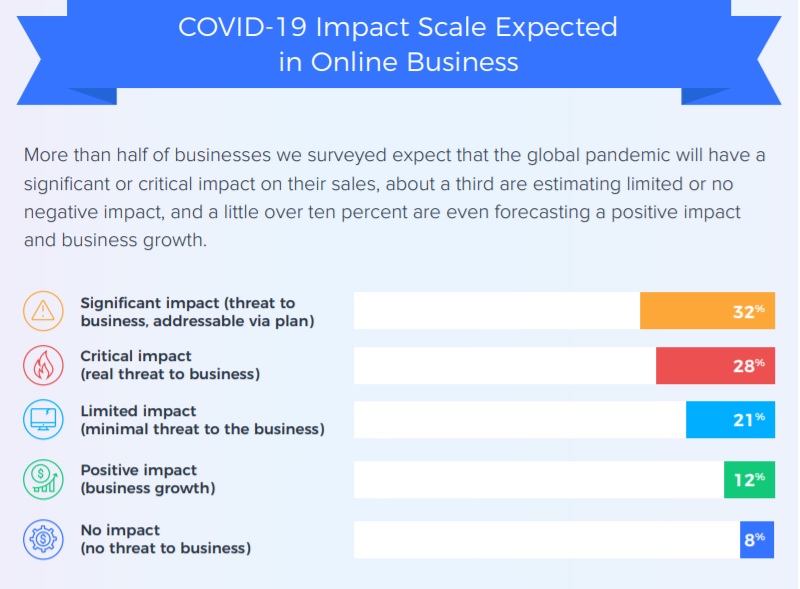

As would be expected, only a small number of merchants (12%) surveyed expect to benefit from the current situation. Multimedia software producers, middleware companies and some entertainment providers are among those fortunate enough to forecast record business growth as the year advances.

On the other side of the spectrum, 28% of companies are expecting the worst, with those in physical goods retail being the most concerned about the effect of the crisis on their business. While about a third of merchants (32%) expect the current pandemic to have a significant negative impact on their business, they hope to mitigate it with a well-executed crisis response plan. Those in this bucket mainly include businesses on the production side of the supply chain (manufacturing resource management, consumer electronics and hardware), as well as those dependent on user consumption habits–marketing and advertising, human resources management.

Finally, findings show that only 8% anticipate no impact on their business and another 21% foresee a minimal impact on overall revenues.

Challenges faced by businesses

Slow Sales – The number one challenge faced by merchants under the new pandemic conditions is slow sales – 60% of respondents are preparing for a sluggish sales cycle. More specifically, 18% of merchants report difficulty with finding or closing new business, and 17% are struggling with restricted or stagnant funnels. While the majority of these challenges require extensive planning and pivoting, some can be addressed through improved and intensified communications with clients and prospects.

Forecasts for slower sales span a variety of industries and markets. From manufacturing to communications, companies across the board have been dealing with contracted sales in the first half of the year. The struggle to find new business is something faced by companies in consulting, marketing, and technology, among others.

Supply Chain Delays – Companies in the consumer electronics and hardware, physical goods retail, manufacturing, and drop shipping industries are the ones most affected by fulfillment and supply chain issues. While 21% of these companies struggle with fulfillment and supply chain delays currently, the vast majority are in the physical goods retail businesses.

Productivity – Reduced workforce productivity is another challenge reported, albeit at a much smaller percentage, but these industries have continued to conduct business throughout the pandemic. The main industries impacted have been call centers, developer tools, and online content producers.

Other challenges

Merchants selling digital goods, such as multimedia software or computer programs, face a unique challenge with respect to changing consumer attitudes and conditions, with 15% of respondents reporting increased chargebacks and refund requests as a result of pandemic-related consumer hardship and uncertainty.

Digital Commerce Priorities Moving Forward

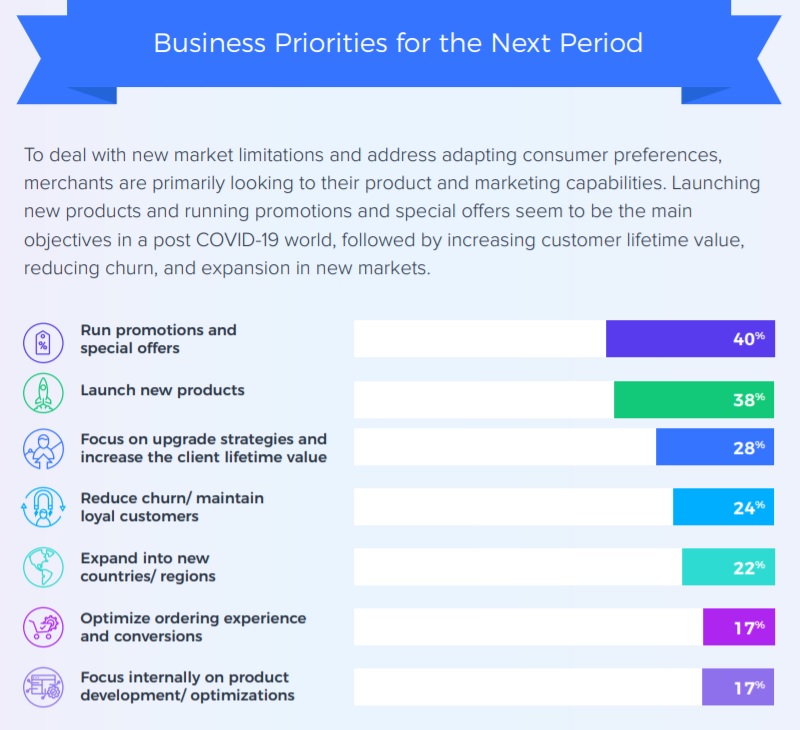

Launching new products & running promotions – Many companies are looking to their product and marketing teams to adapt to the new market conditions and changing consumer preferences, with 38% and 39% of respondents planning, respectively, to launch new products and run promotions to overcome the challenges of the COVID-19 landscape.

Promotional campaigns are a bounce-back option considered by verticals such as system utilities, desktop tools, and business software. New product development is a go-to solution for merchants in industries such as communications, developer tools and legal services. In addition to new product development and promotional campaigns, 28% of merchants are also prioritizing tactics such as upsells and upgrades, aimed at increasing customer lifetime value.

Churn Reduction – Another effective strategy recommended by industry experts is a focus on customer retention. Currently, 24% of respondents, mainly in the desktop and internet software industries, as well as the hosting and middleware industries, are concentrating their efforts on reducing churn and maintaining or increasing customer loyalty.

Expansion into new markets – 22% of respondents are aggressively entering foreign or unfamiliar markets in search of new business, with companies in consumer electronics and online education leading the way.

Optimization and marketing tactics – 17% of respondents see the current situation as an opportunity to take stock of their user experience and are using testing and conversion rate optimization (CRO) tactics and strategies to improve their onsite order flow and increase conversions. Similarly, another 13% are looking at improving positioning, packaging, and pricing to adapt to the changing times.

„To counteract challenges and adapt to the new „world order,” brick-and-mortar companies see the online channel as a must-have, a trend which emerged at a faster pace than before the pandemic,” said Erich Litch, 2Checkout’s President and Chief Operating Officer. „At the same time, companies are looking to innovate and improve their offerings through new packaging, better client service, optimized processes and improved communication. A strong digital commerce strategy is critical, and 2Checkout is positioned to help ease the transition as well optimize and grow existing online operations.”

For more information on the survey findings, view the infographic on 2Checkout’s survey on Expected Impact of COVID-19 Pandemic for Online Business.

This report was based on a survey conducted in April and May 2020 on a global basis with 843 respondents from more than 50 countries around the world.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: