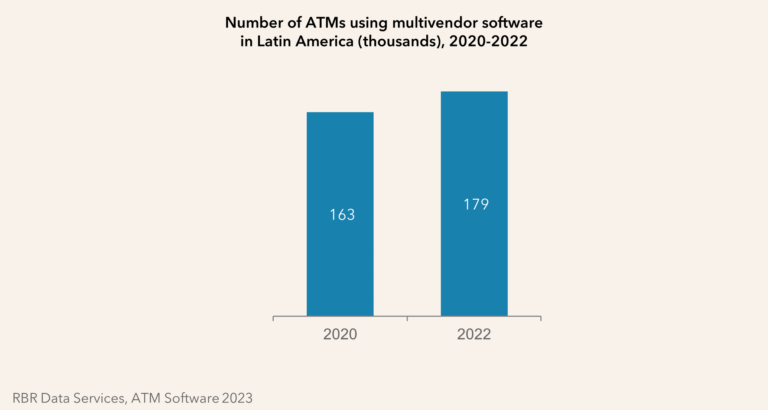

The implementation of new software projects, such as a key initiative at Banorte in Mexico, means Latin America was the fastest growing region for multivendor ATM software over the past two years

ATMs using multivendor software in Mexico increase by 66% since 2020

RBR Data Services’ ATM Software 2023 shows that six of the seven Latin American markets surveyed, showed at least a double-digit percentage increase in the number of ATMs using multivendor software. 13 major new projects were launched across the region over a 24-month period, according to Datos-Insights.

RBR Data Services defines a multivendor software project as one in which at least some of the ATMs running the same application software are not manufactured by the supplier of that software. The study looks at “bank-grade” ATMs running a full version of Windows, or other operating system.

Mexico led the recent growth in Latin America, with the number of Mexican ATMs using multivendor software increasing by 11,600 between 2020 and 2022. Deployers in Latin America increasingly value a unified approach to managing software updates, as well as the flexibility multivendor software can offer in terms of using different hardware vendors.

Global decline masks a mixed picture across countries and regions

The number of ATMs running multivendor software worldwide decreased by 4% between 2020 and 2022; this was driven largely by a precipitous drop in the total number of ATMs in China, with the remaining machines in this country increasingly using vendor-native software solutions. Elsewhere in the Asia-Pacific region, India, Pakistan and Australia saw strong growth as multivendor projects at deployers such as SBI increased in size, while other markets stayed relatively stable or shrank.

North America and western Europe also saw declines at a regional level, as banks rationalise their ATM fleets in the context of increases in the use of cashless payments. Moreover, a growing number of ATMs in the UK, and several other markets, are now part of unified software and hardware estates, as deployers see cost benefits in simplifying their ongoing software testing and maintenance processes by moving back to this approach.

By contrast, the Middle East and Africa and Central and Eastern Europe both showed strong regional growth, the latter despite the ongoing Russia-Ukraine conflict. Both Russia and Kazakhstan saw significant increases in the number of ATMs using multivendor application software, as a small number of mid-sized banks greatly increased the size of their multivendor projects.

Rachel Kelley, who led RBR Data Services’ ATM Software 2023 research, remarked: “It will be interesting to see how the global multivendor ATM software market develops, as younger markets hold potential for expansion while more mature markets revert to a unified approach. We expect India to have a large impact as banks with mixed hardware vendor fleets migrate to, or increase their fleets’ shares of, multivendor software”.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: