imagin, the neobank powered by CaixaBank, has seen a significant increase in its teenage client base served through imaginTeens. „As of the end of July 2025, the number of users aged 12 to 17 is close to 600,000, representing an 8% increase compared to July of the previous year. Moreover, new client registrations have grown by 25% in the last 12 months. These figures confirm imagin as the leading neobank among teenagers, who use imaginTeens for their first financial experiences.” – according to the press release.

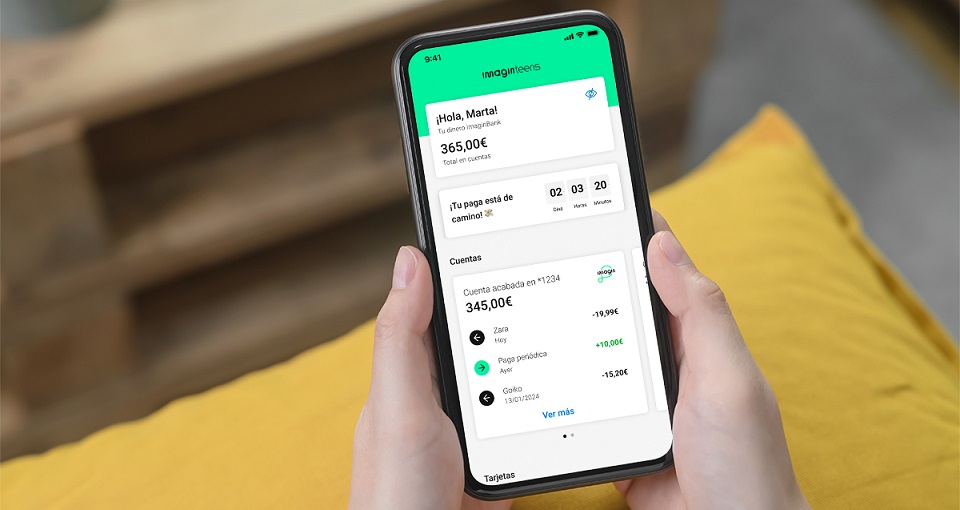

imagin’s offering for young people includes a free account with no fees and a card—available as debit, prepaid, or the Youth Card in some Autonomous Communities—also free of charge. All of this is integrated into an age-appropriate app designed to help them learn how to manage their money. Through imaginTeens, young users can monitor their spending in real time and create savings goals. All cards support mobile payments and work seamlessly abroad.

Parents or legal guardians can manage their children’s products, monitor account activity, and set spending and cash withdrawal limits via the CaixaBankNow app. Additionally, minors can be registered digitally through the CaixaBank app without needing to visit a branch. Parents can also encourage their children to save by setting shared challenges to help them reach their goals. Once they turn 18, these young users automatically become imagin clients and retain their existing products free of charge.

Tailored financial solutions for youth

imagin not only provides basic banking services to this age group but is also committed to offering practical financial solutions tailored to their needs and lifestyle. For example, all imaginTeens clients have access to a free debit card with travel benefits. The imaginTeens debit card allows payments in any currency without fees and enables cash withdrawals from international ATMs without additional charges, although fees from the ATM-owning bank may apply.

In a recent effort to expand user capabilities, imagin has implemented Bizum for users aged 12 and 13. With this integration, completed in April 2025, all imaginTeens clients aged 12 to 17 can now make transactions via this payment platform. imagin is one of the few banks offering this functionality to minors, and since its initial rollout for ages 14 to 17 in March 2024, young users have made over 4.2 million Bizum transactions.

The expansion of these services has also helped strengthen user loyalty to the imaginTeens app. Notably, app usage has increased by 30% over the past 12 months, with over 3.3 million monthly visits. Card usage has also grown by 20% compared to a year ago.

„Through imaginTeens, imagin aims to help young people gain autonomy and learn to manage their finances. In addition to banking services, users can access financial education content and even participate in the imaginPlanet Challenge, a project that helps youth aged 16 and up develop entrepreneurial ideas linked to environmental or social causes.” – the bank said.

______________

imagin is the leading neobank among young people in Spain, powered by CaixaBank and with a clear mission to create a positive impact on society. The platform offers digital, financial, and non-financial services that support its clients—mostly under 35—in their daily lives and future projects.

From a banking perspective, imagin provides a comprehensive range of products and services, unique among neobanks, that cater to all financial needs and decisions of young people. The catalog includes accounts, payment services, and commission-free cards—even for foreign currency payments and international use—making everyday financial activities easier. imagin also offers a wide range of financing products, such as mortgages and loans, and investment options, including funds and a stock trading broker. All services are delivered through a mobile-only experience, a hallmark of imagin since its launch in 2016.

In recent years, the platform has innovatively connected with the sustainable and social concerns of its user community through its app. To this end, imagin develops products, services, content, and initiatives that contribute to improving the planet and society. These efforts are channeled through imaginPlanet, focusing on areas such as marine ecosystem regeneration, youth financial education, and entrepreneurship.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: