The Monetary Authority of Singapore launches guidelines to protect users of electronic payments

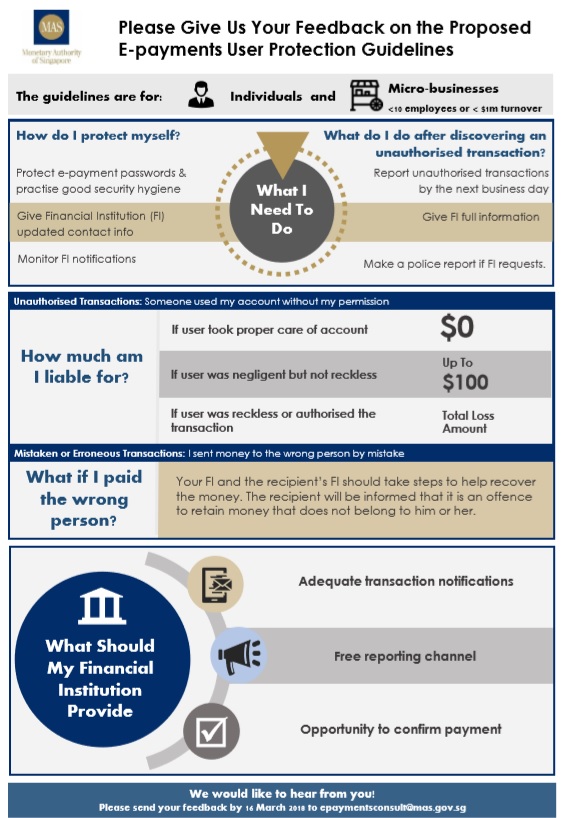

The Monetary Authority of Singapore (MAS) launched a public consultation on proposed guidelines to protect users of electronic payments (“e-payments”). The proposed E-payments User Protection Guidelines aim to encourage wider adoption of e-payments by setting standards on the responsibilities of financial institutions (1) and e-payment users (2).

Under the new Guidelines, individuals and micro-Enterprises (3) who hold e-payment accounts can expect financial institutions to provide timely notifications of all e-payment transactions. Financial institutions will be expected to set clear resolution processes for unauthorised or erroneous payment transactions. The Guidelines also set out the responsibilities of e-payments users, including good security practices they should adopt to protect their passwords and e-payment accounts.

MAS Deputy Managing Director, Ms Jacqueline Loh said, “MAS hopes that these guidelines will help to make e-payments simpler and more secure, and give individuals and micro-enterprises more confidence to adopt and integrate e-payments into their daily activities.”

The public consultation will run from 13 February to 16 March 2018. Copies of the public consultation paper and policy highlights document are available on the MAS website.

(1) Any bank, non-bank credit card issuer, finance company or holder of a widely-accepted stored value facility. The four approved widely-accepted stored value facilities are “EZ-Link Card”, “NETS CashCard”, “NETS FlashPay”, and “CapitaVoucher”. More details can be found here.

(2) E-payment users refer to holders and users of e-payment accounts.

(3) Defined as “Any business employing fewer than 10 persons or with annual turnover of no more than S$1 million”.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: