The market for eKYC could double in 2023 says Qoobiss. Currently, in Romania, approximately 35% of companies use remote identity verification solutions.

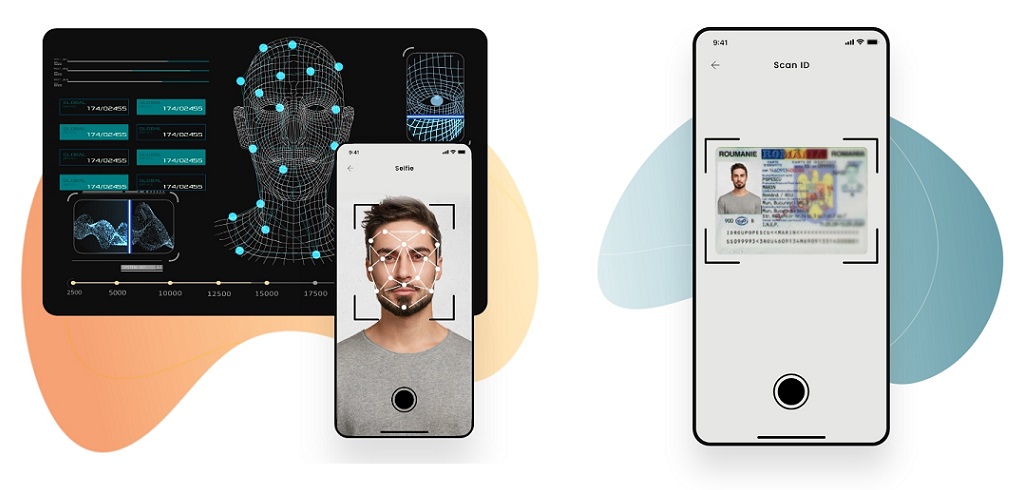

The market for remote identity verification solutions (eKYC – electronic Know Your Customer) could double in 2023, as companies in the financial – banking sector and online stores invest in the implementation of these types of solutions and complies with national and European legislation in force, according to an analysis by the Romanian company Qoobiss, the developer of Qoobiss Identify, a fully automated solution that offers a secure and digitized identity verification process.

Currently, in Romania, approximately 35% of companies use such solutions. The amplification of the digitalization phenomenon in business and the adoption of the use of online services by end customers, as well as the need to reduce the operational costs of companies, by automating identification processes and the need to better control expenses, will be, this year, the growth engines of the market for online identity verification solutions.

Alignment with the legislative norms in force will contribute to the growth of the market. In the last year, the market in Romania has changed, in the sense of the migration of the activity from offline to online. And this, according to the legal provisions, requires that the documents be signed with an electronic signature. Before signing documents electronically, it is necessary to identify customers through remote identity verification solutions.

“We estimate an increase of more than 200% in the customer portfolio in 2023 compared to last year. Across the market, automation of the KYC process is accelerating, with an emphasis on the use of advanced technologies such as artificial intelligence, machine learning and natural language processing. This will reduce costs and improve the efficiency of the KYC process„, says Ileana Comănescu, KYC Global Product Manager at Qoobiss, noting that in 2023, they aim to implement the remote video identification service for at least one beneficiary in Spain or Estonia, countries the company is considering for expanding its operations.

„For this year, we are considering both geographic expansion and diversification of our client portfolio, targeting more industries. Our target is that, by the end of the year, we will provide solutions for at least one of the following industries: medical services, telecom, insurance and private pensions”.

Most investments in this type of solutions are made by banking and non-banking institutions, multinational companies and from the gambling, fintech and crypto industries. In 2023, tourism, education, telecom, medical services, insurance, car-sharing and alcoholic beverage industry companies will increasingly use KYC solutions, according to Qoobiss specialists.

____________

At the end of last year, Qoobiss became an accredited supplier by the Romanian Digitization Authority (ADR) for remote identity verification services, using video resources. Currently, Qoobiss has offices in Romania and the Republic of Moldova.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: