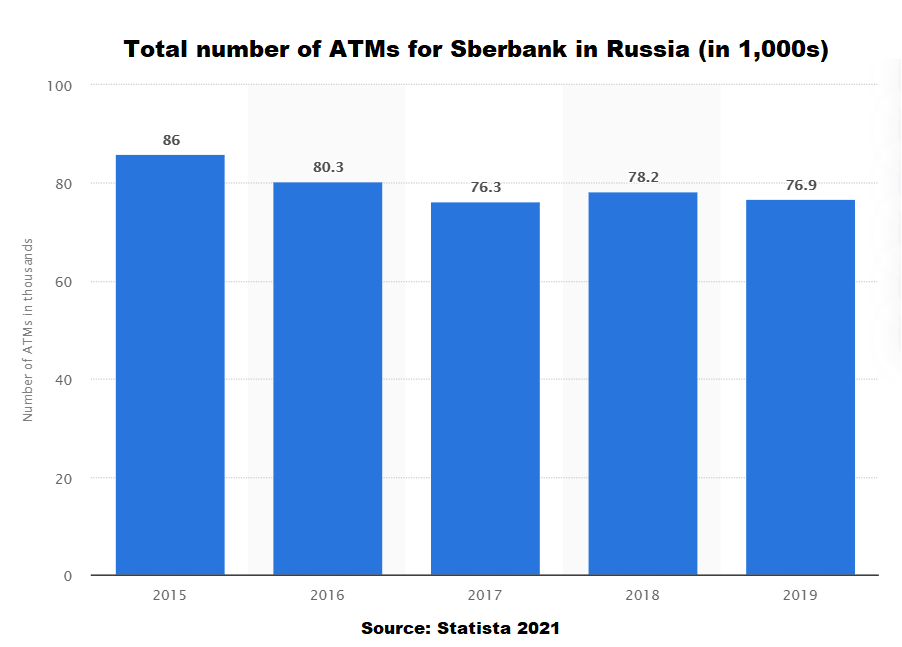

Vedomosti reports Sberbank announced that its Russian ATM network declined by 8.5 percent, from 76,900 to 70,400 terminals, in 2020, the largest drop in ATMs in the bank’s history, according to the annual report of the credit institution. The bank ended 2020 with 99 million clients in its portfolio, holding 15 mil. credit cards and 123 mil. debit cards. Sberbank has a 45,5% share of the Russian credit card market.

“In 2020, the number of self-service devices decreased by 10%. Optimization of the placement of ATMs and terminals is based on AI-models and has more affected cities than villages, ”the document says.

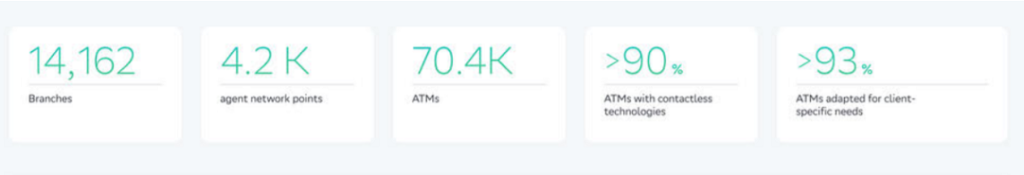

Sberbank network at the end of 2020

According to the bank, the introduction of AI-models – that is, artificial intelligence – to search for new locations for ATMs has reduced the waiting time for customers in queues by 14%. Also, the number of user complaints about self-service devices decreased by almost a quarter (23%).

The largest number of ATMs in the Sberbank network was recorded in 2014 – 90.1 thousand, it follows from the reporting of the credit institution. Since 2015, the number of devices began to decline – to 80.3 thousand by 2016. True, in 2018 the bank slightly expanded its network: from 76.3 thousand devices to 78.2 thousand. Then the downward trend continued.

On June 27, 2019, when the ATM’s 52nd anniversary was celebrated worldwide, Sberbank said it owns more than 40% of ATMs in Russia.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: