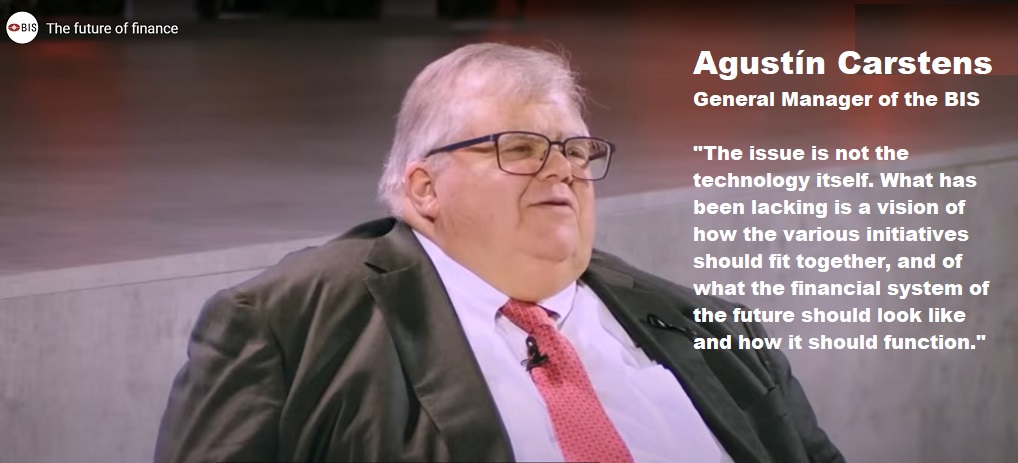

The future of finance: „The issue is not the technology itself. What has been lacking is a vision.” – says the general manager of BIS

Remarks by Agustín Carstens in a fireside chat at the Santander International Banking Conference 2024

The Innovation Hub undertakes projects across six broad themes: (i) suptech and regtech, (ii) next generation financial market infrastructures, (iii) open finance, (iv) cyber security, (v) green finance and (vi) central bank digital currency, or CBDC. Our CBDC work accounts for a large part of the Innovation Hub’s project portfolio and certainly accounts for much of the public attention. But we have made important contributions in each theme.

Since establishing the Innovation Hub, we have completed 28 projects, with another 27 currently under way. Central banks, of course, are doing their own innovations, and there are many other initiatives under way by both the public sector and the private sector.

While all of the technological innovation has been important, it would be fair to say that it has had modest real-world impact to date. If you compare the degree of progress in the application of digital technologies in, say, the communications industry to that in the financial industry, I am sure you will agree.

The issue is not the technology itself. As I mentioned, there have been great advances there.

What has been lacking is a vision of how the various initiatives should fit together, and of what the financial system of the future should look like and how it should function.

Together with Nandan Nilekani – Chairman of Infosys and the driving force behind India’s digital public infrastructure initiatives – I wrote a paper earlier this year that laid out such a vision. We call it the „Finternet”. The aim of the Finternet is to use technology to make the financial system much more user-centric and to eliminate many of the frictions that add cost and complexity to today’s financial system. It does not advocate for a specific technology, but instead aims to add some guidance about what we want to achieve.

Let me delve more deeply into the Finternet. What does it involve, concretely?

The Finternet rests on three broad pillars. The first is a robust economic and financial architecture. The second is the application of advanced technology. The third is a sound legal and regulatory basis. Let me address each in turn.

The basic economic and financial architecture would resemble that of today’s financial system. As is the case today, there would be a two-tier banking system. Central bank money would be at the core, with commercial bank money accounting for the bulk of the money used day to day. This money, however, would have a more advanced digital representation. We would have tokenised central bank money, which could exist in wholesale form – the digital equivalent of central bank reserves – or retail form – the equivalent of digital banknotes. And we would have tokenised commercial bank deposits.

But tokenising money is just the first step. To get the real benefits of tokenisation you need to combine money with other financial assets, ideally residing on the same ledger.

Government bonds strike me as a natural starting point. These are incredibly important assets in today’s financial system. They serve as the basis for pricing all other financial assets.

Once you have money and government bonds residing on the same platform, you essentially have the basis of the current financial system. Adding other assets to the platform would naturally follow.

Tokenising financial assets would bring many benefits. In particular, if the assets were on a common ledger, there would be much less need for complex messaging and clearing, which are the source of so much cost and delays in today’s financial system. Tokenised assets can settle atomically, helping to further reduce the time needed for financial transactions. And tokenised assets can be programmed. This could open up a huge array of financial transactions that are not possible today.

Of course, not all assets will be tokenised and not all tokenised assets will reside on the same ledger. So we need some way of moving assets across ledgers and from the tokenised to the non-tokenised world. Technology can also help achieve this.

Other technologies can also help to turn the Finternet into reality. For example, compliance with anti-money laundering and countering the financing of terrorism regulations – which I would emphasise is hugely important – can also be extremely costly. Technology should allow us to automate such checks, allowing for greater reliability, lower costs and faster processing speeds. Data governance and privacy would draw on the latest privacy-preserving technology. There are many related topics we explore through our projects. One good example is Project Mandala, which has shown how to embed regulatory compliance in cross-border transaction protocols. Beyond economics and technology, the Finternet will also rest on a sound legal and regulatory basis. At a minimum, this should respect all existing laws and governance measures. Privacy, cyber security and related concerns will also need to be addressed. However, technology should also allow us to achieve greater security in the financial system.

This all sounds very promising in principle. But can it be delivered? How could one turn the Finternet vision into a reality?

Absolutely. Indeed, we are already taking active steps to turn it into reality, including through our Innovation Hub projects.

Let me give you a concrete example of one such project, called Project Agorá.

This is probably our largest Innovation Hub Project to date. We have teamed up with six central banks and more than 40 private sector institutions, coordinated by the Institute for International Finance. I should mention that Santander is one of the participants.

The specific aim of Project Agorá is to look at whether, using tokenised deposits integrated with tokenised wholesale central bank money, we can streamline cross-border payments.

This is an area ripe with inefficiencies, and where services in some jurisdictions have actually worsened in recent years due to the shrinkage of the correspondent banking system. One important reason is that the system, by and large, rests on legacy systems. This implies long sequences of messages being sent back and forth, across national borders, using systems that do not necessary communicate with each other very well. The various regulatory compliance measures – which are particularly important in cross-border transactions – often require manual processes, which add delays and lead to errors.

In principle, using tokenised assets residing on unified ledgers could ease many of these burdens. Transactions using tokenised assets can settle atomically – that is immediately – with all parts of the transaction settling at once. Compliance with regulatory norms can be embedded programmatically inside the tokens. So they will be adhered to with certainty and without the need for manual intervention.

So this is a big project, with big potential gains.

But even more than the specific application, what really excites me about Project Agorá is that it has central banks and commercial banks working together to craft a structure that could form the basis for a future financial system.

I mentioned before the useful catalytic role for central banks in initiating technological innovation. But central banks cannot do it alone. The two-tier banking system lies at the heart of today’s financial system. The system needs money. But very little money comes from the central bank. Commercial bank money provides the bulk of it.

The two-tier banking system helps deliver two foundational principles. The first is the singleness of money. This ensures that a euro is a euro, whether it is the banknote in my pocket or in my deposit at Santander or any other bank. The second is settlement finality, which comes about through the final settlement of all transactions on the balance sheet of the central bank.

We do not know what the financial system of the future will look like. But it is hard for me to imagine that it will not require a two-tier banking system. This means that as well as tokenised central bank money – particularly in wholesale form – it will require banks to provide their customers with tokenised deposits. Project Agorá provides a powerful use case, and I hope that it will spur further innovation.

At the same time, cross-border payments can be a controversial topic. For example, I have noted media speculation recently that one of your projects – Project mBridge – could provide the basis for a BRICS initiative to circumvent sanctions. Is that plausible? Can you comment on this?

In the Innovation Hub we try to be a catalyst for innovation. The way it works is that we talk with the community of central banks, identify their needs and then develop projects. And we do them in partnership with central banks.

MBridge has been a project we have been involved with for four years. We have several central bank partners and many, many observers. I think the project has been a big success. It’s a payment system where through wholesale CBDCs you could facilitate tremendously cross-border transactions.

I would say that the project has been so successful that we can declare that we have graduated out. The BIS is leaving that project, not because it was a failure and not because of political considerations but instead because we have been involved for four years and it is at a level where the partners can carry it on by themselves. That has happened already with other projects.

At the same time, I have to say that mBridge is not mature enough to start operating; it is many years away from that.

With respect to political aspects, the noise out there, mBridge is not the „BRICs bridge” – I have to say that categorically. mBridge was not created to cater to the needs of the BRICs. It was put together to satisfy broad central bank necessities.

We at the BIS – I think this is an opportunity to set record straight – we always try to be good global citizen. And the BIS does not operate with any countries, nor can its products be used by any countries that are subject to sanctions. This will continue to be the case. And all central bank members are in this mindset that we need to be observant of sanctions and whatever products we put together should not be a conduit to violate sanctions.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: