The Euro Retail Payments Board publishes a new report which highlights the holes in PSD2

A year ago, the European Retail Payments Board (ERPB) flagged that “In practice, PSD2 and the EBA RTS will not cover all aspects that are relevant for the development of an integrated market of Payment Initiation Services (PIS) in the EU”. As result, the Euro Retail Payments Board (ERPB) decided at its November 2016 meeting to set up a working group with the participation of relevant other stakeholders (e.g. third-party providers as well as standardisation and market initiatives) „to identify conditions for the development of an integrated, innovative and competitive market for payment initiation services (PIS) in the European Union”.

Now, ERPB release a new report which provides a summary of the main outcome of the work conducted by the ERPB Working Group on PIS between January and May 2017, in line with its mandate. The report highlights several important gaps that need to be filled. „Unfortunately, regarding interfaces, disagreements in the working group prevented consensus being reached.”, according to Tom Hay from Icon Solutions Ltd.

In order to progress quickly, given the limited time available, with the task of defining common technical, operational and business requirements, three dedicated expert subgroups were created which respectively focused on the topics of identification, interfaces and other operational and technical matters.

Due to time constraints the working group was unable to address:

1) potential technical requirements such as for the choice of the communication layer, message formats and for dealing with the complexity of co-signing in particular in the context of corporate payments.

2) possible implications or synergies that its work may have for the provision of account information services (AIS) and for the confirmation on the availability of funds.

It should be noted that at the time of the working group’s activities the process for adoption of the European Banking Authority (EBA) Regulatory Technical Standards (RTS) on strong customer authentication (SCA) and common and secure communication (CSC) had not yet been completed.

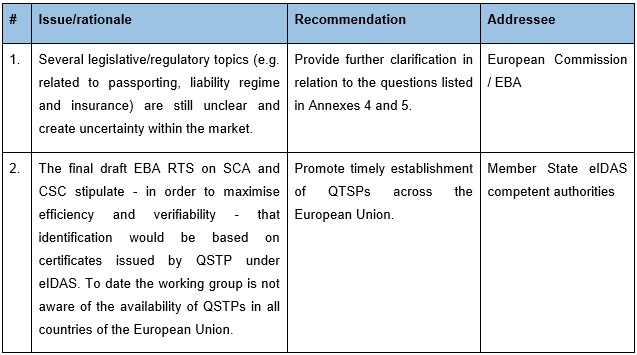

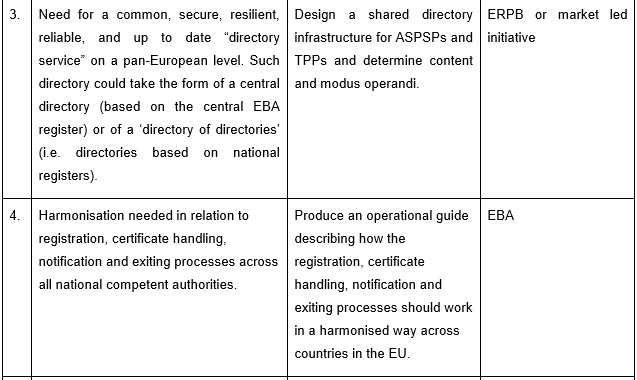

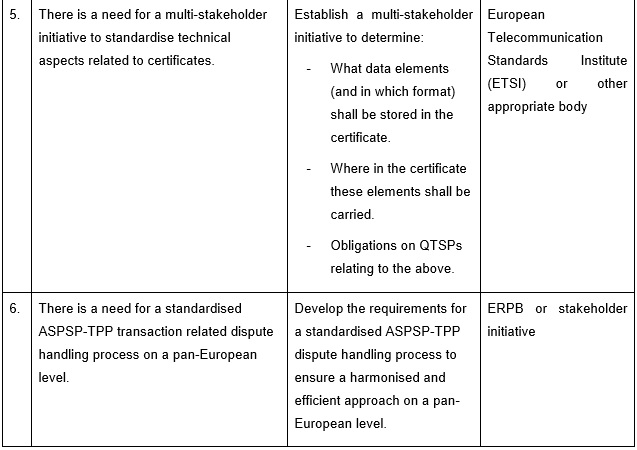

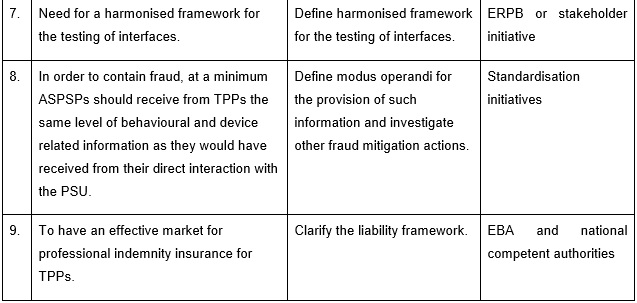

On the basis of the above, the working group suggests the following recommendations for consideration by the ERPB at its 12 June 2017 meeting:

The ERPB is invited to discuss the identified issues and recommendations outlined in the report and whether further action will be necessary to address diverging views between stakeholders and the need for harmonisation between various market and stakeholder initiatives.

For more details download: Report of the ERPB Working Group on Payment Initiation Services

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: