The Economist: „times change quickly and banks are risking their own existence – who will survive the disruption?”

„The digital revolution has moved from existential threat to potential survival strategy for the world’s retail banks. Times change quickly and banks are risking their own existence if they choose to ignore the rise of smartphones and the proliferation of real-time, low-cost competitors.” according to the latest report of the Economist Intellligence Unit called „Retail banking – In tech we trust”.

‘The scale of disruption is unprecedented, across every market, every distribution channel and every single product line. Fintech poses a potentially fatal risk and will be a severe test of banks’ IT systems and their ability to respond to rapid changes in customer expectations, short product development times and growing cyber risks.”, says the report.

„Discussions now centre on just how quickly and how far transactional banking will be unbundled and margins slashed. Strategically, banks have a number of potential responses; the correct path is not yet clear-cut. Some banks are building their own technological solutions, where resources allow. Others are buying the fintech upstarts outright, a quicker but increasingly expensive option to molly-coddling fintech hubs.”

The question of the authors is „who will survive the disruption”.

The Economist Intelligence Unit surveyed 203 senior retail banking executives around the world about customer expectation, regulatory and technological developments. The key findings are as follows.

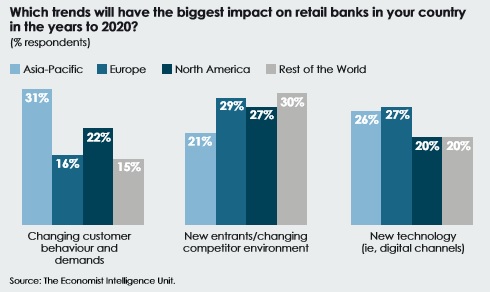

The banking revolution is global and not just led by Silicon Valley. Changing customer demand is the single biggest driver in Asia, twice as important as it is to banking executives in Europe.

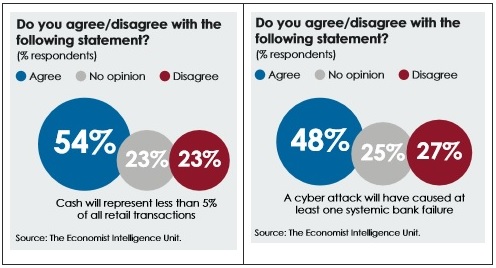

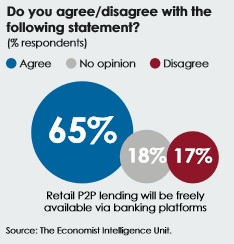

The banking world of the future – By 2020 bankers expect the banking environment to be shaped strongly by technology and non-traditional competitors. They believe that retail peer-to-peer (P2P) lending will be available via banking platforms (65%); retail banking will be fully automated (64%); and more money will flow via fintech firms than traditional retail banks (57%).

Profits face multiple attacks – Business models must adapt to survive. Individually, the “scare scores” attached to changing customer behaviour (22%), new entrants (26%) and new technology (24%) are significantly lower than in previous years; collectively, however, they still represent a significant threat.

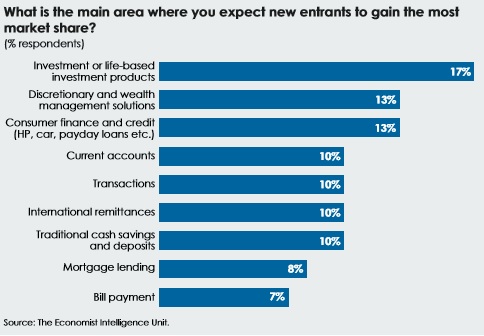

A multi-headed monster – That competitive threat will come from many quarters. Apple Pay and its ilk (20%) and other non-financials (20%) may yet emerge to really upset the traditional banking sector. As keen as regulators are to encourage competition, new banks are seen as less of a threat (16%). Robo-advisers could lure away more profitable wealthy (and the not-so-wealthy) clients (17%), and P2P lenders attract dissatisfied borrowers and savers (21%).

Regulators still watching – The too-big-to-fail rules are almost complete, but there is still plenty to keep compliance departments busy. Regulators now have time to cast an eye over consumer protection issues, with product design and transparency (24%) and fines and recompense orders (19%) still in play. l Banks are adapting. Bankers see three main areas that they must change in order to survive: adapting the role of the branch network (36%); getting the right talent (35%); and modernising their technology (31%). Banks still have the relationships and the data, but can they maintain and build on that advantage?

Bankers see three main areas that they must change in order to survive: adapting the role of the branch network (35%); getting the right talent (35%); and modernising their technology (31%).

Monica Woodley, the editor of the report, says: „The true winners will have the technology to cope with co-operation. Security and integrity will be as important as cost, efficiency and speed. But even the winning banks could be reduced to a mere screen icon for many customers, becoming the trusted platform via which consumers access a range of services from third-parties like fintechs.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: