The economic implications of services in the metaverse

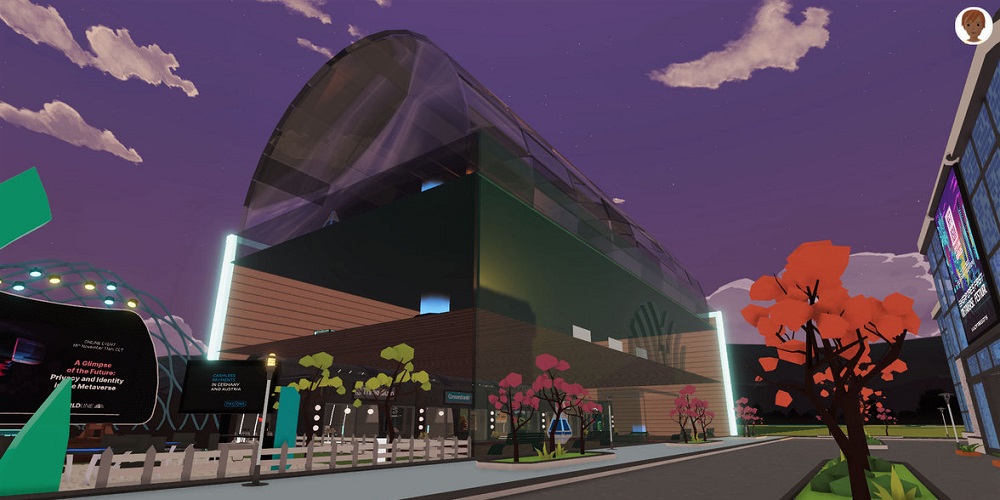

How could an immersive computer-generated environment („the metaverse”) impact services in the digital economy? Investment in virtual worlds has grown rapidly. Yet the technology still falls short of achieving fully immersive experiences. And despite hyperbolic predictions, various indicators show interest has fallen in the last two years.

While some use cases show promise (eg gaming, education, healthcare), others seem distinctly gimmicky (eg virtual bank branches, land speculation). If the metaverse does succeed, it could mean: (i) a blurring of lines between the tradable and non-tradable sectors, (ii) greater cross-border economic integration and (iii) new demands on payment services. In principle, retail fast payment systems, retail central bank digital currencies or tokenised deposits could be designed to support services in the metaverse.

To prevent virtual environments and money from becoming fragmented and dominated by powerful private firms, public policy would need to support efficient, interoperable payments and provide clear standards on data privacy, digital ownership and consumer protection.

BIS Papers No 144 – The economic implications of services in the metaverse

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: