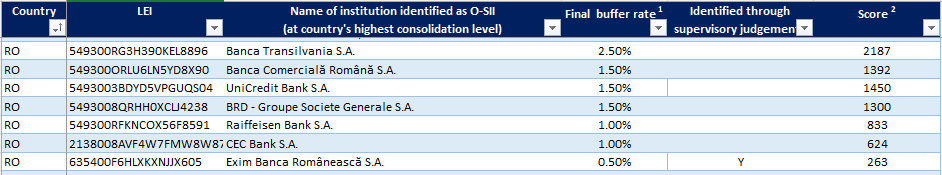

The EBA updates list of other systemically important institutions and identifies 7 banks in Romania

The European Banking Authority (EBA) today updated the list of other systemically important institutions (O-SIIs) in the EU, which, together with global systemically important institutions (G-SIIs), are identified as systemically important by the relevant authorities according to harmonised criteria laid down in the EBA Guidelines.

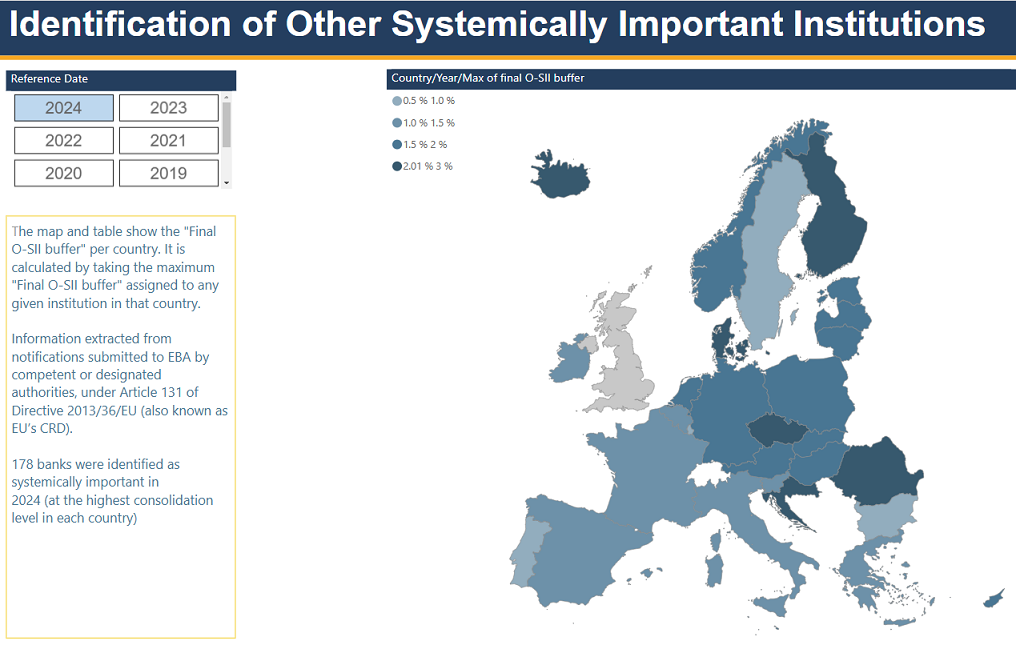

This list is based on notifications received throughout 2024 and includes the overall score calculated according to the EBA Guidelines and the capital buffer rate that the relevant authorities have set for the identified O-SIIs. The list is available also through a user-friendly visualisation tool.

The EBA Guidelines define the size, importance, complexity and interconnectedness as the criteria to identify O-SIIs. They also provide flexibility to relevant authorities to apply their supervisory judgment when deciding to include other institutions, which might have not been automatically identified as O-SIIs. This approach ensures a comparable assessment of all financial institutions across the EU, whilst still not excluding those firms that may be deemed systemically important for one jurisdiction on the basis of certain specificities.

The list published today aims to increase transparency in the EU by providing an overview of OSIIs, including some key facts about the banks identified. 175 banks were identified as systemically important in 2024 (at the highest level of consolidation in each country) with buffer rates ranging from 0.25% to 3%, as shown in the chart below.

Relevant authorities disclose further details on the underlying rationale and identification process for their respective jurisdictions. This additional information may be relevant to understand the specific features of each O-SII and to get some insight in terms of supervisory judgment, optional indicators used, buffer decisions and phase-in implementation dates. As underscored in the Capital Requirements Directive (CRD), the assessment of systemic importance necessary to identify O-SIIs remains under the remit of the national competent or designated authorities.

___________

Related content

List of O-SIIs 2024 (42.46 KB – Excel Spreadsheet) – Download

Other Systemically Important Institutions (O-SIIs)

Guidelines on criteria to assess other systemically important institutions (O-SIIs)

List of O-SIIs 2024 – data visualisation tool

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: