The EBA responds to the European Commission’s Call for Advice on significance criteria and supervisory fees under the Markets in Crypto-Assets Regulation

The European Banking Authority (EBA) published its response to the European Commission’s Call for Advice on two EC delegated acts under the Markets in Crypto-assets Regulation (MiCAR) relating to the criteria for determining the significance of asset-referenced tokens (ARTs) and electronic money tokens (EMTs) and to the supervisory fees that may be charged by the EBA to issuers of significant ARTs and significant EMTs.

The EBA proposes a set of core and ancillary indicators for each significance criterion within the scope of the Call for Advice: financial sector interconnectedness, and activities on an international scale. Such indicators cover diverse elements of interconnectedness (e.g. direct and indirect between the issuer and the financial system, direct between the token and the financial system, or direct between the issuer and other ART/EMT issuers) and international scale (e.g. all types of transactions, or transactions where the token is used as means of exchange) and take account of data availabilities.

Regarding the supervisory fees, the EBA proposes criteria for allocating costs between issuers, as defined in MiCAR, and ensures that all costs it will incur in the performance of its supervisory tasks, including the establishment of supervisory colleges and in the context of any delegation of tasks to national competent authorities, can be charged to issuers of significant ARTs and significant EMTs in accordance with the full cost-recovery approach foreseen in MiCAR.

Background

Regulation (EU) 2023/1114 on Markets in Crypto-assets (MiCAR) establishes a regime for the regulation and supervision of crypto-asset issuance and crypto-asset service provision in the European Union (EU). It came into force on 29 June 2023, and the provisions relating to ARTs and EMTs will be applicable from 30 June 2024.

Among the activities within the scope of MiCAR are the activities of offering to the public or seeking admission to trading of ARTs and EMTs and issuing such tokens. Supervision tasks are conferred on the EBA for ARTs and EMTs that are determined by the EBA to be significant. Additionally, the EBA is mandated to develop 17 technical standards and guidelines under MiCAR to further specify the requirements for ARTs and EMTs, and an additional 3 mandates jointly with ESMA (and, in one case, also with EIOPA).

In December 2022, the European Commission issued to the EBA a Call for Advice in relation to two of its delegated acts under MiCAR, specifically on: (i) certain criteria for the classification of asset-referenced tokens (ARTs) and electronic money tokens (EMTs) as significant (Article 43(11)), and (ii) the supervisory fees to be charged by the EBA to issuers of significant ARTs and EMTs (Article 137(3)). The Call for Advice was received by the EBA on the same date as the joint-ESAs’ Call for Advice on specific delegated acts under DORA, and was issued with the same deadline: 30 September 2023.

The EBA is empowered to issue opinions upon a request from the European Parliament, the Council or the European Commission, or at the Authority’s own initiative on all issues related to its area of competence (Article 16a(1) of the EBA’s Founding Regulation).

To inform the response, the EBA held two public workshops (17 May and 24 July), followed by written procedures enabling workshop participants to provide additional inputs, and has engaged bilaterally with the Financial Stability Board (FSB), the European Commission, the European Central Bank (ECB), the European Systemic Risk Board (ESRB) and the staff of the European Securities and Markets Authority (ESMA) . The response has also been informed by discussions in the context of the EBA’s network on crypto-assets and, as regards the fees element, in coordination with the preparatory work to the response to the DORA Call for Advice.

DOCUMENTS

EBA advice on MICAR CfA on significance criteria and supervisory fees

LINKS

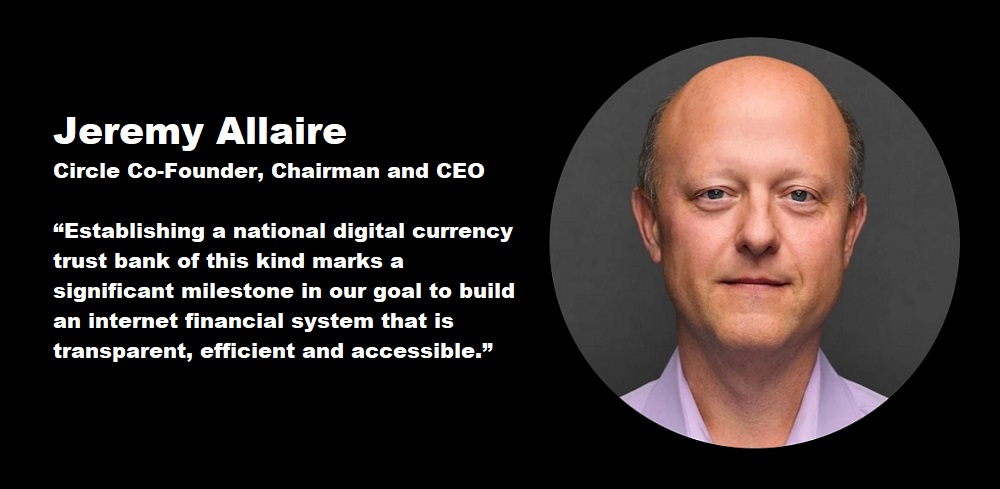

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: