VISTA BANK is the tenth bank that offers its own customers the facility to verify the payee’s identity for payments in lei made through internet banking

Starting from April, VISTA BANK joins the banks in Romania that have adhered to the Confirmation of Payee Service (SANB) made available by TRANSFOND, thus contributing to increasing the security of transactions carried out by customers through electronic payment orders. „The new service is offered free of charge to individual and corporate clients and is available 24/7 among SANB participating banks.” – according to the press release.

How does the Confirmation of Payee Service (SANB) work?

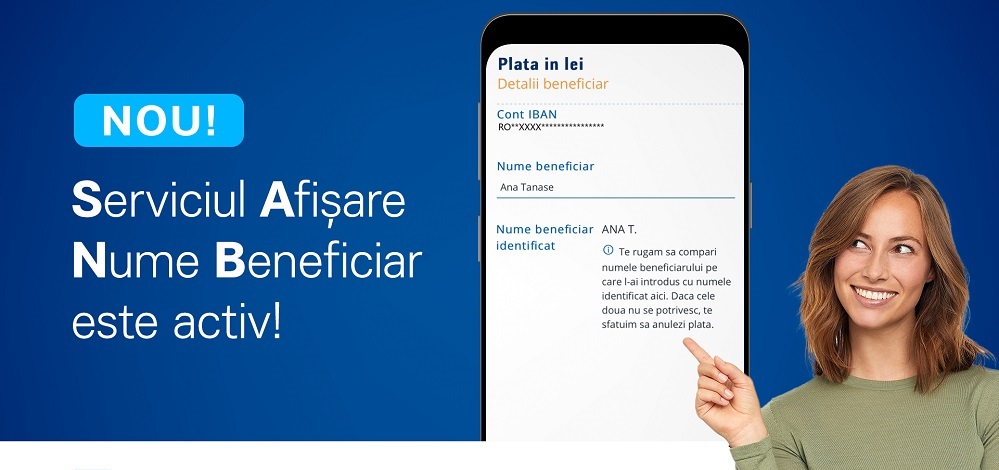

While initiating an electronic payment order in lei to an individual payee and the payer enters the beneficiary’s IBAN code, the banking application will automatically display the payee’s first name and his/her surname initial, as they are transmitted in the SANB system by the payee’s bank. If the payee is a legal entity, part of the company’s name will be displayed for validation. Thus, the payer has the possibility to check if the payee’s name corresponds to the name displayed automatically by querying the SANB database and, if they differ, to correct or cancel the payment order. The facility only works if both the payer’s and the payee’s banks are participating in SANB.

SANB’s objective is to prevent fraud among customers making electronic payments, as well as to reduce erroneous transactions generated by the wrong entry of the payee’s IBAN account.

“By joining the Confirmation of Payee Service, we provide our customers with an additional verification tool, automatic and secure, through which they can ensure that their online payments are made only to the intended beneficiaries. Its usefulness becomes even greater as the vast majority of the transactions in lei initiated by our clients are carried out instantly.” – stated Raluca Dobre – Manager of Digital Channels and Tranformation, VISTA BANK

„SANB minimizes the potential risk of a cybercriminal requesting the payer (via email, sms, etc.), on behalf of beneficiaries known to the payer (utility providers, suppliers of services or goods), to pay invoices, by indicating their own IBAN codes (different from those of the entitled beneficiaries). Thus, some payers may follow these instructions and pay into the indicated account, considering it legitimate. SANB offers the payer the certainty that the funds reach the right destination, by automatically indicating some elements that confirm the name of the beneficiary. We welcome VISTA BANK’s participation in the SANB and we are convinced that all banks will join this service in the shortest time possible, collaborating to provide a secure payment environment to the market.” – said Razvan Faer – Chief Development Officer, TRANSFOND

The Confirmation of Payee service – SANB is made available to banks connected to the Clearing House of interbank payments by TRANSFOND, on an enrollment basis. As a scheme, the Confirmation of Payee service is administered by the Romanian Banking Association, as an option for SEPA RON credit transfer schemes, based on the Convention on National Payment Schemes and the mandate given by the National Bank of Romania.

_______________

TRANSFOND is the administrator and operator of the Automatic Clearing House of commercial retail interbank payments. The main shareholder of TRANSFOND is the National Bank of Romania, and the rest of the shareholders are represented by 18 commercial banks active in the Romanian market. TRANSFOND has developed a number of solutions: Instant Payments, Confirmation of Payee Service (SANB), AliasPay, e-Factur@ and e-Archiv@.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: