The checking account war is over (and the fintechs have won)

an article written by Ron Shevlin, Chief Research Officer at Cornerstone Advisors, Senior Contributor at Forbes

OBSERVATIONS FROM THE FINTECH SNARK TANK

A new study from Cornerstone Advisors, looking at who Americans open checking accounts with, underscores the growth of digital banks and fintechs like Chime, PayPal, and Square—and the decline of megabanks like Bank of America, JPMorgan Chase, and Wells Fargo.

What’s going on in the checking account market?

Digital banks and fintechs dominate new checking account opening. Digital banks and fintechs captured nearly half (47%) of all new checking accounts opened so far in 2023.

Digital bank/fintech growth is coming at the expense of large banks. Since 2020, digital bank’s and fintech’s share of new accounts grew from 36% to 47%. Over the same period, the megabanks’ share dropped from 24% to 17% while regional banks’ share declined from 27% to 21%. Community banks’ and credit unions’ share has remained stable.

Chime and PayPal dominate the digital bank/fintech category. Combined, Chime and PayPal represent 43% of digital bank/fintech account openings and 20% of all new checking accounts opened in 2023.

Winners and losers: SoFi and Wells Fargo. In 2020, SoFi accounted for 1% of new account openings and Wells Fargo’s share was 8.1%. In the first half of 2023, SoFi’s market share quadrupled to 4% while Wells Fargo’s share dropped by more than a half to 3.5%.

Young consumers shape the market. Not surprisingly, a far higher percentage of young consumers are in the market for new accounts than older consumers. Of Americans who have opened a checking account so far in 2023, 72% are Gen Zers or Millennials (i.e., 21 to 42 years old).

Yeah, But How Many People Open New Accounts?

It’s important to remember that, although digital banks and fintechs are dominating the percentage of new accounts being opened, only a minority of consumers open an account in any given year.

According to Cornerstone’s survey, 14% of Americans have opened a new checking account this year—and we’re only half way through the year. In all of 2022, 15% of consumers opened a new checking account—up from 12% in 2021 and 10% in 2020.

Are Megabanks Feeling the Pain?

Despite their loss in market share of new account openings, the megabanks may not be feeling the pain for a couple of reasons:

Consumers increasingly have more than one checking account. Consumers may be opening new accounts with digital banks and fintechs, but that doesn’t mean they’re closing out accounts with megabanks and regional banks. Of the consumers who have opened a checking account in 2022 or 2023, six in 10 have more than one checking account.

Megabanks attract a more affluent consumer. More than half (52%) of consumers opening an account with a megabank in 2023 earn more than $75k. Among new digital bank/fintech customers, just 21% earn that much.

Who Are Consumers Primary Checking Account Providers?

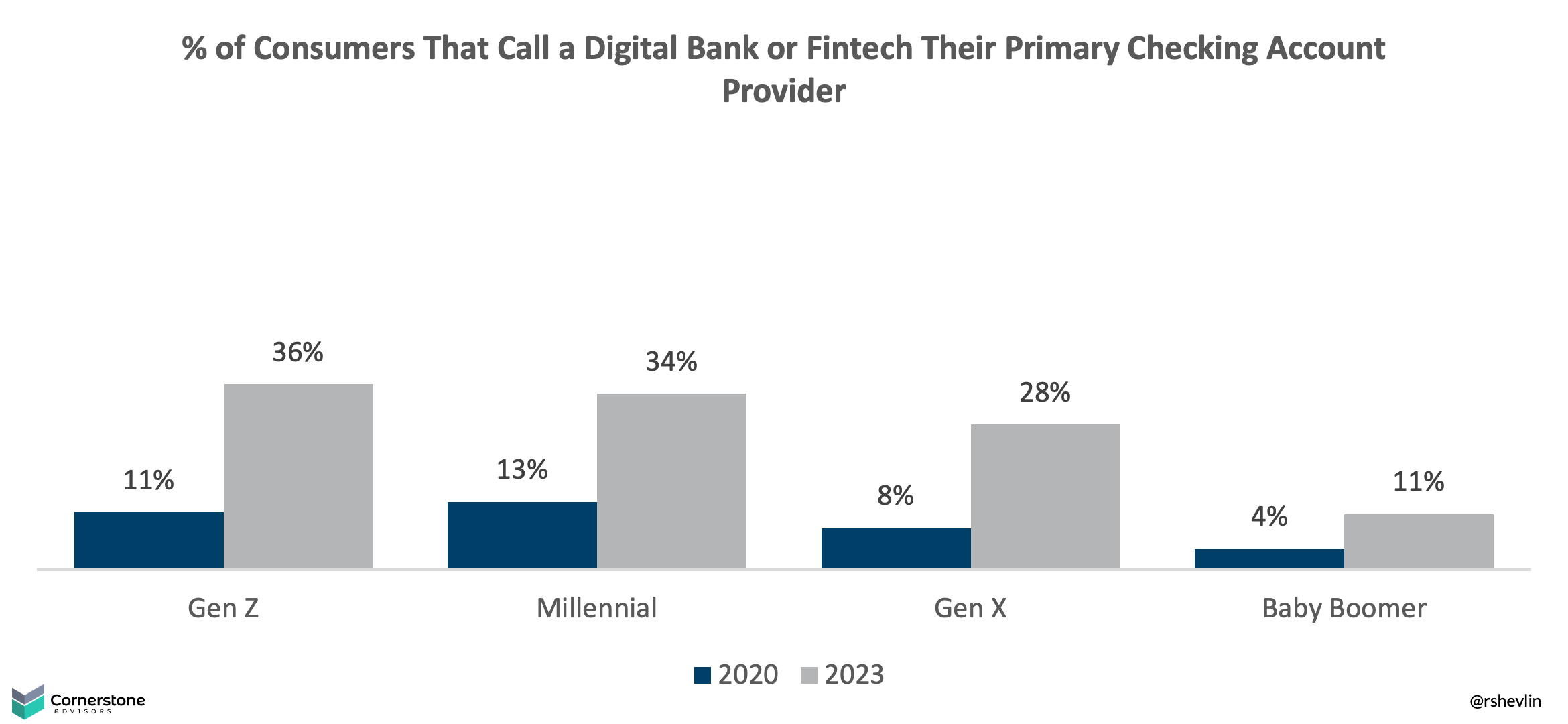

There is a good reason, however, for why the megabanks should feel pain: The percentage of consumers that consider a megabank—BofA, Wells, Citi, and Chase—to be their primary checking account provider is declining.

This is true across generational segments. Since 2020, the percentage of Gen Zers who consider a megabank to be their primary checking account provider has dropped from 35% to 27%, and among Millennials from 41% to 32.

Megabanks aren’t the only institutions losing “primary” customers. Regional banks, community banks, and credit unions are all seeing a decline in the percentage of their customers and members who consider them to be the primary provider, as digital banks and fintechs become the dominant primary provider.

Today, more than a third of Gen Zers and Millennials, and nearly three in 10 Gen Xers, consider a fintech or digital bank to be their primary checking account provider.

The article in full here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: