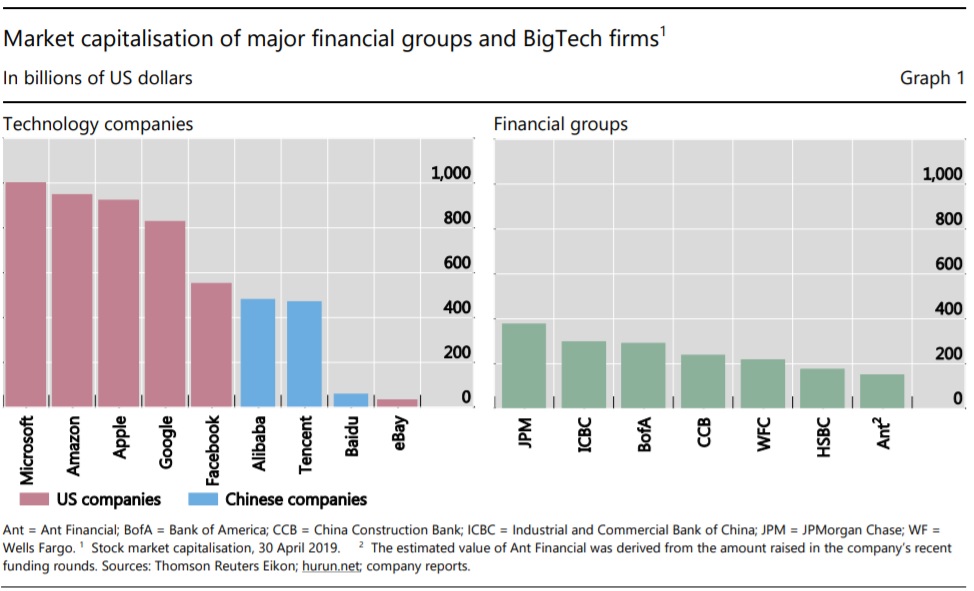

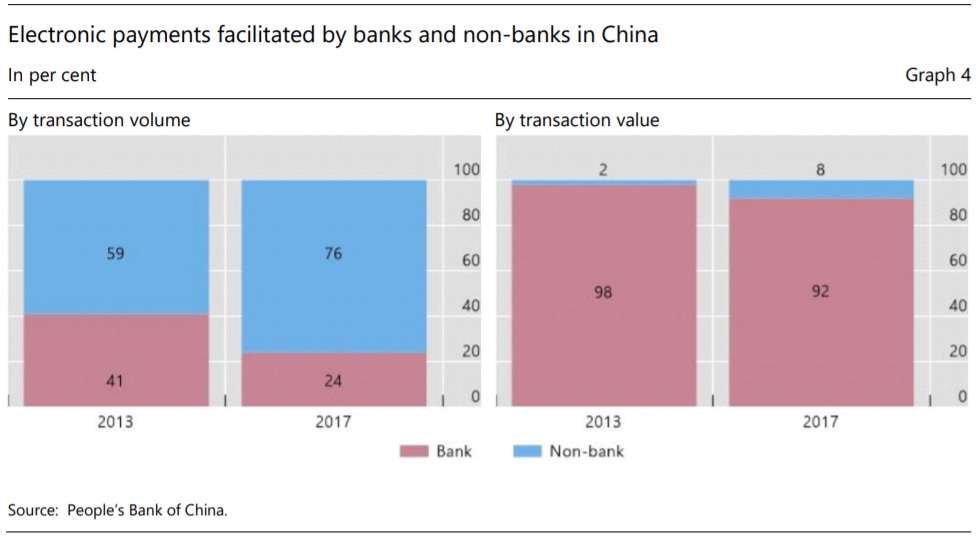

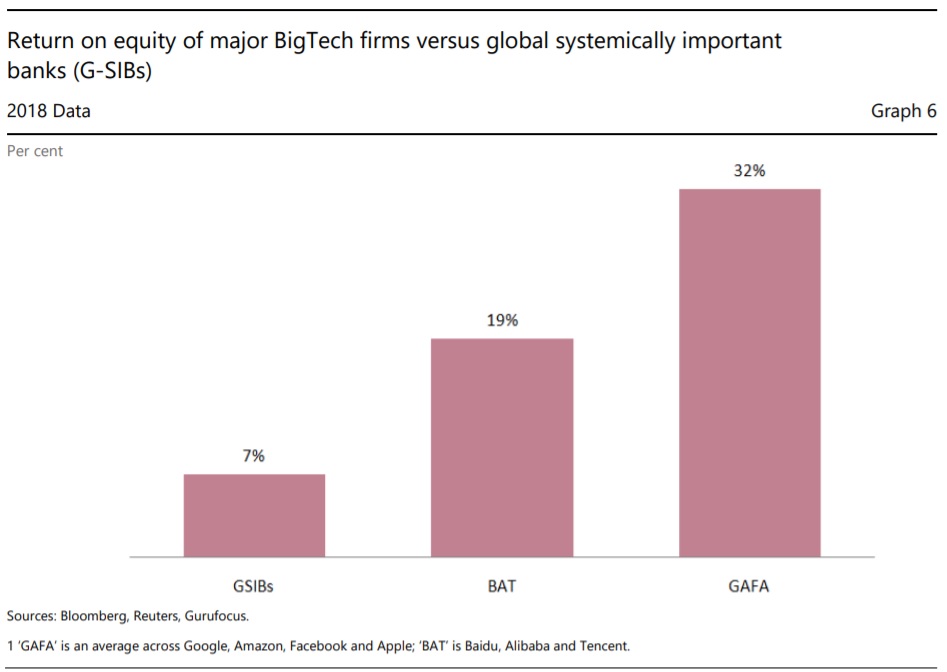

The Financial Stability Board (FSB) considers that the entry into finance of BigTech may have a significantly higher impact than that of other FinTech firms in terms of competition and concentration in the financial sector.

By some estimates, the banking industry’s return on equity (RoE) could fall by around four percentage points to an “unsustainable 5.2 percent” by 2025, absent of any mitigating actions taken by banks to respond to the effects of a heightened competition by BigTech firms. The response of financial institutions to the entry of BigTech firms into finance might in part depend on their capacity to adapt to the digital world through IT investment, changes in business model and mergers and acquisitions.

The response could also vary between institutions depending (amongst other things) on their size and business model:

. The largest financial institutions might aim to develop their own platforms rather than offer services through BigTechs’ marketplaces. Incumbents may also start to cooperate through consortia in order to share their high fixed costs and extend the reach of their combined network.

. Small and medium-sized financial institutions might, on the other hand, elect to partner with BigTech platforms to benefit from the first mover advantage associated with the scale of these platforms (i.e. higher volumes). Others may seek to focus their activity on niche financial services or more complex banking activities, which might be less appealing to BigTechs.

. Financial institutions, large or small, might also try to limit their partnership with BigTech firms to certain product lines (i.e. mobile payments), while continuing to invest in their digital transformation in order to maintain and enhance their customer relationships.

The digital transformation of incumbent financial institutions could offset the impact of a heightened competition on their profitability by as much as 2.5 percentage points of RoE by 2025, limiting the drop to 1.5 percentage point.

However, that digital transformation also means high initial investment and high execution risk with uncertain competitive results. By some estimates, IT expenses are already higher in the banking industry than any other (ca. 9% of revenues) and almost two to three times those of other major industries.

Two important questions emerge: (i) are all financial institutions able to afford the substantial IT capital expenditures required to be competitive in the digital age, and (ii) will their customers be retained during the process of digital transformation.

Some analysts believe that the digital transformation processis likely to include further consolidation of financial institutions in order for the benefits resulting from the high initial investments to scale up.

Eventually, the pace and size of IT investments, changes in business models and consolidation in the financial sector required to cope with the increased competition from BigTech firms’ may be influenced by the regulatory framework governing financial and commercial activities in different jurisdictions.

As noted by the Bank for International Settlements (BIS), BigTechs’ entry presents new and complex trade-offs between financial stability, competition and data protection. For instance, the opening up of banks’ data promoted by initiatives such as PSD2, which are designed to increase competition in financial services, have led some to question whether BigTech firms should also open up their data to banks.

For more details, download the report: BigTech in Finance – Market developments and potential financial stability implications

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: