The Bank of England is to test banks’ resilience to resist and recover from a cyber attack on their payments systems

The Bank is particularly concerned that disruption to one bank’s payments could have a direct impact on the real economy by preventing customers of that bank from paying for goods and services. It may also cause a ripple effect, spreading to other banks, impairing interbank lending and, in turn, activities such as clearing, settlement or mortgage payments, according to finextra.com.

In its Financial Stability report, the BofE says it intends to work with the Prudential Regulatory Authority and the UK’s National Cyber Security Centre to test the ability of firms to meet a defined set of minimum recovery standards, setting a tolerance point after which it judges disruption would begin to cause material economic impact.

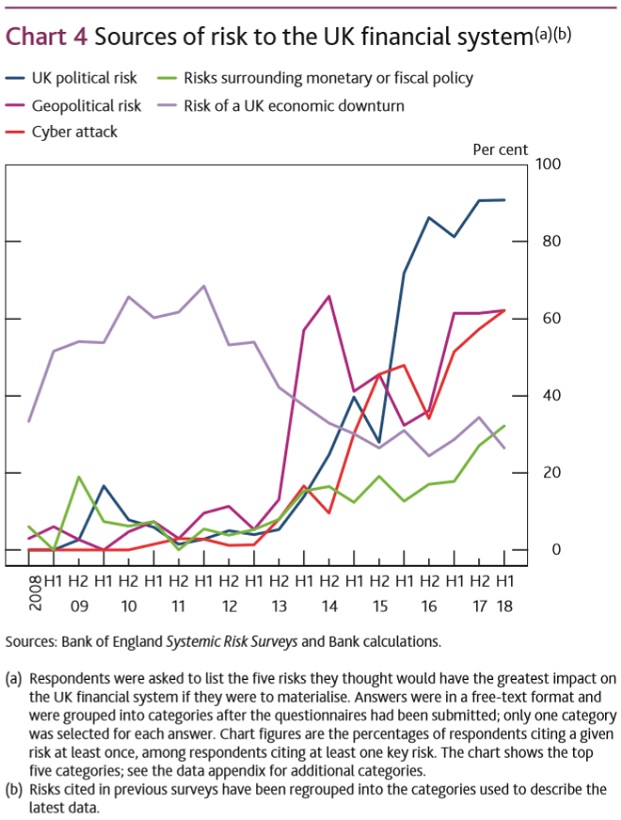

In the Bank’s latest Systemic Risk Survey, published alongside the Financial Stability Report, 62% of banks cited cybersecurity as a key source of risk, up from 51% a year ago. The Bank says it will consult with firms with a view to conducting a pilot of the approach to stress testing cyber resilience in 2019.

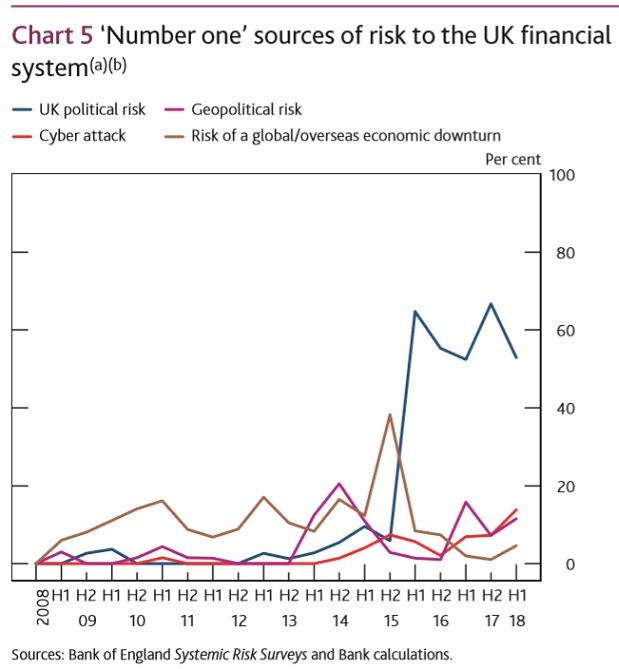

(a) Respondents were asked to list the five risks they thought would have the greatest impact on the UK financial system if they were to materialise, in order of potential impact (ie greatest impact first). Answers were in a free‑text format and were grouped into categories after the questionnaires had been submitted; only one category was selected for each answer. Chart figures are the percentages of respondents citing a given risk as their number one key risk, among respondents citing at least one key risk. The chart shows the top four categories; see the data appendix for additional categories. (b) Risks cited in previous surveys have been regrouped into the categories used to describe the latest data.

Although not systemic in nature, disruption caused by IT outages such as those experienced by Visa and TSB recently, highlight the importance of operational risk beyond cyber incidents for individual firms and consumer protection, says the Bank, and provides a pointer to further work for regulatory authorities. The Bank will publish a discussion paper on this issue next Thursday.

The Systemic Risk Survey is a biannual survey that asks market participants about perceived risks to, and their confidence in, the stability of the UK financial system. The survey is generally completed by executives responsible for firms’ risk management or treasury functions. This report presents the results of the 2018 H1 survey, which was conducted by the Bank of England in the period between 9 April and 3 May 2018. The results presented are based on responses to the survey and do not necessarily reflect the Bank of England’s views on risks to the UK financial system. Eighty seven market participants took part in the survey, representing an 83% response rate.

Participants include UK banks and building societies, large foreign banks, asset managers, hedge funds, insurers, pension funds, large non‑financial companies and central counterparties. Summary statistics are calculated by giving equal weight to each survey response.

Download the full report here: Bank of England – Systemic Risk Survey

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: