The average cash loss for a robbery is estimated at €20,369 per incident, the average cash loss per explosive or gas attack is €10,735 and the average cash loss for a ram raid or burglary attack is €9,377. These figures do not take into account collateral damage to equipment or buildings, which can be significant and often exceeds the value of the cash lost in successful attacks.

The European Association for Secure Transactions (EAST) has just published a European Payment Terminal Crime Report covering 2019 which reports that terminal fraud attacks were up 35%.

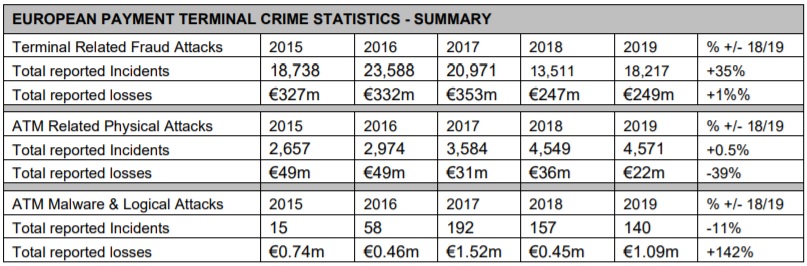

Terminal related fraud attacks rose from 13,511 to 18,217 incidents, mainly driven by an 87% increase in ATM transaction reversal fraud attacks (up from 4,843 to 9,054 incidents), while card skimming incidents fell 21% to an all-time low (down from 1,883 to 1,496 incidents).

EAST Executive Director Lachlan Gunn said, „Despite the overall rise in terminal fraud incidents, total reported losses were almost unchanged. Transaction reversal fraud losses did rise from €2.6 million to €5.2 million, but the continued drop in skimming incidents has helped to keep the overall loss position stable.”

Total losses of €249 million were reported, up 1% from the €247 million reported in 2018. Overall losses due to card skimming were unchanged and losses due to card trapping were down by 14% (from €2.9 million to €2.5 million).

ATM related physical attacks were up 0.5% (from 4,579 to 4,571 incidents). Attacks due to ram raids and ATM burglary were down 11% (from 1,256 to 1,122 incidents) and ATM explosive attacks (including explosive gas and solid explosive attacks) were down 7% (from 1,052 to 977 incidents). Losses due to ATM related physical attacks were €22 million, a 39% decrease from the €36 million reported in 2018.

A total of 140 ATM malware and logical attacks were reported, down from 157 in 2018, an 11% decrease. All the reported attacks were ‘cash out’ or ‘jackpotting’ attacks. In 118 attacks equipment typically referred to as a ‘black box’ was used, and malware was used in the other 22 attacks. Related losses were up 142%, from €0.45 million to €1.09 million. A summary of the report statistics under the main headings is in the table below.

EUROPEAN PAYMENT TERMINAL CRIME REPORT – Period: January to December 2019

The above release is based on a report prepared twice-yearly by EAST to provide an overview of the European payment terminal crime situation for law enforcement officers and EAST members, using statistics provided from 20 European states. The following countries, with an estimated total installed base of 334,305 ATMs, supplied full or partial information for this report: Austria; Cyprus; Czech Republic; Denmark; Finland; France; Germany; Greece; Ireland; Italy; Liechtenstein; Luxembourg; Netherlands; Portugal; Romania; Slovakia; Spain; Sweden; Switzerland; United Kingdom.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: