Tellers beware: robots are coming in branches to interact with bank customers

Japan’s Mizuho Bank is about to deploy robots that have been supercharged by IBM’s Watson cognitive computing platform in several of its branches.

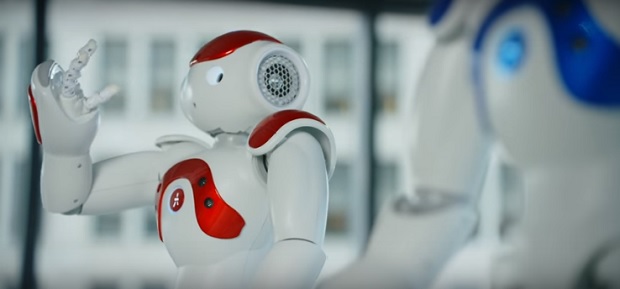

Mizuho hired a 48-inch humanoid called Pepper at its flagship Tokyo branch last summer to entertain customers with games and multimedia and provide basic information on products. But now the bank is putting the SoftBank-made robots to more serious work thanks to a new common robotics platform using research developed by IBM Research-Tokyo.

Beginning in May, Mizuho Bank will deploy this platform on Pepper robots from SoftBank Robotics across local branches.

„The robots will interact with bank customers and analyze information from the Mizuho Bank website as well as customer-specific information to offer more personalized customer interactions, allowing bank employees to focus on higher value tasks. Pepper’s unique physical characteristics, complemented by Watson’s natural language processing capabilities, will allow bank customers to have a natural conversation during which their words as well as their gestures and expressions, are understood.”, according to the press release.

Nobuhide Hayashi, CEO and president, Mizuho Bank, says: „The insights gained from our collaboration with Watson – and customer interactions with our branch robots – will help us further improve our customer service and drive innovation in the financial space.”

Mizuho Bank established its Incubation Department in April 2014, dedicated to fostering the adoption of new technologies and creating new businesses that will improve client experiences. Mizuho Bank will apply the expertise gathered from these projects to other bank operations, including transaction processing and consulting efforts. For example, Mizuho Bank will leverage insights from Watson’s cognitive services to deliver customer support with greater speed and accuracy, eventually using that intelligence to improve mobile app and ATM services for customers.

“Working with innovators such as Mizuho Bank provides an incredible opportunity to put a cognitive-powered form factor in front of consumers,” says Paul Yonamine, general manager, IBM Japan. “As we further embed cognitive capabilities in robotics, we’ll begin to see consumers engage with this technology in new ways, furthering the growth of the technology.”

In October 2015, IBM Research-Tokyo established the Cognitive Robot Innovation Lab (CRIL) to explore and develop new robotics technologies. The CRIL has combined cognitive systems, like IBM Watson, with robots to encourage industry innovation, allowing robots to analyze, perceive and learn information to have more natural interactions with humans.

IBM Watson powered robot – take a look

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: