New global survey of consumers and small businesses identifies top factors they consider when picking a payment provider. Hidden fees evoke a stronger negative reaction than a payment not arriving at all. 81% of consumers and 87% of SMEs explore their bank’s offering first when making a cross-border payment.

Swift today published the results of a global survey of 7,000 consumers and small businesses on attitudes to low-value cross-border payments, finding that security and transparency are the most important factors when sending money internationally.

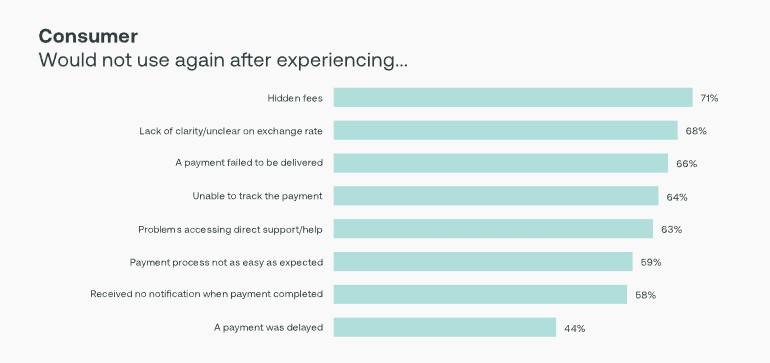

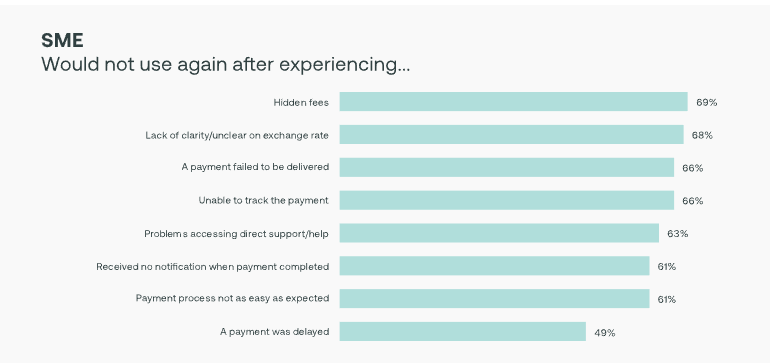

Security was named as the key driver in the selection of a payments provider by both consumers and SMEs, closely followed by trust (for consumers) and transparency of fees (for SMEs). Transparency was deemed very important to both groups and around 70% of consumers and SMEs said they would not use a payment provider again if they experienced hidden fees. In fact, hidden fees evoked a stronger reaction among both groups than a payment not arriving at all.

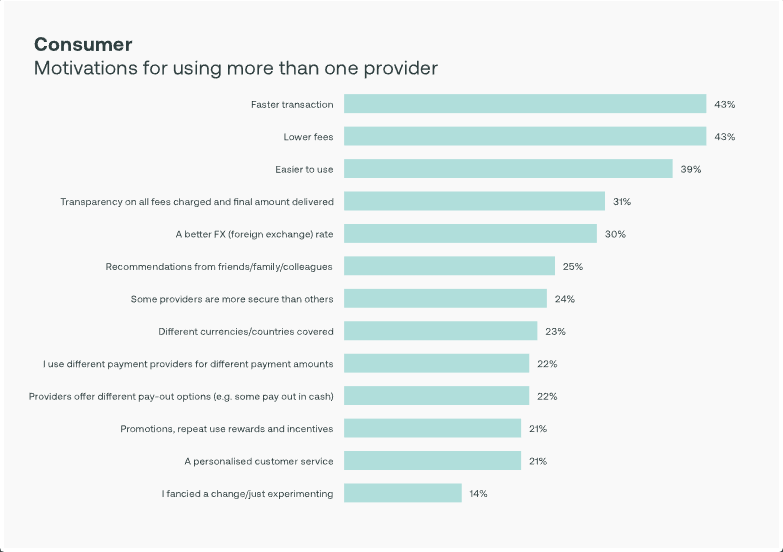

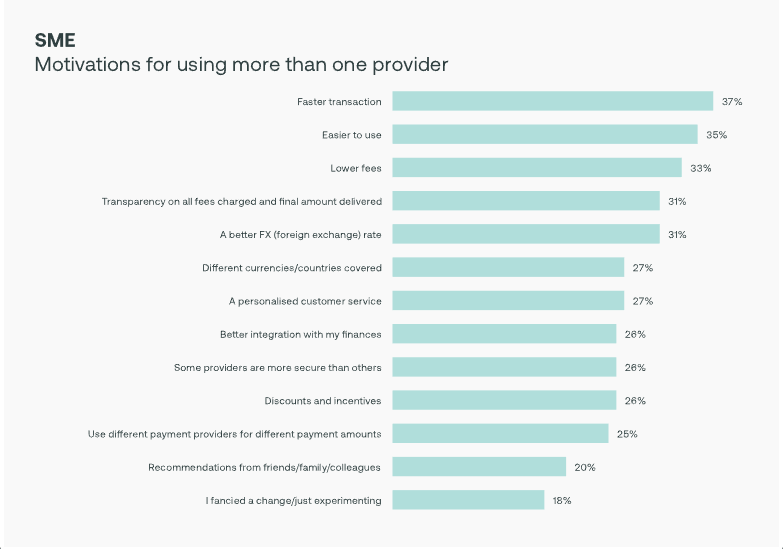

Swift’s research found that customers overwhelmingly look to banks first when making an international payment – confirmed by 87% of SMEs and 81% of consumers – but also reinforced how competitive the market has become. Three-quarters of those surveyed said they would consider using a different provider if they matched the offer they get from a bank, fintech or other provider today.

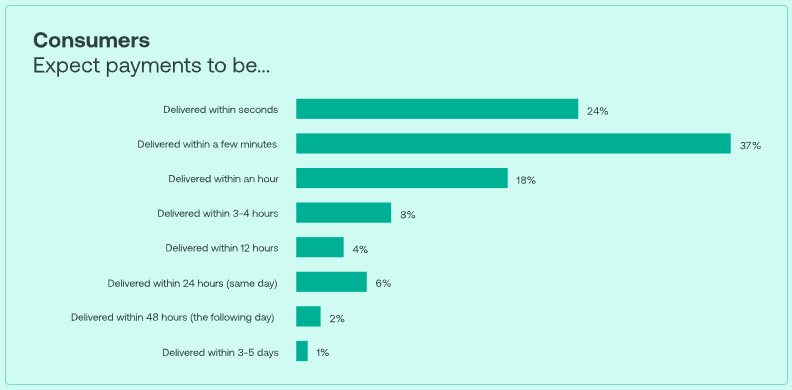

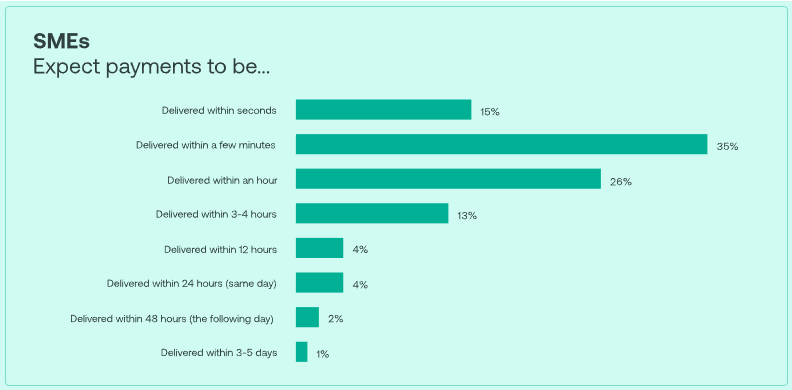

While customers value speed, it is not at the expense of security and transparency. The study found that 79% of consumers and 76% of SMEs expect an international payment to be completed within one hour or less. Only 24% of consumers and 15% of SMEs expect payments to be instant but expectations for speed are likely to increase as more domestic market infrastructures move to instant payments.

Thierry Chilosi, Chief Strategy Officer at Swift, said: “Whether it’s someone sending money to family abroad or a small business trading with a partner in another country, low-value cross-border payments have very real, everyday implications for people around the world. Our research confirms there is a real opportunity for financial institutions to offer compelling solutions that combine simple and transparent digital front-end experiences with secure, reliable, and fast back-end processing. This is exactly why we developed Swift Go with our community to facilitate fast and predictable low-value international payments, and we will keep innovating in this space to ensure payments of all sizes can flow across the globe without friction.”

Swift Go was launched in 2021 to enable financial institutions to offer consumers and small businesses a fast, predictable and competitively priced cross-border payments solution, all based on the highest levels of security that comes with Swift’s network. More than 630 banks across 130 countries have already signed up for the service. It’s part of Swift’s broader strategy to drive instant, frictionless cross-border transactions aligned with goals set by the G20 to enhance speed, transparency, cost and access for international payments.

Swift’s study also found notable variations in responses from customers in different countries. Consumers in Saudi Arabia and Australia are more concerned with the impact of FX conversion when making international payments than those in other nations, while SMEs in Germany place particular importance on the integration of payment processes into other tools, such as accounting software.

The full report is available on the Swift website here.

Research methodology: This research was completed on 29 December 2022. In total, we surveyed 4,205 consumers and 2,720 SMEs across eight key markets: Australia, China, Germany, India, Saudi Arabia, South Africa, the UK and the US. Participants completed a blind online questionnaire through global market research agency, Savanta. Further detail about the makeup of the participants can be found on page 16 of the report.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: