Sweden’s central bank prepares for cashless future with e-krona

Riskbank, the Sweden’s central bank, is pushing ahead with plans to build a technical framework for the issuance of a new electronic currency, the e-krona. The Riksbank has provided the general public with money for 350 years, but as the use of cash is continuing to decline in Sweden, „we need to think in new ways”, the bank said.

The use of cash continues to decline

According to the Riksbank’s survey from 2018, only 13 per cent paid for their most recent purchase in cash. The corresponding figure for 2010 was 39 per cent. As more consumers turn to electronic payments, it will ultimately no longer be profitable for retailers to accept cash. If the trend continues, Sweden may find itself in a few years’ time in a position where cash is no longer generally accepted by households and retailers.

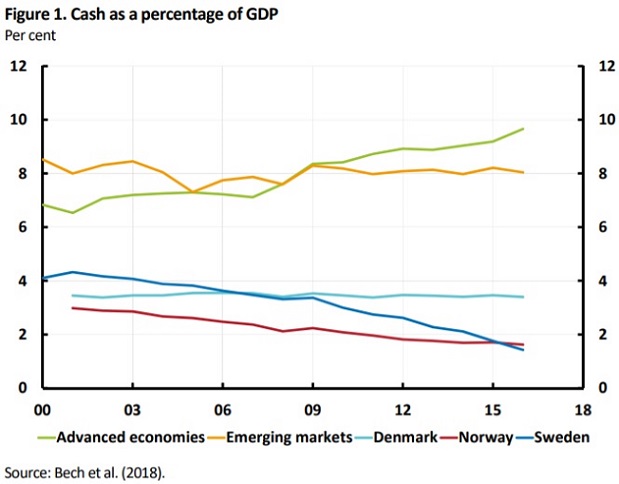

The use of cash is declining particularly rapidly in Sweden, and since 2008 the value of cash in circulation has declined by around 50 per cent. There are differences between countries in Europe with regard to the use of cash, but for the euro area as a whole the value of cash as a percentage of GDP is just over 10 per cent, which can be compared with Sweden where the corresponding figure is just over 1 per cent.

In Sweden, the decline in the use of cash has also affected the trade sector’s expectations of the future. Half of the retailers in Sweden believe that they will stop accepting cash as a means of payment in 2025 at the latest, as it will ultimately become too expensive to accept cash if use continues to decline. This development is not seen abroad.

In the future, cash may be used to such a limited extent that it is difficult to pay with it. In response to this, the Riksbank started a project in the spring of 2017 to examine the scope for the Riksbank to issue a central bank digital currency (CBDC), a so-called „e-krona”.

An e-krona could ensure that the general public will still have access to a state-guaranteed means of payment. Adopting a position on whether Sweden should introduce an e-krona will take time. But at the same time, the analysis work needs to continue to increase the Riksbank’s knowledge of the consequences of an e-krona and technological solutions need to be developed and tested.

The state needs to have a role on the payment market

For a long time, the state has provided the general public with banknotes and coins to use for payments. Cash has enjoyed the confidence of the general public and facilitated trade in goods and services. Today’s digital payment market means that we face a new situation in which all means of payment accessible to the general public are issued and controlled by private agents. If the state, via the central bank, does not have any payment services to offer as an alternative to the strongly concentrated private payment market, it may lead to a decline in competitiveness and a less stable payment system, as well as make it difficult for certain groups to make payments. Ultimately, it may also risk eroding basic trust in the Swedish monetary system. Some of these problems could be neutralised or mitigated by an

e‐krona.

What can an e‐krona provide?

The e‐krona could become a modern krona in electronic form as a complement to physical cash. The public could then continue to have general access to central bank money. The e‐krona could also strengthening preparedness, as the private market cannot be expected to take all the responsibility for ensuring that payments function in crisis situations. In serious crises, when private payment systems may fail, an e‐krona could work as an alternative system and thereby increase stability in the payment system as a whole. The e‐krona could hence help to promote a safe and efficient payment system.

The e‐krona could offer a competitively neutral infrastructure which payment service providers can join if they wish to offer services to households and companies. This could increase competition, benefit innovation and possibly slightly reduce the fees charged to the general public.

There are currently groups in society that are encountering problems as cash use declines because they find it difficult to use digital payment solutions for one reason or another. Such groups include older people, people with disabilities or those who, for different reasons, do not have access to payment instruments other than cash. Since it cannot be expected that the private market fully cater for these groups, the state can choose to take greater responsibility for them by. This could for example be done by designing a simple and user‐friendly e‐krona or by legislating and regulating so that the private sector is forced to take greater responsibility.

The e‐krona – value‐based or account‐based

E‐krona can be described as Swedish krona that can either be held in an account at the Riksbank (account‐based) or be stored locally, for example on a card or in a mobile phone app (value‐based). Both types of e‐krona assume that there is an underlying register so that it is possible to record transactions and safeguard who is the rightful owner of the digital krona. This means that digital transactions with e‐krona will be traceable.

For it to be practically possible to use e‐krona for online purchases or in physical shops, the e‐krona platform, which contains the underlying register for e‐krona, needs to interact with a number of other systems and agents. Banks and other companies, for example, need to be able to join the e‐krona platform in order to be able to develop and offer payment services to households and companies. Systems are also needed that enable money laundering checks and a link to a settlement system so that e‐krona can be moved into and out of the platform.

Legally speaking, a value‐based e‐krona is classed as e‐money, while an account‐based e‐krona can be likened to a deposit. E‐krona could be offered in the same way as cash is today and be widely available to households and companies (regardless of domicile). However, an application to open an e‐krona account may need to be assessed based on established rules and conditions just as when a bank account is opened at a private bank.

How the e-krona project can move on

Today the Riksbank’s e-krona project is publishing a new report where the project team proposes that the Riksbank:

. Begin to design a technical solution for an e-krona in order to test which solutions are practicable and possible to realise

. Draw up proposals for legislative amendments needed to clarify the Riksbank’s mandate and an e-krona’s legal standing

. Continue investigating the financial aspects of an e-krona

E-krona can be described as Swedish krona that can either be held in an account at the Riksbank (account-based) or be stored locally, for example on a card or in a mobile phone app (value-based). A value-based e-krona is compatible with the Sveriges Riksbank Act, but the project assesses that to issue an account-based e-krona, the act would need to be amended. The Riksbank should therefore begin an investigation that produced concrete proposals regarding what amendments need to be made to the Sveriges Riksbank Act. However, it is up to the legislator to amend the act.

Developing one or more possible technical solutions for an e-krona would provide the Riksbank with greater room for manoeuvre and knowledge prior to a decision on whether or not to issue an e-krona. A preliminary technical solution for the e-krona should focus on a value-based e-krona without interest and with traceable transactions. The Riksbank should also continue investigating an account-based e-krona which would require coordination with other authorities. It is reasonable that a system for an account-based e-krona is built in agreement and perhaps together with other authorities, say the Riksbank’s e-krona project team.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: