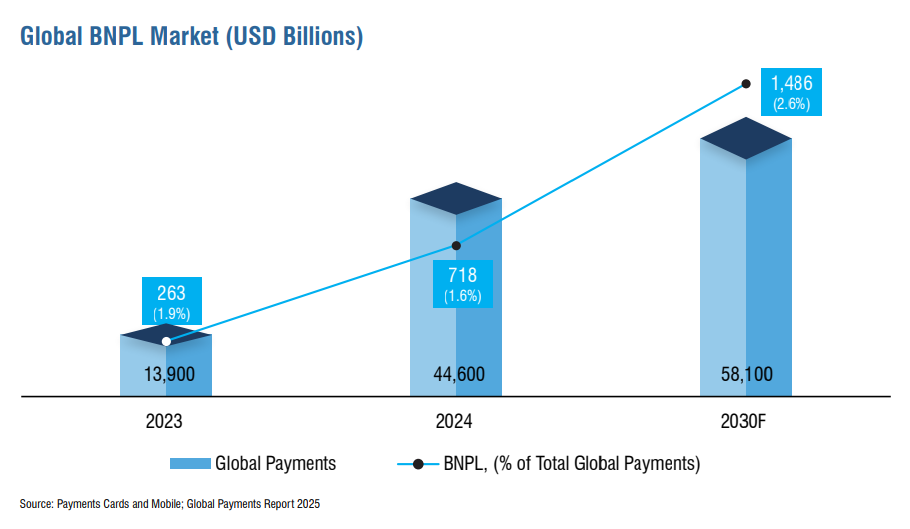

The Buy Now Pay Later’s (BNPL) accounted for 1.6% of total global payments transaction value i.e., USD 718 billion in 2024. The BNPL market is expected a 12.9% compound annual growth rate (CAGR) to reach USD 1,486 billion by 2030, according to the latest Riyadh Valley Co’s report.

Globally, the top 5 markets by market share of BNPL services are European countries. As of 2024, Sweden was the fastest adopter of BNPL services, which accounted for 6.1% of the country’s payments market, which is the largest globally.

However, in terms of transaction volume, China was the biggest market globally, accounting for 32.7% of total transactions in 2024.

Buy Now, Pay Later (BNPL) has emerged as a key strategy for businesses to boost sales, reduce cart abandonment, and appeal to customers seeking payment flexibility. There are more than 200 global providers now offering instalment loans at checkout mirroring popular BNPL offerings.

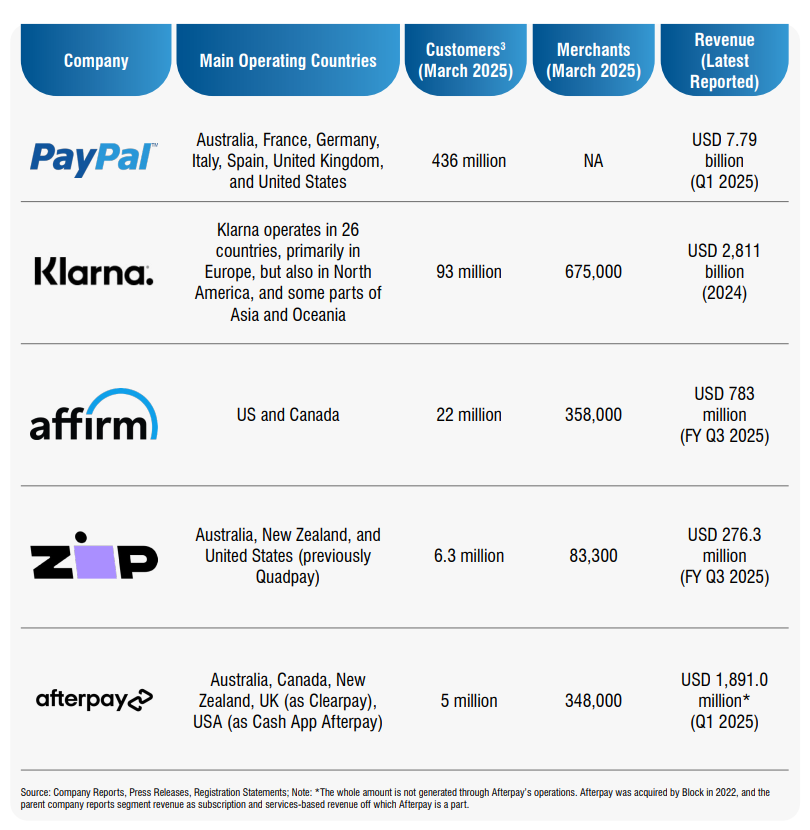

Key players are listed below:

As per PYMNTS’ December 2024 estimates, Klarna, Afterpay, and Affirm accounted for a combined market share of 67.4% of the US BNPL market, outstripping PayPal’s estimated market share of 12.3%. However, merchants largely prefer bank-branded BNPL products in part because they are a post-purchase financing option and merchants do not have to support an additional integration to offer that. These include offerings such as Citibank’s Flex Pay and Wells Fargo’s Flex Loan, which offer payment schedules like BNPL but with the added constraint of the banking regulatory framework.

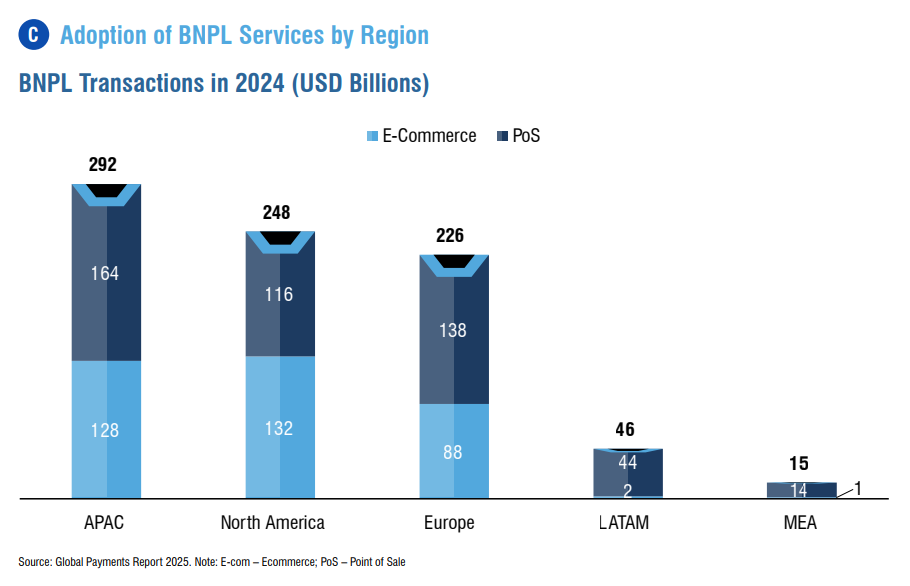

As of 2024, the Asia Pacific region was the largest adopter of BNPL services followed by North America. Middle East and Africa is a nascent market for BNPL services, recording only USD 15 billion in total BNPL transactions compared to APAC’s USD 292 billion.

The authors of the report concludes: „The global BNPL market represents one of the fastest evolving segments within the payments market. BNPL isn’t just a payment option anymore. It’s becoming part of the digital finance infrastructure.”

More details here:

The Buy Now, Pay Later (BNPL) – Leading the Embedded Finance Service Framework

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: