Respondents indicate that they are less likely to us gen AI tools to obtain financial and medical advice, areas that require a relatively higher degree of trust in experts.

Generative artificial intelligence (gen AI) is poised to affect everyday lives profoundly. Millions are already exploring gen AI to create text, music and videos, and a growing number of firms in all sectors are integrating gen AI tools into their business operations. Despite the remarkable speed of adoption, little is known about consumers’ uses of and attitudes towards gen AI. Furthermore, the level of trust households place on decisions made by gen AI and whether this trust depends on the context or provider remain unclear.

This BIS Bulletin (No. 86) sheds light on these questions with novel data from the Survey of Consumer Expectations (SCE). The SCE, a representative high-quality survey of US household heads, is widely used to measure households’ expectations about inflation, the labour market and their finances.

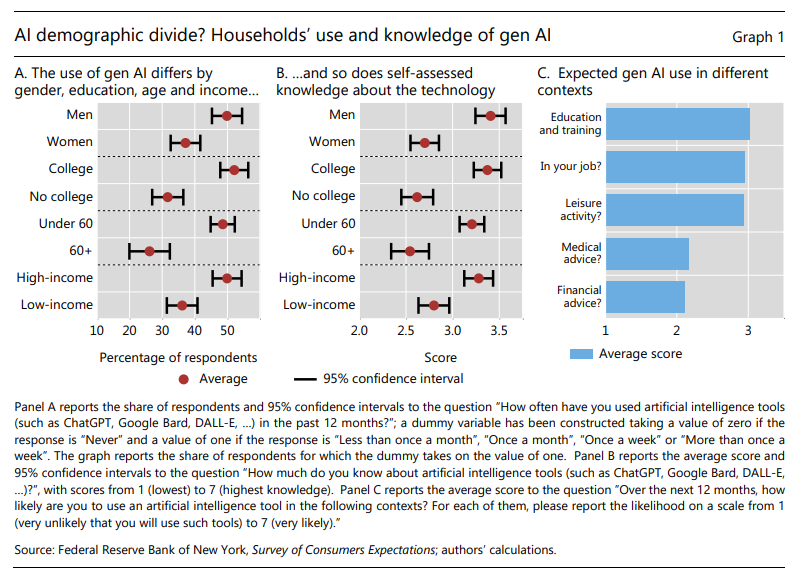

By leveraging a special module on gen AI recently added to the SCE, this Bulletin finds that almost half of all US households use gen AI and that usage and knowledge are significantly higher among men, younger individuals and households with higher income or educational attainment. These groups are also more optimistic that AI will bring more opportunities than risks for their job prospects. However, the vast majority of respondents trust gen AI less than humans to provide services, especially if provided by big techs, in part reflecting users’ privacy concerns. Households also overwhelmingly favour regulation.

Households expect to use gen AI tools more in relatively low-stake activities. Regarding use in the next 12 months (Graph 1.C), households’ responses suggest they are more likely to use it for education and training purposes, for job tasks, as well as for leisure activities (for example, writing, drawing or creating videos). In contrast, respondents indicate that they are less likely to use gen AI tools to obtain financial and medical advice, areas that require a relatively higher degree of trust in experts.

Consumers’ trust in gen AI

Gen AI converses through everyday language and shows almost uncannily human-like capabilities in content creation. An increasing number of companies are already experimenting with chat bots that interact directly with end users. But how much do consumers trust gen AI compared to humans?

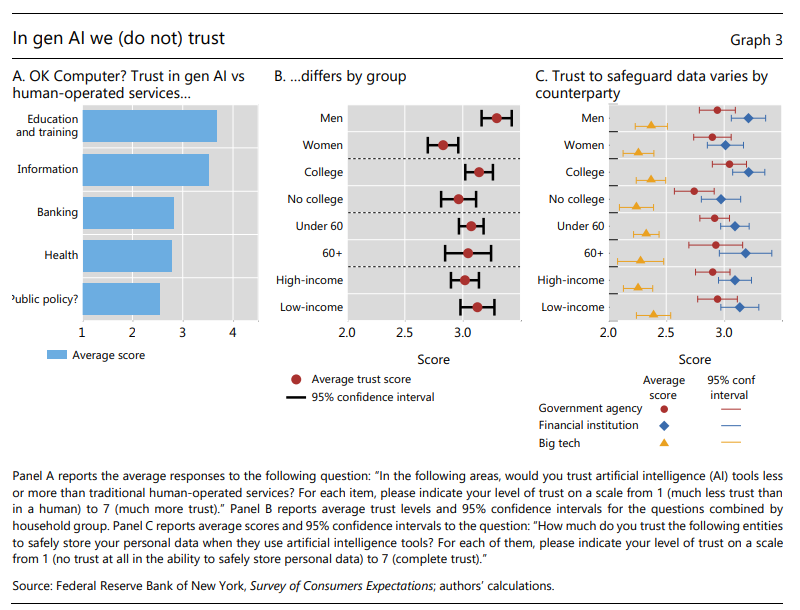

In general, users have lower trust in gen AI tools than their fellow human beings. Respondents were asked to rate their trust in AI tools over traditional human-operated services on a scale from 1 (much less trust than in a human) to 7 (much more trust) in different areas. While relative trust in gen AI services is considerably lower than in humans in each area (Graph 3.A), trust is particularly low in banking, public policy and health. These patterns suggest that the adoption of gen AI tools, at least in the short run, is more likely to succeed in the fields of education and information. Differences across demographic groups are small.

There are marked differences in the trust households place in how AI tools store their personal data depending on which institutions provide such tools (Graph 3.C). Respondents report the highest trust in traditional financial institutions, eg to store their bank transaction history, geolocation or social media data. The median respondent chose a (relatively low) value of 3. Trust in a government agency (ie federal and local governments) is slightly lower. Trust was the lowest for big techs (eg large technology companies such as Amazon, Apple, Meta or Google). The median respondent assigned a value of 2, and four fifths of respondents selected a value between 1 and 3. Values are similar across demographic groups.

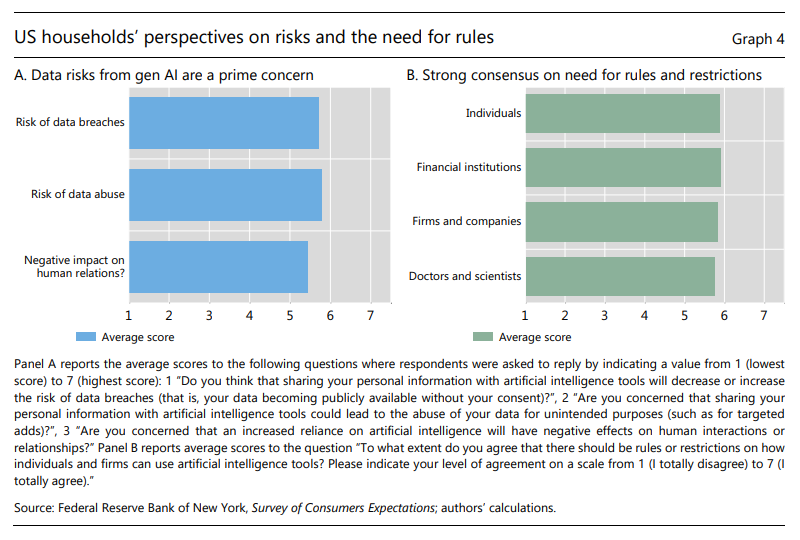

Data are a prime concern for US households, who invariably deem regulation of AI necessary. When asked about their specific concerns, respondents appear equally worried about the risk of data breaches and the abuse of data for unintended purposes (Graph 4.A). Moreover, households clearly state that regulation on the use of AI tools is necessary (Graph 4.B). These assessments hold irrespective of demographics and of the type of agent engaging with AI (eg individuals, financial institutions, nonfinancial companies, and doctors and scientists).

_____________

The SCE is a high-quality monthly, internet-based survey produced by the Federal Reserve Bank of New

York. Launched in 2013, it has been used extensively to help researchers and policymakers understand

how expectations are formed and how they affect consumer behaviour. The SCE uses a 12-month rotating

nationally representative panel of approximately 1,300 US household heads. New respondents are drawn

each month to match demographic targets from the American Community Survey, and they remain on

the panel for up to 12 months before rotating out. The main objective of the survey is to collect expectations for a wide range of economic outcomes (eg inflation, income, spending, household finance, employment and housing). The survey reports detailed demographic information, including the respondents’ gender, age, income and education.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: