The European Central Bank (ECB) recently published the results of the latest study on the payment attitudes of consumers in the euro area (SPACE). Despite the trend towards digital payments, the number of cash payments remains significant in 2024, especially for small-value and person-to-person payments.

In terms of number of payments, cash is used at the point of sale in 52% of transactions, down from 59% in 2022. In terms of value, cards are the most dominant payment instrument (with a share of 45%, down from 46%), followed by cash (39%, down from 42%) and mobile apps (7%, up from 4%).

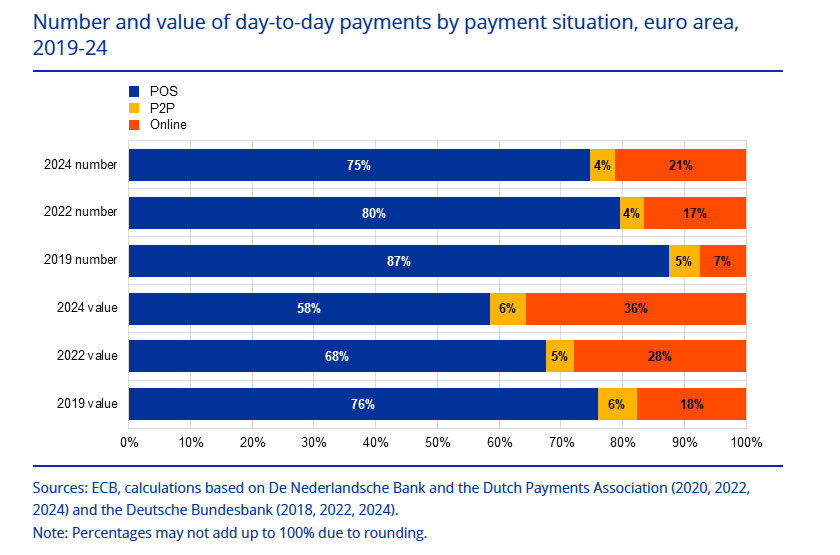

The growing share of digital payments is supported by an increase in online payments; these account for 21% of consumers’ day-to-day payments in number and 36% in value, up from 17% and 28% respectively in 2022. The most frequently used instrument for online payments is cards, accounting for 48% of transactions, followed by other electronic means of payment such as payment wallets and mobile apps, which together accounted for 29% of transactions.

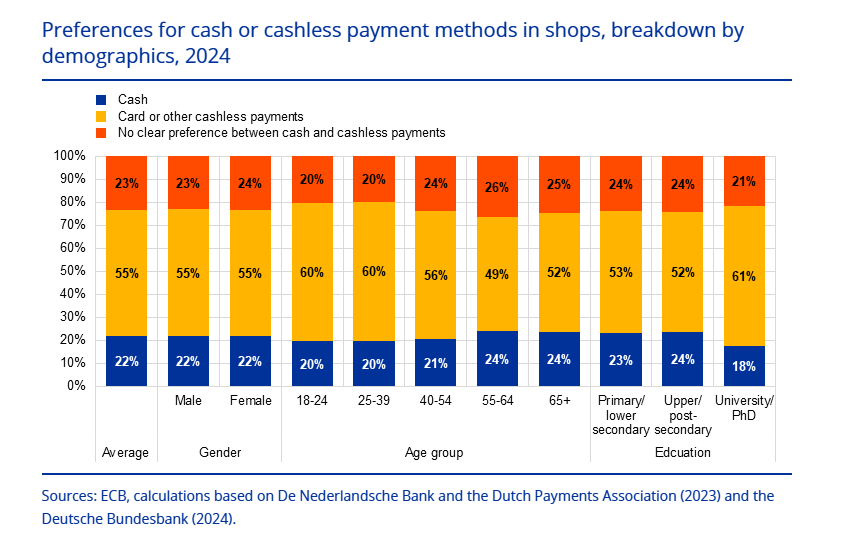

Consumers’ stated payment preferences have not changed. In 2024 as in 2022, 55% of consumers prefer paying with cards and other non-cash means in shops, 22% prefer paying with cash and 23% have no clear preference. On average, consumers deem cards faster and easier to use. They consider cash more helpful for managing their expenses and protecting their privacy.

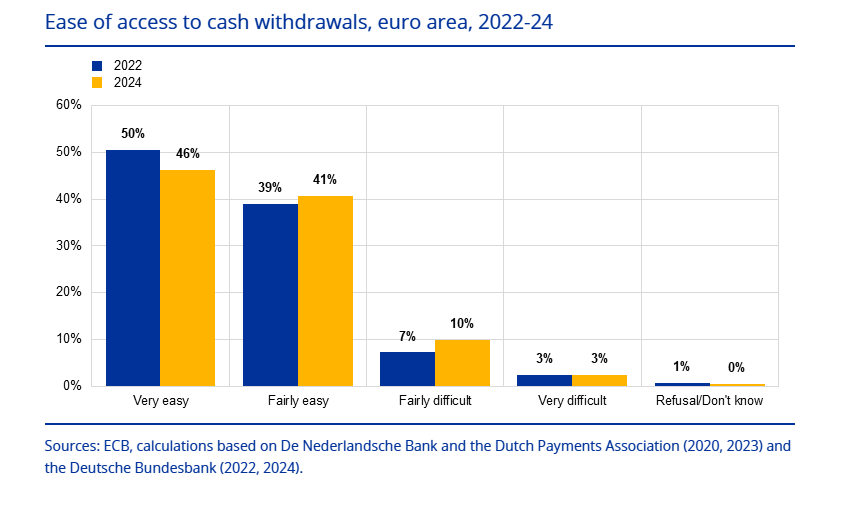

A majority of consumers (62% in 2024, up from 60% in 2022) consider it important to have cash as a payment option. And a large majority (87%) are satisfied with their access to cash, finding it very or fairly easy to withdraw cash from an ATM or a bank, even though satisfaction decreased slightly (down from 89% in 2022).

Executive Board member Piero Cipollone reaffirmed the ECB’s commitment to protecting consumers’ freedom to pay as they choose. “We are dedicated to ensuring secure, efficient and inclusive payment options. By supporting both cash and the development of a digital euro, we want to guarantee people can always choose to pay with public money, now and in the future.”

The SPACE 2024 results are summarised below.

The share of online payments in consumers’ day-to-day payments has continued to increase. In 2024, 75% (80%[2]) of day-to-day payments were made at the POS and 4% (4%) were person-to-person (P2P) payments, while 21% (17%) of consumers’ day-to-day payments were made online.

In terms of payment value, 58% (68%) of day-to-day payments were made at the POS, 6% (5%) as P2P payments and 36% (28%) online.

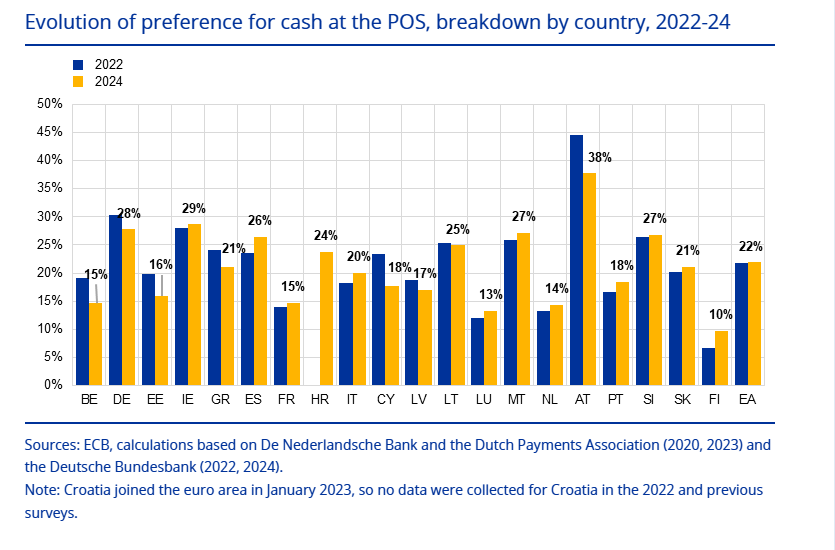

Cash was the most frequently used payment method at the POS in the euro area and was used in 52% (59%) of transactions, but the share of cash payments has declined.

In terms of value, the most important single payment instrument was cards, with a share of 45% (46%). Cash had a share of 39% (42%).

Cash was the most frequently used payment method for small-value payments at the POS, in line with previous surveys. For payments over €50, cards were the most frequently used payment method.

Cash was the dominant means of payment in P2P transactions, accounting for 41% of such payments. Cards and mobile apps were used for 33%, credit transfers for 9% and instant payments for 6% of P2P transactions.

The most frequently used instrument for online payments was cards, representing 48% (51%) of transactions. The share of e-payment solutions, i.e. payment wallets and mobile apps, was 29% (26%).

The large majority of recurring payments were made using direct debit, with credit transfers ranking in second place.

In 2024, 55% of euro area consumers expressed a preference for cards and other cashless payments when paying in a shop, while 22% preferred cash and 23% had no clear preference. Stated payment preferences were unchanged from 2022.

An increasing majority of euro area consumers, amounting to 62% (60%), considered it important or very important to have cash as a payment option.

The perceived key advantages of cash were, first, its anonymity and protection of privacy and, second, the perception that it makes consumers more aware of their own expenses.

The perceived key advantages of card payments were that consumers do not have to carry cash with them, and that card payments are faster and easier.

A majority of euro area consumers (58%) said they were concerned about their privacy when performing digital payments or other banking activities.

Most euro area consumers said they were satisfied with their access to cash, but this satisfaction has decreased slightly. A large majority, i.e. 87% (89%) of consumers, find it fairly easy or very easy to get to an ATM or a bank. Most consumers, i.e. 57%, never paid a fee when withdrawing cash from an ATM whereas 11% paid a fee always or most of the time.

A majority of euro area consumers (57%) said they had the option of withdrawing cash at shop counters.

The share of euro area consumers holding a payment account increased from 91% in 2022 to 93% in 2024. The share of consumers who own a payment card decreased from 94% in 2022 to 92% in 2024.

In 2024, 24% of euro area consumers reported that in the past month the payment method they would have preferred to use at physical locations was not always offered by the merchant or payee.

The next SPACE is planned to be published in 2026.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: