A new study from Juniper Research has revealed the vendors currently leading the global modern card issuing market. The report predicts that global revenue from modern card issuance will increase from $1.2 billion in 2024 to more than $2.8 billion by 2029; driven by the rising digitalisation of payments and growing demand for quick card activation.

Modern card issuing platforms facilitate the issuing of payment cards using APIs (Application Programming Interface). An API-driven approach greatly improves the efficiency of card issuance through automation, whilst broadening consumer choice by enabling the instant issuance of virtual cards and the option for physical card delivery.

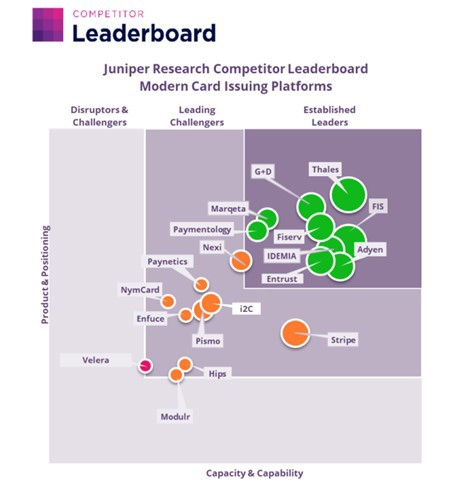

The report assessed 19 leading modern card issuing vendors in the Juniper Research Competitor Leaderboard, on factors such as platform innovation, variety of cards offered, and partnerships.

The market leading vendors for 2024 are:

The capability to personalise cards was identified as a key feature provided by leading vendors. The study found that facilitating this customisation is a key component of personalising banking experiences, which can be effectively implemented through APIs. Leading players in the Competitor Leaderboard offer APIs that enable legacy banking systems to connect with novel digital banking services, such as virtual cards.

Research author Lorien Carter remarked: “To challenge these leading modern card issuing platforms, providers must invest in the evolving API services that enable end-to-end lifecycle card management for banks. By doing so, this will enable service providers to capitalise on a market where global revenue is expected to grow 130% over the next five years.”

___________

Find out more about the latest research in Global Modern Card Issuing Platform Market 2024-2029, or download a free sample.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: