State of Fintech 2025

A 111 page report into the big trends in Fintech. Wallet Wars, Klarna’s Gen AI story, and the Stablecoin renaissance.

Highlights

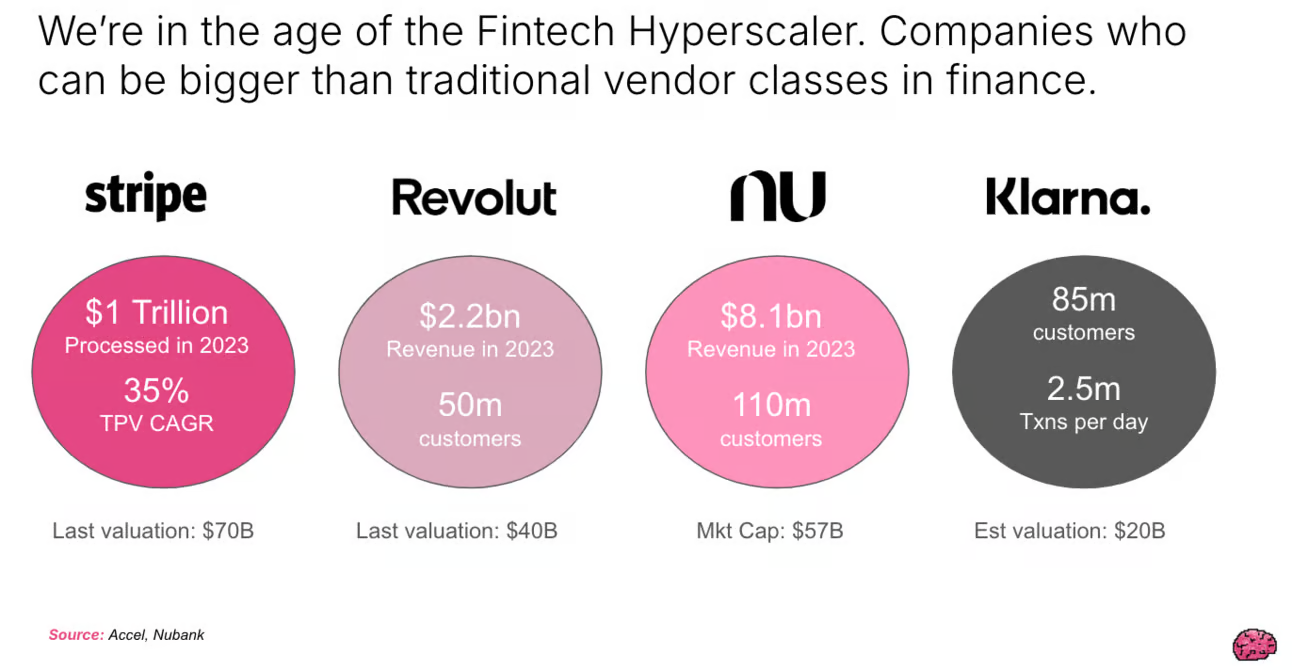

We’re at the dawn of the Fintech hyperscaler, with Nubank having over 100 million customers, Klarna at 85 million, and Revolut snapping at their heels at 50 million.

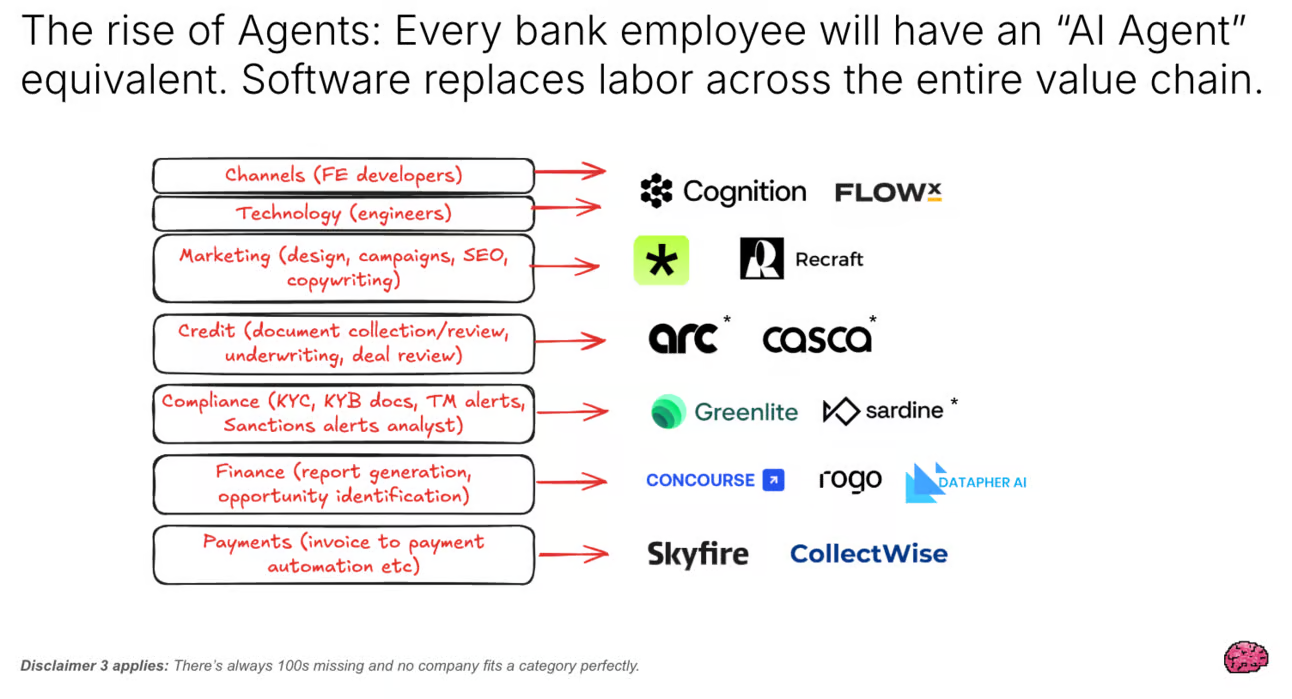

There’s an AI Agents Fintech for everything:

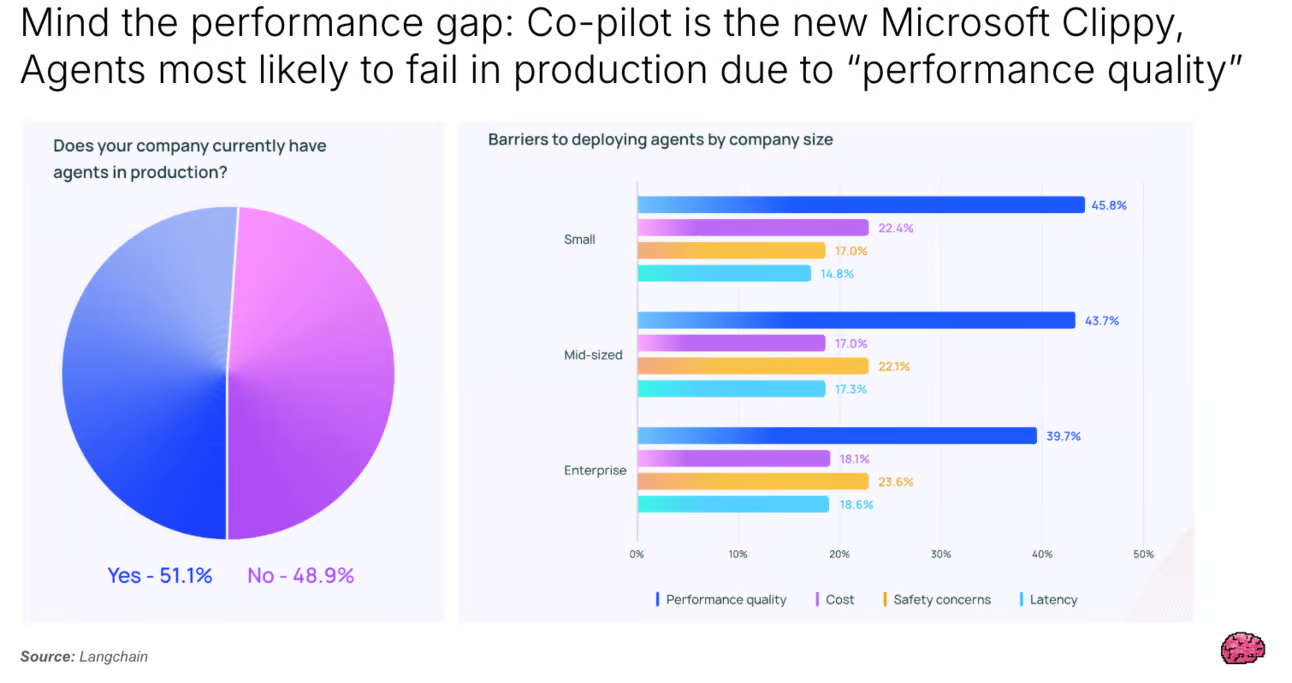

But your AI Agent results may vary.

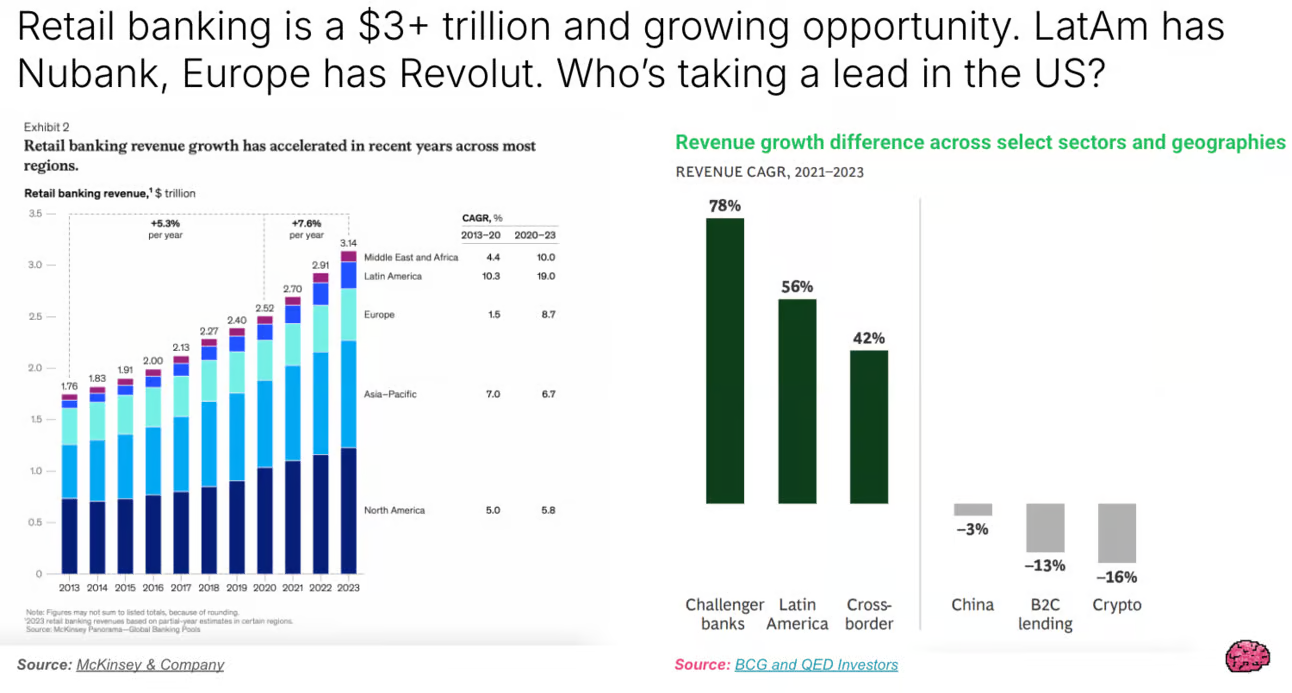

Will Revolut, Nubank or someone else get a charter and come after the big banks in 2025?

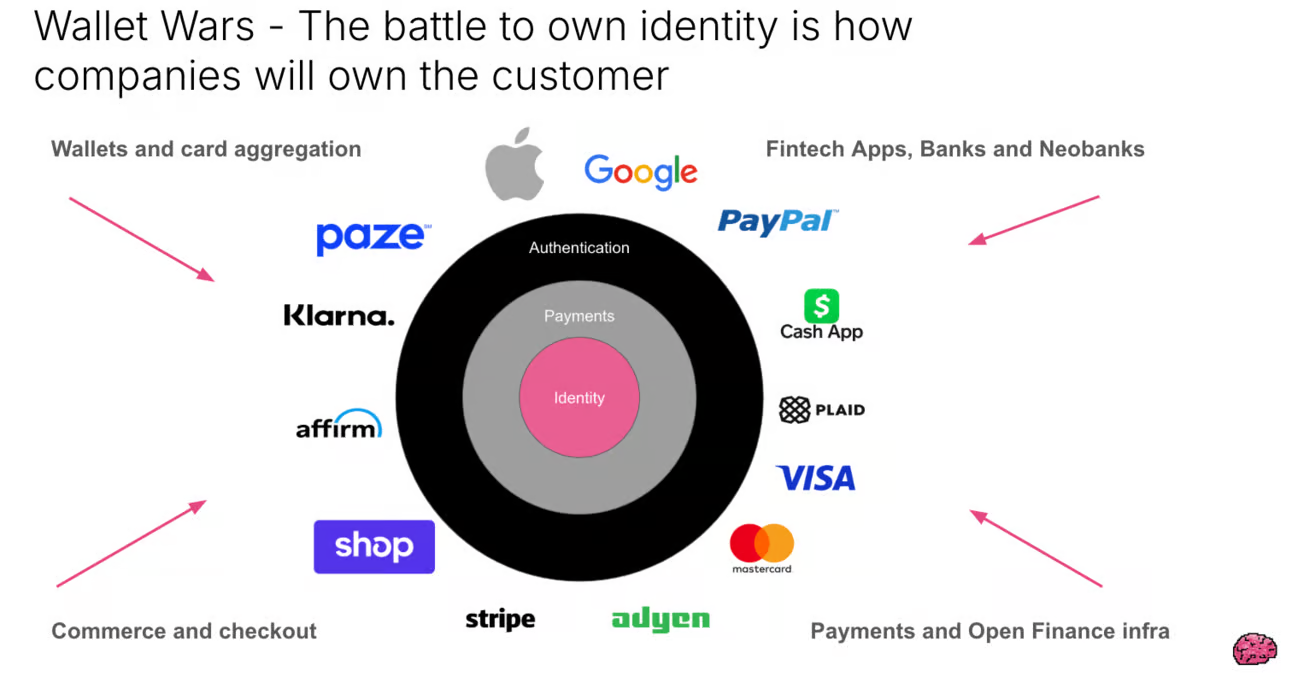

The wallet wars have started, with the battle to “own” the customer wide open since Apple was forced by the EU to open NFC.

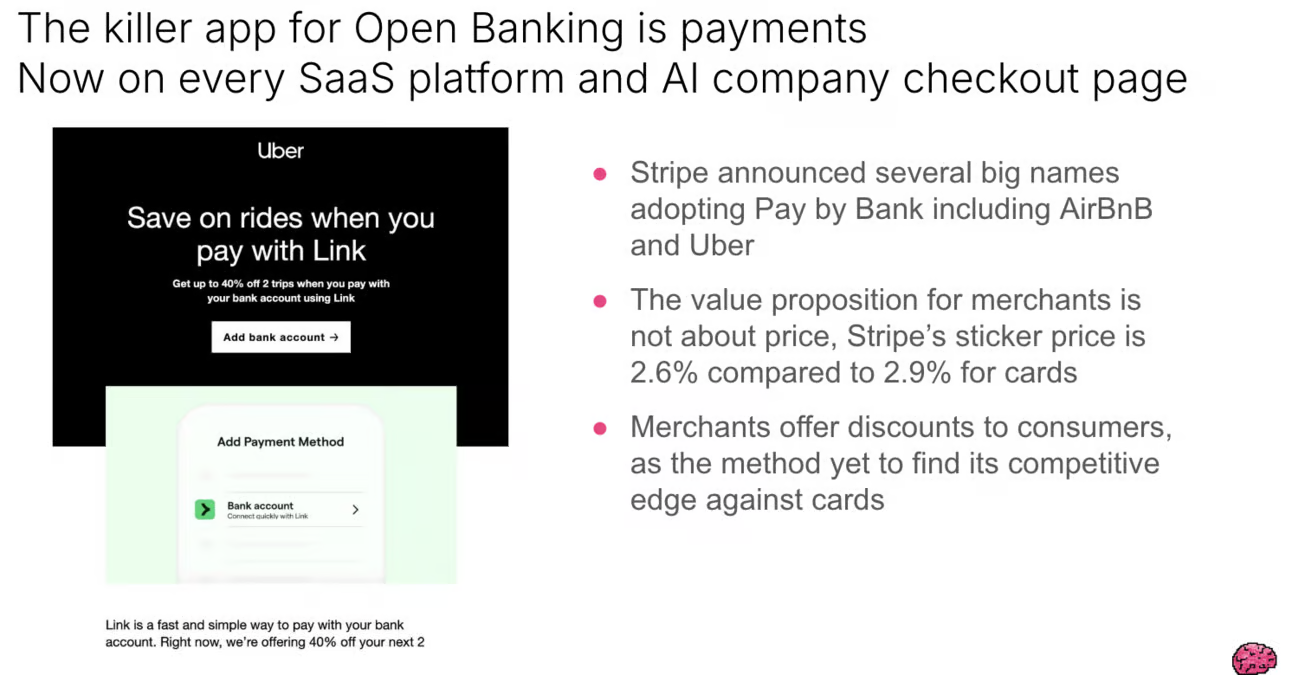

Pay by bank keeps appearing in the wild. Is it the new consumer payments authentication rail over real-time payments with FedNow and others?

The Stripe acquisition of Bridge has got everyone talking about Stablecoins. The vibe has monumentally shifted.

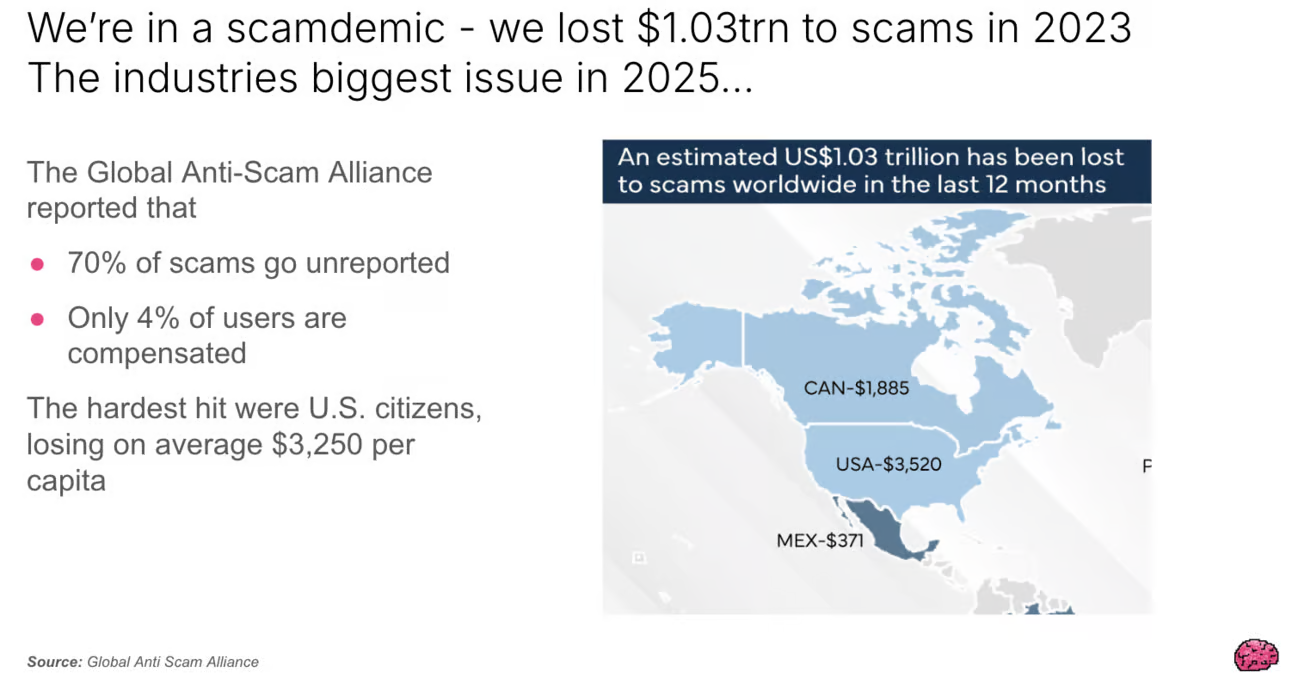

Sadly its not all good news. We’re in a more uncertain world, where AML alerts and scams have never been a bigger issue.

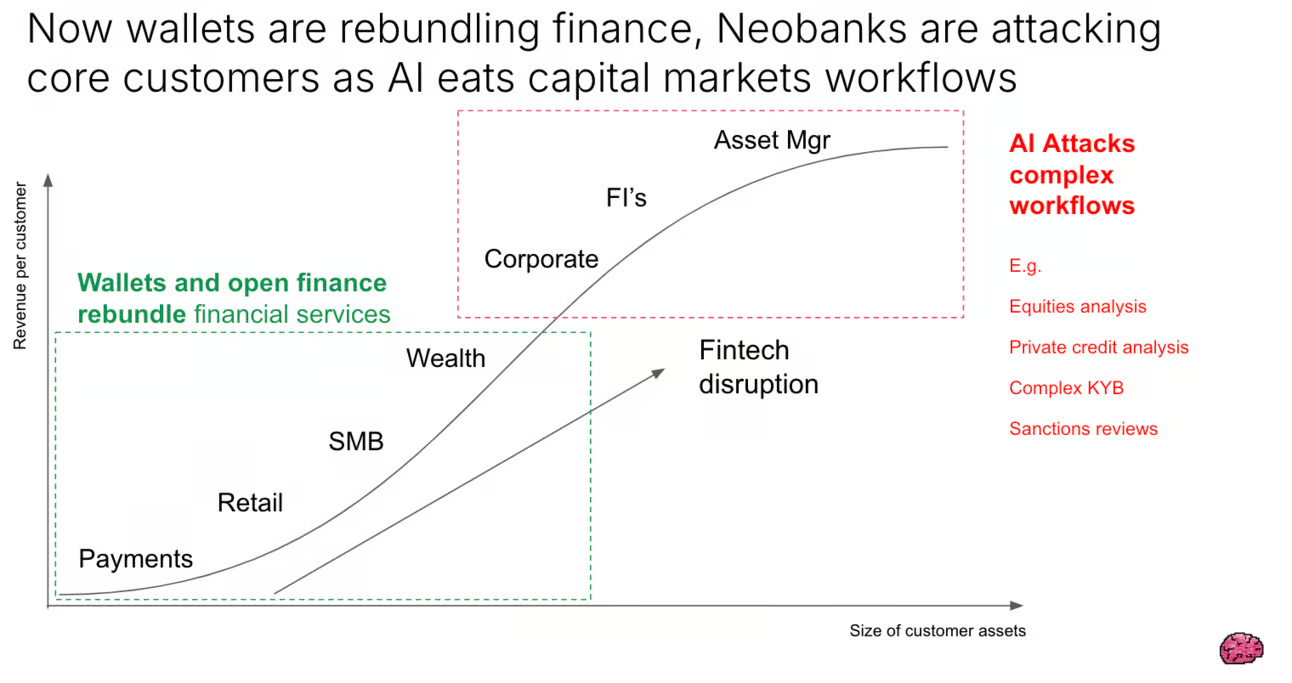

In the age of the Fintech hyperscaler, wallets and Neobanks are re-bundling consumer finance to hit profitability. AI is also helping those companies become more profitable and accelerate their growth. If they keep growing at this pace, they’ll over take incumbents in the next 5 years.

AI is now also enabling a true disruption to capital markets workflows for the first time.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: