Adoption of most forms of digital payments continues its upward trend across the United States and Europe, as shown in the results of the ninth annual McKinsey Digital Payments Survey. This edition of the survey is the first to explore preferences and behavior of European consumers alongside those of the United States. In addition to using more forms of digital payments more often, consumers’ buying journeys are increasingly starting with digital payments, for example with buy now, pay later (BNPL) platforms and offer marketplaces. This shift to digital payments is becoming increasingly important as an origination point for shoppers’ decision making—and not merely a checkout option—and may signal the need for payment providers to think about how they can reach and engage consumers earlier in the shopping process.

Roughly nine in ten consumers in both the United States and Europe report having made some form of digital payment over the past year, with the United States reaching a new high at 92 percent. Our survey defines “digital payments” as those made in digital environments such as websites or apps, or in-store through a dedicated app such as a digital wallet (a mobile application for making payments and storing electronic cards and tickets).

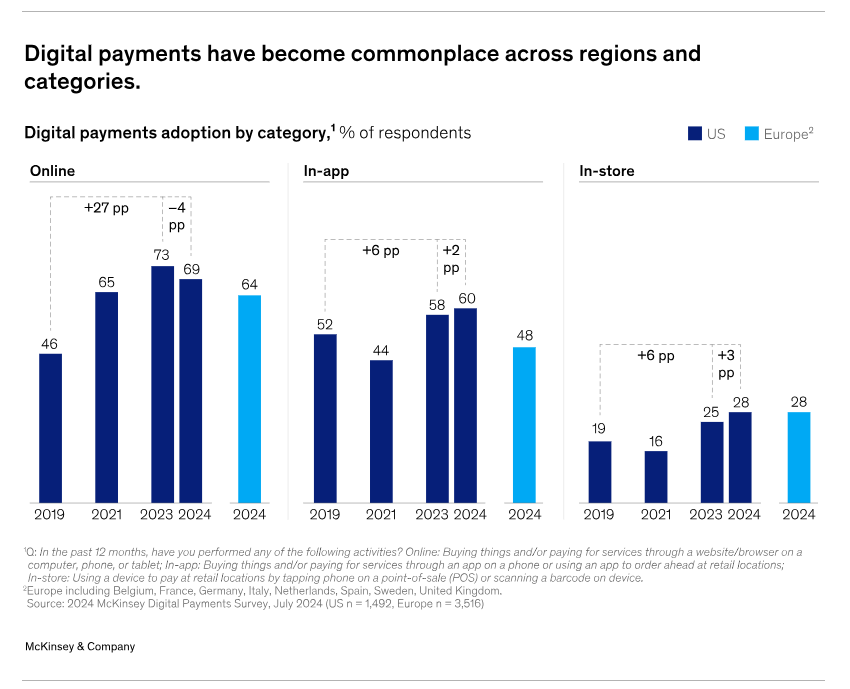

Although online shopping (through a brand’s website) remains the most adopted digital payments use case across the United States and the Europe, it appears to be plateauing at the 70 percent range in the United States (Exhibit 1).

Exhibit 1: Digital payments have become commonplace across regions and categories

In the United States, in-app and in-store are the fastest growing channels for digital payments adoption. Usage of digital payments for in-app purchases in the United States has reached 60 percent, an increase of 8 percentage points since 2019. Digital wallet penetration is also extending from in-app and online strongholds into in-store purchases, with in-store adoption increasing from 19 percent in 2019 to 28 percent in 2024. This increasing penetrating represents a channel that totals roughly $10 trillion[1] of annual consumer-to-business spending across the United States and Europe. Our survey found that one in five digital wallet adoptees often leave home without their physical wallet, relying instead on digital methods to pay and transact in physical locations.

In-store penetration is at similar levels between the United States and the eight countries surveyed in Europe in 2024, with less pronounced variations across countries than might be expected. Even traditionally cash-heavy countries like Germany and Italy show solid signs of adoption with a quarter of respondents indicating in-store use of a digital wallet in the past 12 months.

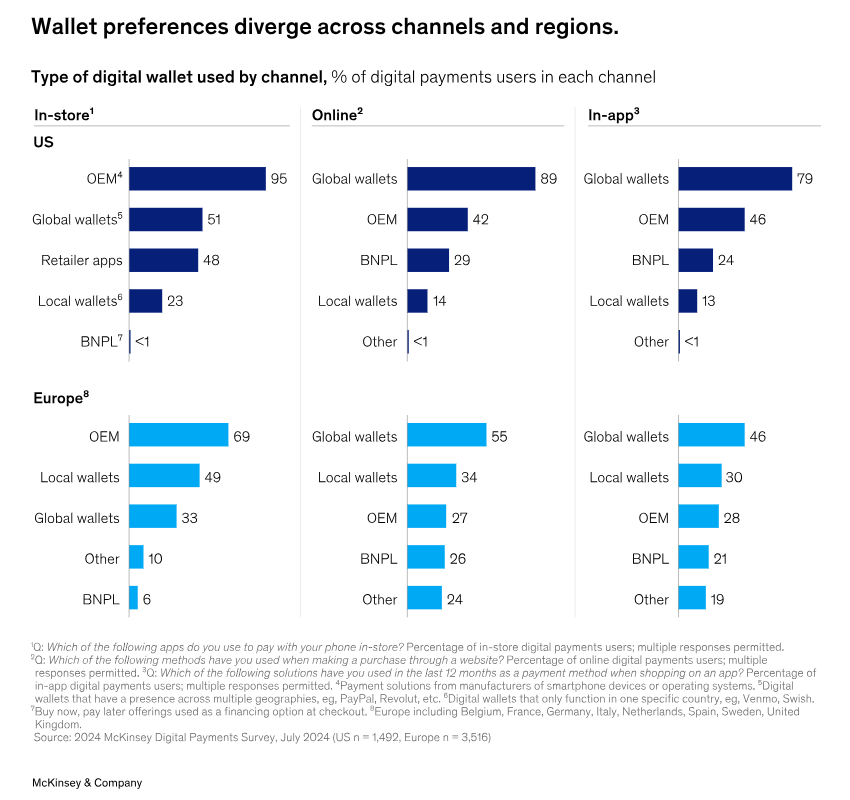

Although macro-level adoption is relatively similar in the United States and Europe, our survey finds notable differences in consumer digital wallet preferences across both channel and region (Exhibit 2).

Exhibit 2: Wallet preferences diverge across channels and regions.

In-store purchases: OEM wallets, meaning payment solutions from manufacturers of smartphone devices and their operating systems, are the most common in-store digital payment devices in both the United States and Europe. Beyond this leading category, the geographic differences are striking. Retailer apps (such as those offered by Starbucks, Walmart, and McDonald’s) are commonplace in the United States, with nearly half of digital in-store users embracing such solutions. This category remains nascent in Europe, except for Germany, where consumers are starting to embrace the payment functionality of leading retailers such as Kaufland and EDEKA, which run mostly on account-to-account (A2A) rails rather than cards.

Local wallet solutions (such as Swish in Sweden, iDEAL in the Netherlands, Payconiq in Belgium), also rely mostly on A2A rails. Although these wallets have achieved greatest overall penetration in select European countries, their frequency of in-store usage seems to trail that of Apple Pay in some countries. The ability of OEM players to deliver a seamless user journey seems better aligned with customers’ in-store preferences. It remains to be seen whether recent changes liberalizing access to near-field communication (NFC) capabilities on Apple devices will enable local solutions to close this user experience gap.

In-app and online purchases: Global wallets provided by technology companies such as PayPal and Amazon are the most common solutions in both the United States and Europe. In Europe, this is likely driven by PayPal’s market-leading position in large geographies such as the United Kingdom, Germany, and France.

However, in countries with well penetrated local solutions previously described, our survey finds local wallets capturing the greatest share of online payment volumes. In line with the European Central Bank’s retail payment strategy, European players continue to explore the use of account-to-account transfers for retail transactions, and large payment processors and open banking players are actively introducing new offerings. For example, Adyen is partnering with Plaid (North America) and Tink (Europe), Stripe is partnering with TrueLayer (Europe), and VISA announced its own A2A program in the United Kingdom. Meanwhile, pay-by-bank specialists like Trustly and GoCardless are posting high double-digit growth in processed payment volumes.

Digital payments players increasingly seek to capture consumers earlier in the shopping journey. We see examples of payment players becoming the origination point for shopping with, for example, BNPL marketplaces through which consumers browse and select products, rather than simply offering the BNPL option at checkout as a payment option.

Our research reveals a growing trend of consumers, particularly younger ones, initiating shopping journeys through channels other than merchant apps and websites, including BNPL marketplaces and offer aggregators. US consumers under the age of 35 are almost twice as likely as the broader population to begin shopping journeys at non-merchant sites (18 percent of 18- to 34-year-olds start shopping journeys in BNPL marketplaces, as compared to 13 percent across all age cohorts). Notably, consumers in the United States who start their journeys through BNPL and aggregator marketplaces typically spend 1.5 to 2 times more than those who initiate the shopping process at the merchant’s dedicated venue (the merchant’s online website or mobile app, for example).

Ease of checkout and security have become table stakes for users of digital payment methods, with 74 percent of US consumers and 71 percent of European consumers surveyed indicating easier and faster checkouts as a primary reason to use digital wallets. However, we see early signs that rewards and offers are increasingly influential in consumer selection of digital payments. This is particularly true in the United States, where roughly one-quarter of respondents indicated that the ability to collect points and discounts drives their payment choice, as compared to 17 percent of European respondents.

That said, rewards seem poised for a meaningful role in driving differentiation among digital payments solutions going forward, especially in the United States. Many digital payment providers have started embedding rewards and loyalty into their core propositions to reinforce user engagement, while striking a delicate balance with economic returns.

This edition of our annual digital payments survey highlights the ubiquity of digital payments across consumer segments, channels (in-store, online, et cetera), and regions. Notably, digital wallets have become even more embedded in consumers’ commerce habits, signaling a likely future of further innovation as digital wallets begin to replace physical wallets and use cases proliferate.

We see four key opportunities for ecosystem participants to capitalize on these trends:

Apply an omnichannel view to wallet rewards programs. Offers and incentives could reward purchases made with the digital wallet across online, in-app, and in-store environments.

Consider scaling a shopping marketplace or aggregated offers portal to meet consumers earlier in the shopping journey. These venues could be used to present offers tied to use of a particular payment method and incent use of that method at checkout.

For issuers, re-imagine digital wallet partnerships and provisioning strategies. As achieving “top-of-wallet” takes new meaning, seamless provisioning of account credentials and tailored rewards programs will be even more critical, if not already table-stakes.

Think beyond card rails for wallet operations. Various forces are driving broader usage of A2A payments in Europe beyond the established strongholds in the Netherlands and Sweden. In the United States, for example, two potential rules changes—to open banking regulations, and to the “honor all cards” rule requiring merchants to accept any card from a payment network regardless of issuing entity—may spur merchants to pursue “pay by bank” A2A models to reduce their payments acceptance cost.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: