Starbucks app leads mobile payments market ahead Apple, Google or Samsung

Starbucks will remain the most popular proximity mobile payment app, staying ahead of Apple Pay and other competitors, according to eMarketer’s latest forecast on US proximity mobile payments.

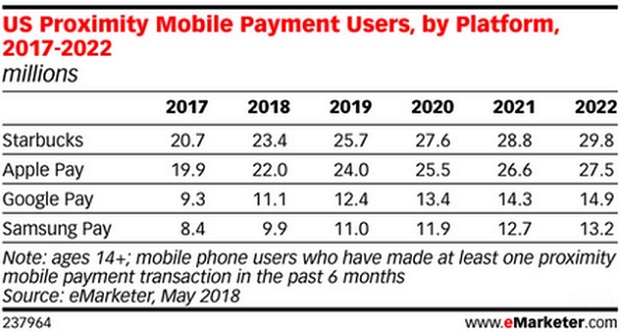

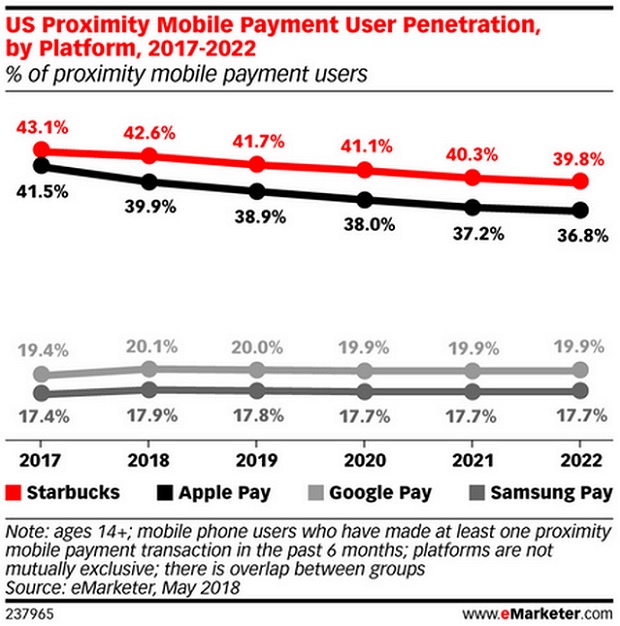

This year, 23.4 million people ages 14 and over will use the Starbucks app to make a point-of-sale purchase at least once every six months. That puts it slightly ahead of the 22.0 million people who will use Apple Pay. Google Pay (11.1 million users) and Samsung Pay (9.9 million) will round out the top four payment apps. The ranking will remain unchanged through 2022.

“The Starbucks app is one of the bigger success stories in mobile proximity payments,” said eMarketer forecasting analyst Cindy Liu. “It has gained traction thanks to its ability to tie payments to its loyalty rewards program. For users of the app, the value of paying with their smartphone is clear and simple—you can save time and money at the register, all while racking up rewards and special offers.”

Apple Pay has the second-highest adoption rate, having launched before the Google and Samsung apps, and is currently accepted at more than half of US merchants. Google Pay is not as widely accepted, but it benefits from being preinstalled on Android phones. While Samsung Pay has the lowest adoption in terms of users, it is the most widely accepted by merchants.

Competition is intensifying, however. While each of the top four apps will continue to gain users in the US throughout the forecast period, their share of mobile payment users will continue to drop. That can mainly be attributed to new payment apps entering the market, particularly merchant-branded mobile apps.

“Retailers are increasingly creating their own payment apps, which allow them to capture valuable data about their users. They can also build in rewards and perks to boost customer loyalty,” Liu said.

Overall, the number of US proximity mobile payment users will grow 14.5% this year to reach 55.0 million. In 2018, for the first time, more than 25% of US smartphone users ages 14 and older will make a proximity mobile payment at least once every six months.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: