Stablecoins surge globally for a variety of use cases – Chainalysis report

The stablecoin regulatory landscape has evolved significantly over the past 12 months. While the GENIUS Act in the U.S. has not yet taken effect, its passage has driven strong institutional interest, while in the EU, the MiCA stablecoin regime has paved the way for the launch of licensed euro-referenced stablecoins like EURC.

Still, when we look at on-chain data, stablecoin transaction volume remains dominated by USDT (Tether) and USDC, which consistently dwarf other stablecoins in scale, according to the latest Chainalysis report.

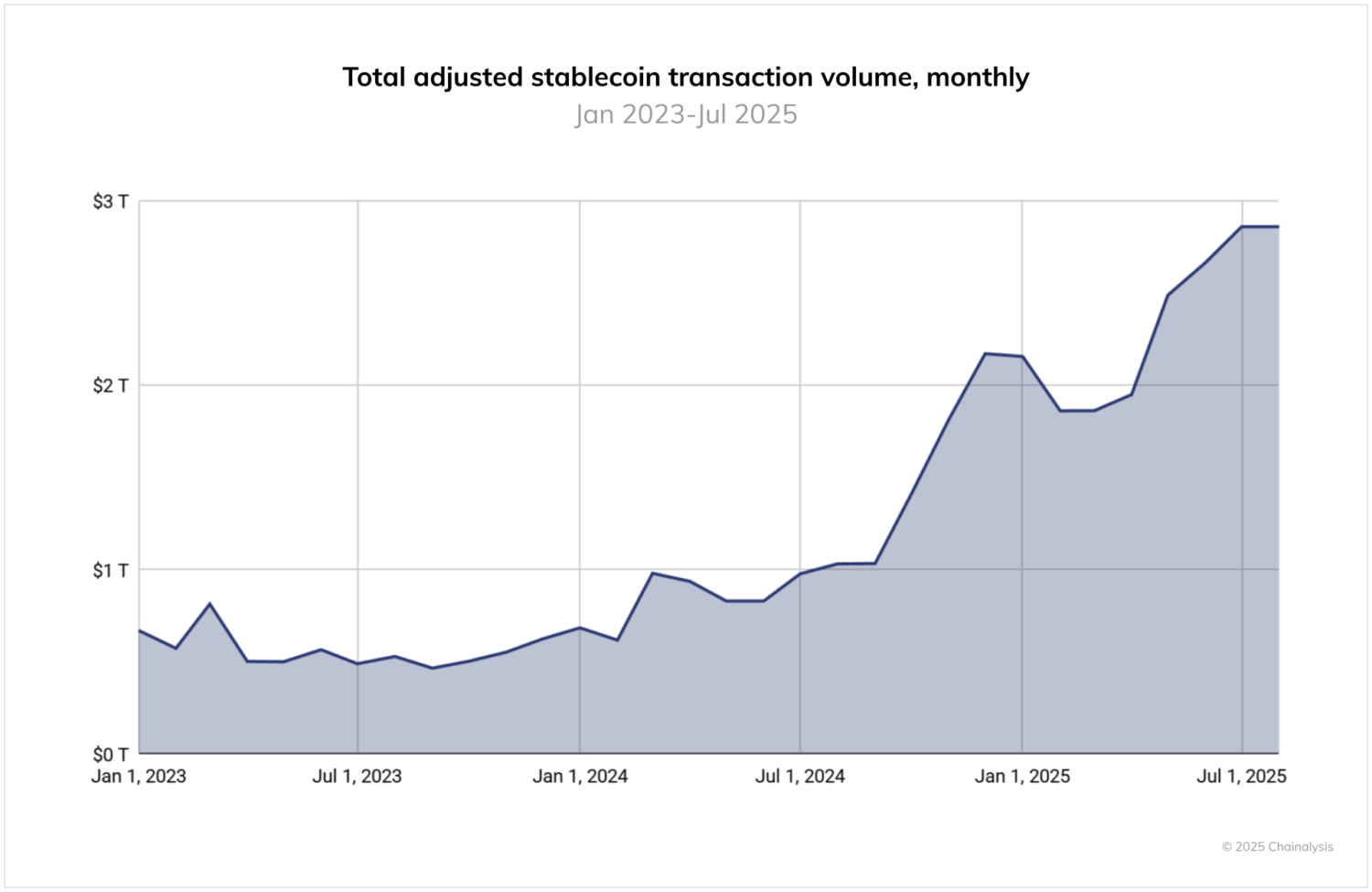

Between June 2024 and June 2025, USDT processed over $1 trillion per month, peaking at $1.14T in January 2025. USDC, meanwhile, ranged from $1.24T to $3.29T monthly, with particularly high activity in October 2024. These volumes highlight the continued centrality of Tether and USDC in crypto market infrastructure, especially for cross-border payments and institutional activity.

* Adjusted transaction volume: For account-based blockchains (non-UTXO) such as Ethereum, Base, and Solana, adjusted transaction volume calculates the net balance change per transaction, asset, and cluster. It then aggregates the net received amounts for clusters within each transaction. For UTXO-based blockchains like Bitcoin and Litecoin, it filters out transfers that are not associated with a cluster in the data but appear to be change outputs.

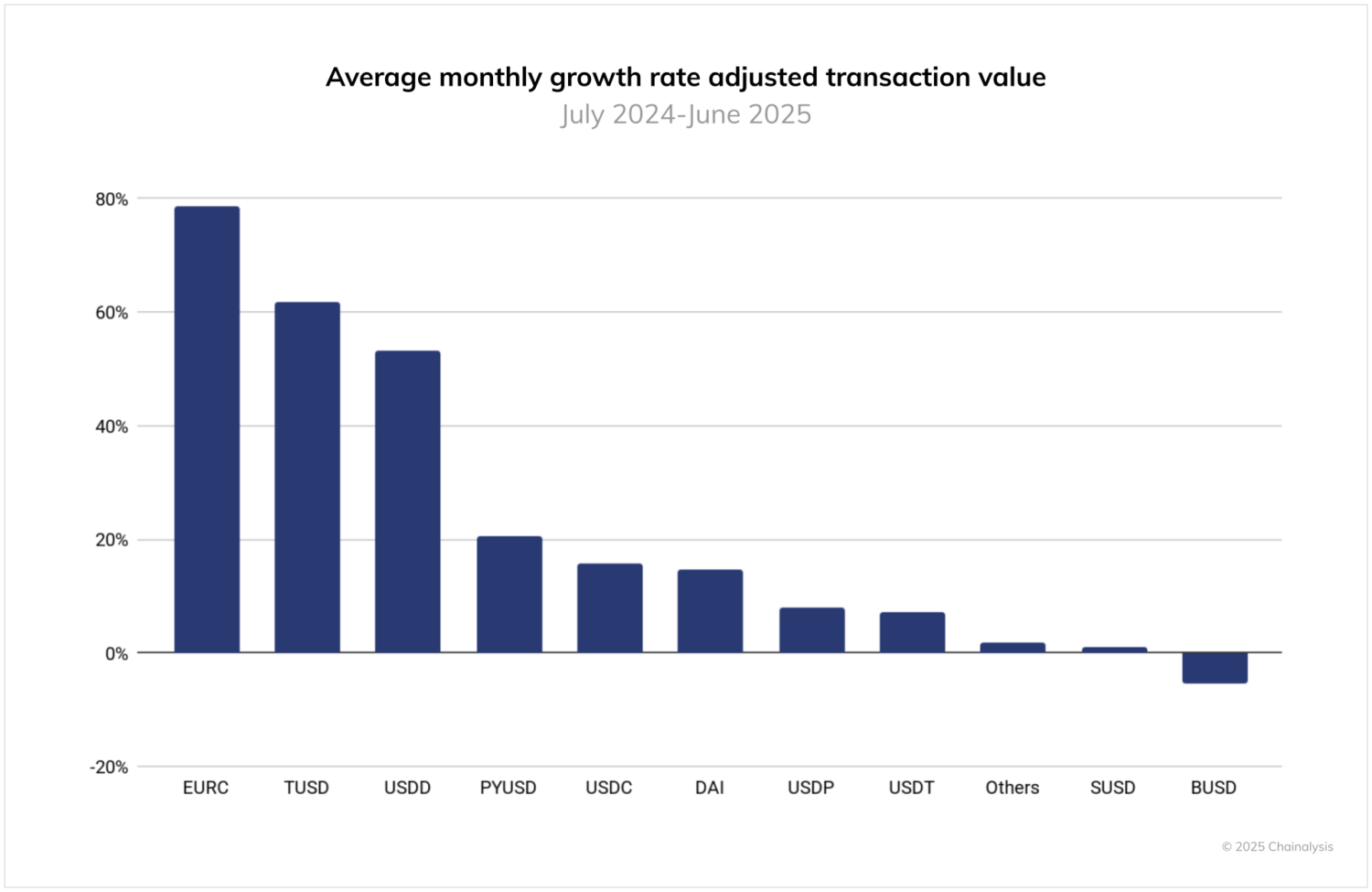

However, looking at growth trends reveals a different dynamic. While Tether and USDC saw fluctuations with some volatility, smaller stablecoins like EURC, PYUSD, and DAI experienced rapid growth. For example, EURC grew nearly 89% month-over-month on average, with monthly volume rising from approximately $47 million in June 2024 to over $7.5 billion by June 2025. PYUSD also showed sustained acceleration, rising from around $783 million to $3.95 billion in the same period.

These shifts coincide with a rise in institutional activity around stablecoins. Stripe, Mastercard, and Visa have all launched products enabling users to spend stablecoins via traditional rails, while platforms like MetaMask, Kraken, and Crypto.com have introduced card-linked stablecoin payments.

On the merchant side, partnerships between Circle, Paxos, and companies like Nuvei aim to streamline settlement in stablecoins. At the same time, traditional financial institutions such as Citi and Bank of America have announced their intentions to explore expanding their offerings and hinting at even launching their own stablecoins.

Regionally, this divergence may signal a shift in how stablecoins are being used. USDC’s growth appears closely linked to U.S.-based institutional rails and regulated corridors, while EURC’s rise suggests growing interest in euro-denominated digital assets, possibly driven by MiCA-compliant platforms and European fintech adoption. PYUSD’s growth could point to a broader appetite for alternative, highly regulated stablecoins in retail and payment contexts. These developments suggest a fragmenting but expanding stablecoin landscape, where local use cases increasingly shape global volumes.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: