The game is definitely heating up in cross border payments. The opportunity is too big but also too complex to resolve. SWIFT has been trying to innovate in this direction over the past years (SWIFT GPI, Blockchain experiments) but they have to balance an existing structure.

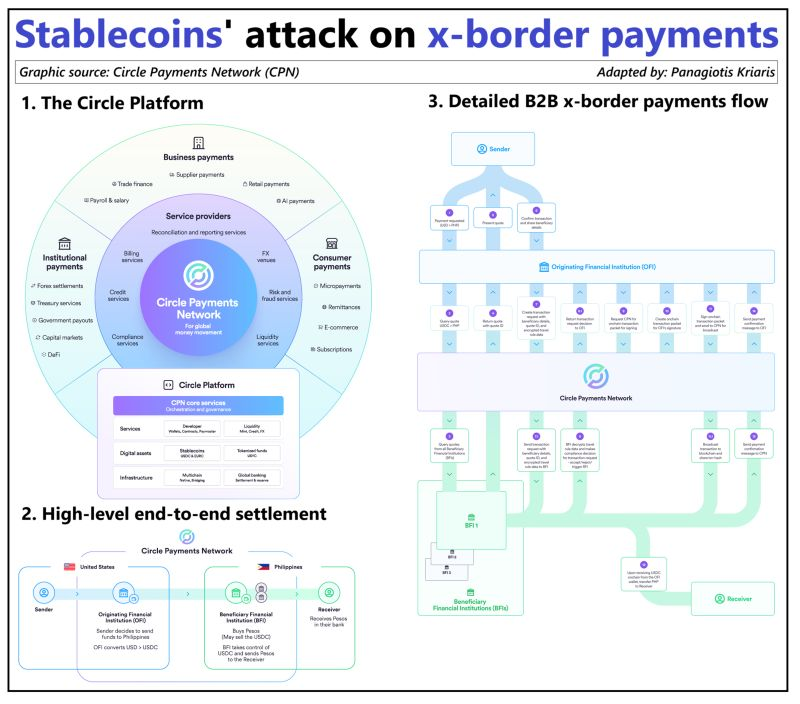

Circle’s newly announced CPN (Circle Payments Network ) is not the first stablecoin-based attempt but it’s the most ambitious so far. Let’s take a look with the help of Panagiotis Kriaris.

Cross-border payments are a $290 billion revenue opportunity (McKinsey). Compared to domestic payments, cross-border payments are notoriously more inefficient with high costs, limited transparency and slow response times. Legacy technology, complex processes and outdated data formats are some of the main culprits.

Stablecoins like USDC (Circle) and USDT (Tether) have already been used for cross-border payments, and major payment companies such as Visa and PayPal have explored stablecoin-powered international transfers, with PayPal even launching its own stablecoin (PUSD) for cross-border use.

𝗪𝗵𝗮𝘁 𝘀𝗲𝘁𝘀 𝗖𝗣𝗡 𝗮𝗽𝗮𝗿𝘁 𝗶𝘀 𝗶𝘁𝘀 𝘀𝗰𝗮𝗹𝗲 𝗮𝗻𝗱 𝗶𝗻𝘀𝘁𝗶𝘁𝘂𝘁𝗶𝗼𝗻𝗮𝗹 𝗳𝗼𝗰𝘂𝘀:

1. Circle is collaborating with major global banks (Standard Chartered, Deutsche Bank, Santander, Société Générale) and fintechs to create a real-time, programmable, and compliance-focused network that directly connects financial institutions for seamless cross-border settlements using regulated stablecoins like USDC and EURC.

2. CPN does not move funds directly; rather, it serves as a marketplace of financial institutions and acts as a coordination protocol that orchestrates global money movement and the seamless exchange of information.

3. As the network operator, Circle defines the CPN protocol and provides application programming interfaces (APIs), software development kits (SDKs) and public smart contracts to orchestrate global money movement.

4. While other stablecoin initiatives have targeted cross-border payments, CPN marks the first time a regulated settlement asset in the form of stablecoins is married with an institutional coordination and governance layer purpose-built for financial institutions. This integration connects traditional payment systems to assets like USDC and EURC, while establishing a trusted counterparty framework for more efficient settlement with fewer intermediaries.

5. By introducing a new ‘clearing layer’ based on compliant, always-on digital dollars, CPN wants to lay the foundation for cross-border settlement at internet scale.

𝗧𝗵𝗶𝘀 𝗶𝘀 𝗵𝗼𝘄 𝗶𝘁 𝘄𝗼𝗿𝗸𝘀:

1. Sender sends $1000 to a receiver in Philippines via CPN

2. CPN (via the originating financial institution) converts USD to USDC

3. CPN connects to a beneficiary financial institution in the Philippines that converts USDC to Pesos and sends to the receiver

4. The receiver receives Pesos in their bank

What do you think, can CPN challenge traditional payment rails?

Comments:

Sanjeev Kumar said – „A few things that stood out most:

1/CPN as a coordination layer, not a fund mover — this flips the script. Instead of competing with domestic payment networks and financial institutions, it enables them to interoperate using stablecoins as the shared settlement asset.

2/ The marriage of a regulated stablecoin with institutional-grade governance. It’s not just token plumbing; it’s institutional trust embedded at the protocol level. Probably the toughest promise for Circle to deliver on. They’ll need to work closely with central banks in emerging markets, and that means figuring out how to bring FX flow transparency in a way those regulators are actually comfortable with.

3/And most importantly, the design leaves space for other regulated stablecoins, including bank and fintech-issued ones, to plug into the network. This could set the stage for a multi-stablecoin future for cross-border payments with compliance and oversight baked in.„

Sunil Mehta stated: „These methods have been tried for 7-8 years. The 2 biggest challenges in ubiquitous acceptance of stable coins are:

1) the originating bank would have to convert USD TO USDC – a crypto/currency which is not legal tender. The central banker of the respective country needs to approve this.

2) no matter how small the time between conversion of dollars to USDC in originating country and converting USDC back to beneficiary currency- there is a risk of price volatility. Who will bear this loss?

3) the agency who is converting usd to USDC in originating country would be left with high amount of dollars. Using it for incoming txns is easy to say but difficult in practise. So this will need to be physically/ digitally transferred – the agency running the USDC would be in deficit in beneficiary countries.

In my view products launched by Visa for B2B cross country transfers are most apt to succeed. But I guess they too are facing challenges.„

Dominic Lynch reacted: „Actually none of the cryptos/stable coins will be allowed to thrive by the existing players. Take Citi or JPMC. They have core banking relations with banks in most countries. Currently there is a process of nostro /vostro accounts credit / debit etc. once there is s real threat from alternative processes like stable coins, the bank will setup a direct relationship with one bank in each of the top countries ( which would cover 80-90% of cross border business), bypassing SWIFT.

Similar to domestic remittances, these banks will have a drop down menu to chose the bank in each country for cross border payments. Once submitted, it will reach the bene country instantly through API and from there a domestic txn will move to the actual beneficiary’s bank account( wherever there is 24*7 instant payments, like India has). The funds settlement will happen later. This would mean that the bene bank takes a credit risk on citi/jpmc but which is quite normal anyway.

However this will happen only when stable coins become a credible threat. BecoZ by changing the process banks are going to lose money and they will do it only if it’s a real threat. Similarly Western Union can do it.„

Martin Koderisch: „Really interesting to see Circle’s network evolving alongside public sector projects like mBridge. Both are rethinking cross-border value flows but with very different philosophies around openness, control, and programmability. Also raises big questions about where SWIFT fits in this new landscape where messaging alone may no longer be enough when the rules and logic are increasingly embedded in the transaction itself. Curious to see how SWIFT adapts.„

Martin Koderisch: „The game is definitely heating up in cross border payments. The opportunity is too big but also too complex to resolve. SWIFT has been trying to innovate in this direction over the past years (SWIFT GPI, Blockchain experiments) but they have to balance an existing structure.„

Igor Kostyuchenok: „Despite all the bad rep that crypto have accumulated over the years and will continue to accumulate, we can say for sure that the blockchain itself is a proven piece of tech. Combined with stablecoins the tech duo becomes one of the best ways to move money around the world in a fast and reliable way. So, why non of the banks have switched to using the stablecoins and blockchain yet?

The answer is relatively simple: security and convinience and I’m not talking about the convinience of a customer to send the money abroad. I’m talking about the banks’ convinience. With SWIFT they don’t have to change anything. No new infrastructure, no tests, no time spent on new technology, no potential hiccups.

The banks being slow, wealthy and risk averse are not interested in improving their technology as long as it doesn’t hurt financially really bad. The only hope for the banks to use the newest tech and offer cheap and instant payments to their customers is a startup that will build a SWIFT alternative based on stablecoins and blockchain. There will be a trust problem though, so we are almost destined to end up with a newer version of SWIFT that will be faster but not cheaper for the end consumers.„

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: